Cornerstones of Competitive Advantage: Resource-Based View

Explore the cornerstones of competitive advantage through a resource-based view, focusing on heterogeneity, limits to competition, and valuable assets. This research delves into the integration of resources and firm performance to provide a comprehensive model for further study in the field.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

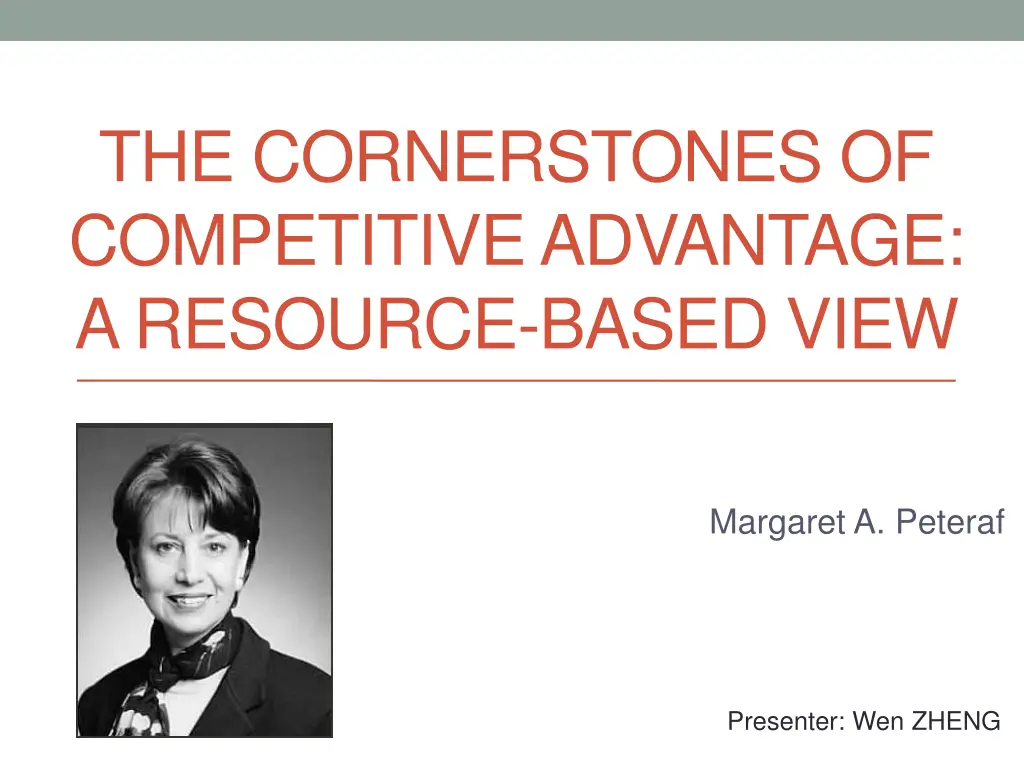

THE CORNERSTONES OF COMPETITIVE ADVANTAGE: A RESOURCE-BASED VIEW Margaret A. Peteraf Presenter: Wen ZHENG

Research Question Develop a general model of resources and firm performance, which at once integrates the various strands of research and provides a common ground from which further work can proceed. Four cornerstones of competitive advantage Applications of the resource-based model

Cornerstones Heterogeneity Ex Post Limits to Competition Imperfect Mobility Ex Ante Limits to Competition

Cornerstones Heterogeneity Ex Post Limits to Competition Imperfect Mobility Ex Ante Limits to Competition

Heterogeneity Resource and capabilities are heterogeneous across firms. (Barney, 1991) Superior Resources (Limited supply) Ricardian rents Scarcity of resource supply Monopoly rents Restriction of output

Cornerstones Heterogeneity Ex Post Limits to Competition Imperfect Mobility Ex Ante Limits to Competition

Ex post limits to competition Condition of heterogeneity can be preserved Competition Ricardian Rents: supply of scarce resource (supply curve elasticity) Monopoly Rents: output (individual demand curve elasticity)

Ex post limits to competition Imperfect substitutability: Demand elasticity (Porter, 1980) Imperfect imitability Entry barrier (Bain, 1956) Isolate industry participants from potential entrants Mobility barrier (Caves and Porter, 1977) Isolate groups of similar firms in a heterogeneous industry Isolating mechanisms (Rumelt, 1984, 1987) Property rights, information asymmetries, frictions, causal ambiguity, producer learning, buyer switching cost, reputation, buyer search costs, channel crowding, economies of scale Failure of competitive market (Yao, 1988) Production economies; sunk cost; transaction cost; imperfect information Firm orientation (Ghemawat, 1986) Size advantage, preferred access to either resources or customers, restrictions on competitors options Valuable but non-tradeable assets (Dierickx and Cool, 1989) Time compression diseconomies, asset mass efficiencies, interconnectedness of asset stocks, asset erosion, and causal ambiguity

Cornerstones Heterogeneity Ex Post Limits to Competition Imperfect Mobility Ex Ante Limits to Competition

Imperfect Mobility Perfectly immobile Property rights are not well defined (Dierickx and Cool, 1989; Meade, 1952; Bator, 1958) Idiosyncratic and no other use out side the firm (Williamson, 1979) Imperfectly mobile Resources are specialized to firm-specific needs (Montgomery and Wernerfelt, 1988) Co-specialized assets (Teece, 1986) Transaction cost is high (Williamson, 1975; Rumelt, 1987) Necessary conditions for Sustainable competitive advantage Resource will remain available to the firm Rents will be shared by the firm The opportunity cost does not offset the rent (next best potential users)

Cornerstones Heterogeneity Ex Post Limits to Competition Imperfect Mobility Ex Ante Limits to Competition

Ex ante limits to competition Prior to any firm s establishing a superior resource position, there must be limited competition for that position. Economic performance depends on both the returns of the strategies and cost of implementing the strategy (Barney, 1986)

Applications Why do some firms outperform others? Help managers understand, preserve, or extend their competitive advantage Single Business Strategy Corporate Strategy

Single Business Strategy Help managers have a clear understanding of whether their situation meets necessary conditions for a sustainable advantage Differentiate valuable from less valuable resource Mobility Imitable License vs. Internally develop Imperfect mobile internally develop Co-specialized assets internally develop

Corporate Strategy Scope of the firm Barney (1988): strategically related acquisition How rare and inimitable is the resulting combination of resources Montgomery and Hariharan (1991): diversification Broad resource bases Theory of diversification Quasi-fixed fungible Excess capacity in resources+ high transaction cost Paradox excess capacity scarcity rents Montgomery and Wernerfelt (1989): extent of diversification Specificity + market opportunities extent of diversification Dosi, Teece and Winter (1990): coherence of business activity Core competence degree of coherence Speed of learning, breadth of the path dependencies, degree of asset specialization and nature of selection environment scope of firm

![READ [PDF] Scoring Position: Reformed Playboy Romance (Nashville Songbirds Book](/thumb/42222/read-pdf-scoring-position-reformed-playboy-romance-nashville-songbirds-book.jpg)