Corporate Governance in Emerging Markets: BRIKT Time-Series Insights

Explore the nuances of corporate governance in Brazil, Russia, India, Korea, and Turkey through time-series evidence, research questions, methodological challenges, and main approaches in the context of emerging markets.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

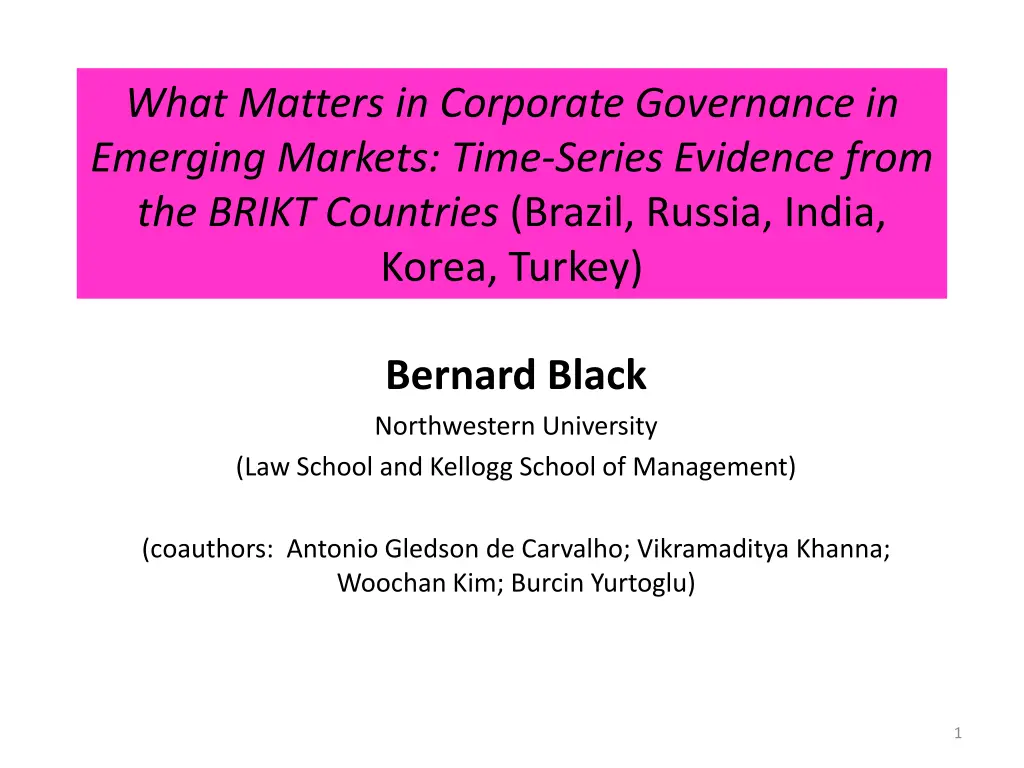

What Matters in Corporate Governance in Emerging Markets: Time-Series Evidence from the BRIKT Countries (Brazil, Russia, India, Korea, Turkey) Bernard Black Northwestern University (Law School and Kellogg School of Management) (coauthors: Antonio Gledson de Carvalho; Vikramaditya Khanna; Woochan Kim; Burcin Yurtoglu) 1

Some broad research questions How does optimal firm-level governance vary across countries? Across firms within countries? How do we measure corporate governance , anyway? Can we build a meaningful, firm-level corporate governance index that predicts share price, profitability, tunneling, or other performance measures within country What are the components of such an index? How will such an index vary across countries? Different question (LLSV etc.): Effect of country-level governance on firm value; economic development, etc. 2

Array of methodological issues Construct validity issues: What is good governance? Can we measure it? How does it vary across countries? Tobin s q (as dependent variable) is a construct too Several flavors of endogeneity : Omitted variables Reverse causation (value governance) Optimal differences between firms Differences in local legal rules What varies across firms is country specific Local practices vary [often idiosyncratic] Data limitations Data on governance Data on control variables 3

Two Main Approaches [Massively] Multicountry studies (broad and shallow) Indices: S&P disclosure (2002); CLSA (2001); ISS/RiskMetrics (2003-) Papers: Klapper Love (JCF 2004); Durnev Kim (JF 2005); Aggarwal Erel Stulz Williamson (RFS 2006); Bruno Claessens (JFI 2009); Doidge Karolyi Stulz (JFE 2007); Dahya Dimitrov McConnell (JFE 2008) Country studies (narrow and deep). Representative list in emerging markets: Brazil (Black, de Carvalho, Gorga, JCF 2012; Leal and Carvalhal-da-Silva, 2007, Braga-Alves and Shastri, FM 2011) China (Cheung, Jiang, Limpaphayom and Lu (2009) Hong Kong (Cheung, Connelly, Limpaphayom and Zhou, 2007, 2009) India (Black and Khanna, JELS 2007; Balasubramanian, Black and Khanna 2009; Dharmapala and Khanna, JLEO 2013) Korea (Black Jang and Kim, JLEO 2006; Black & Kim, JFE 2012; Black Kim Jang and Park 2012) Russia (Black, EMR 2001; Black, Love and Rachinsky, EMR 2006) Turkey (Ararat, Black, Yurtoglu, working paper 2012) 4

This project: Blend of the two approaches Country studies in 5 major emerging markets: BRIKT Not China, less generalizability Examine: What is generalizable? And what isn t Big picture answer: Not much is generalizable Cast doubt on massively multi-country efforts 5

Why Country Studies? Why focus on emerging markets? Core corporate governance issues are different in developed vs. emerging markets. Stylized view: Core US issue: ensure good management Core emerging markets issue: control self-dealing Governance more important in emerging markets No good multicountry index ISS/RiskMetrics: US-centric only developed countries Other multicountry indices are dated, limited: S&P (2002): run once; only disclosure CLSA (2001): run once; some elements subjective 6

Why Country Studies - II? Endogeneity is key issue: we care about causation, not just association: Will gov cause y y = Tobin s q; other outcome variable Simple regression isn t enough: Regress y = a + b*gov + c*controls + Coefficient b on gov tells us about association, not causation One example, reverse causation: Regress gov = a + b *y + c *controls + b and b usually have same sign, similar statistical significance 7

To assess causation minimum: extensive control variables better: panel data, firm fixed or random effects Address unobserved time-invariant firm characteristics best: respectable natural experiment/shock not available in most countries (No good non-shock instruments exist) Suppose we require a study to be about (or include) emerging markets and want even one of these . . . (Or results so strong that alternate explanations are unlikely) 8

Emerging markets, plus decent econometrics: Multicountry studies Papers: Klapper and Love (JCF 2004); Durnev and Kim (JF 2005); Doidge, Karolyi and Stulz (JFE 2007); Dahya Dimitrov McConnell (JFE 2008) [Nothing left.] Country indices Brazil(Black and de Carvalho, JCF 2012) Hong Kong (Cheung, Connelly, Limpaphayom and Zhou, 2009) India(Black and Khanna, JELS 2007; Dharmapala and Khanna, JLEO 2013) Korea(Black Jang and Kim, JLEO 2006; Black and Kim, JFE 2012; Black, Kim Jang and Park, working paper 2012) Russia(Black, EMR 2001; Black, Love and Rachinsky, EMR 2006) Turkey (Ararat, Black and Yurtoglu, working paper 2012) [Apologies for the self-citation, but that s what exists, to my knowledge.] 9

Country studies have problems too Hard to generalize from one study Endogeneity still a major concern Indices not fully comparable across studies Still, can get time series, firm fixed or random effects, good controls In Korea and India, decent natural experiments Maybe Turkey too (shock in late 2011; research underway) My ongoing research strategy: Time series, country studies in BRIKT countries Similar indices (not identical because laws vary) [mostly lose Russia] Exploit natural experiments, when they exist Local coauthors to ensure I understand what matters Look for similarities and differences across countries 10

This project: Combine data across countries Brazil corp. gov. surveys: 2004, 2007, 2009 India surveys: 2005, 2007, 2012 Turkey: 2006-2011 (extending through 2011) Korea: 1998-2004 (extending through 2009) Russia: 1999-2005 (can partly extend thru 2008) 11

Each country: build local index Index elements in each country must be: Measurable Meaningful (in judgment of local coauthors) We thinkthey might reflect good governance Lots of judgment here! Significant variation across firms Not required by law Not otherwise nearly universal or rare Similar subindices, to extent feasible 12

Endogeneity: How Big an Issue Important in developed markets E.g., low performance high boardindependence (Bhagat & Black, 2002) Maybe, smaller issue in emerging markets hard to predict firm-level governance choices (Black, Jang and Kim, JCF 2006a, Korea) similar in India (adj. R2 < 0) Large role for apparently idiosyncratic firm choice More work needed on what firm-level factors predict governance across emerging markets: . . . next project 13

Similar indices, subindices In each country: Build broad corp. governance index Rely on our own surveys, to supplement public data Similar subindices, to extent feasible Often only partly feasible, as we ll see Why different subindices? What elements are required by law? [If so, little/no variation across firms] What are typical practices? Which elements have meaningful variation across firms? What data exists? 14

Brazil Corp Gov Index (BCGI) in 2005 Use Brazil to illustrate approach and complexities Subindices (each 0 ~ 1) for: Board Structure (7 elements) Ownership Structure (5 elements) Board Procedure (6 elements) Disclosure (12 elements) Related Party Transactions (5 elements) Minority Shareholder Rights (7 elements) BCGI = [ (subindices)/7] Range: [0.32, 0.81) BCGInorm = normalized [ (normalized subindices)] 15

Whats in BCGI? Focus on Board Structure Subindex (2004) Subindex Element Public data Mean Board includes one or more independent directors 0 0.73 Board Board has at least 30% independent directors 0 0.47 Structure Board has at least 50% independent directors 0 0.20 CEO is NOT chairman of the board 1 0.71 Audit committee exists 1 0.14 Permanent or near-permanent fiscal board exists Audit committee or permanent fiscal board exists and includes minority shareholder representative 0 0.68 0 0.47 Note: Only 2/7 elements rely on public data Guessing may not work well. For Brazil: Dahya Dimitrov McConnell (2008) estimate 57% indep directors Our data: 2004 mean (median) = 24% (20%) 16

Importance of local knowledge Brazilian institution: fiscal board Can be permanent (in charter) or near-permanent (demanded every year or most years by minority shareholders) Function similar to audit committee Might be more effective: must include representative of minority shareholders Brazil: substitute for audit committee Many firms have one or the other; few have both Audit committees rare (mean = 0.14) Fiscal board more common (mean = 0.68) 17

Compare Brazil to Korea for Board Structure Brazil Element Board includes one or more independent directors (NP) 30% independent directors (NP) 50% independent directors (NP; mean = 0.20) Korea Required Requires 25% indep. directors Index element Board has majority of indep. directors Not available Index element Not meaningful CEO is NOT board chairman Audit committee exists (uncommon; mean = 0.14) Permanent or near-permanent fiscal board exists Audit committee or permanent fiscal board includes minority shareholder representative Rare (NP) Rare (NP) Not available; rare Compensation committee exists Outside director nom. committee exists NP = no public data (we use our survey) Only common elements are: 50% outside directors (uncommon in Brazil) audit committee (rare in Brazil; misleading alone) 18

Example 2: Board procedure subindex Start with Brazil & India: see if avail in Korea, Turkey Overall Procedure subindex 4 regular board meetings per year Average board meeting attendance rate 80% Outside directors attend minimum % of meetings Brazil NP NP India NP X NP Korea X Turkey available X Firm has system to evaluate CEO NP X Firm has system to evaluate other executives NP X Firm evaluates nonexecutive directors NP X Firm has succession plan for CEO NP X Firm has nonexecutive director retirement age X Directors receive regular board training X Nonexecutives-only or outside directors only annual board meeting exists NP, rare X X Board receives materials in advance NP X Nonexecutives can hire own counsel & advisors X Directors positions on board meeting agenda items are recorded in board minutes NP NP X Firm has code of ethics Specific bylaw/policy to govern board Firm has 1 foreign outside directors Shareholders approve outside directors aggregate pay NP NP NP X X X NP NP NP X X available NP, rare With only public data, can t build Brazil index at all Even with surveys, can t build consistent subindex across countries 19

Example 3: Ownership Structure Brazil vs. India, Korea Brazil Elements Fraction of common shares held by largest shareholder 1.5*[(common shares/(total shares)-1/3] Ownership parity (for largest shareholder) [((members of control group, winsorized at 11) -1)/10]. firm has an outside 5% institutional investor India (no ownership index) Korea Data available Data available Not meaningful: One share, one vote rule Not meaningful: One share, one vote rule Ownership parity (for control group) Not meaningful, no pyramids No data No data Data available Data available Only potential common elements are: ownership by largest shareholder Existence of outside 5% shareholder. How meaningful are these? India: Choose not to build ownership structure subindex 20

Disclosure subindex: Compare Brazil to ISS ISS disclosure index: consulting fees to auditors < audit fees audit committee has solely independent directors shareholders approve auditor Nothing about what firms actually discloses!? Compare Brazil: Address auditor independence through audit firm rotation (every 5 years) 80% of firms pay 0 consulting fees to auditor (only 6% pay > 10% of audit fees) audit committee at only 14% of firms, solely independent at 1 firm in 2004 Control group shareholder approval of auditor not meaningful Brazil firm scores: almost always 1, minimal variation 1 point for low consulting fees 0 for solely indep audit committee 0 for shareholders approve auditor 21

Lesson: index must be country-specific If we require the same elements in each country: Can measure little What we can measure may not be very relevant Problem gets worse if add more countries Even if measure same thing, meaning will differ Consider proportion of outside directors US: minimum 51%; median 70% India: minimum 1/3 (+ CEO board chair); otherwise min 50% Korea: minimum 25%; median 33% [> 50% required for large firms] Turkey: minimum 0 (75% of firms), mean 25% With country fixed effects, estimate impact of typical within-country variation Not really measuring the same thing across countries? 22

Severe construct validity questions We re not sure how to measure governance We re not sure what counts as good governance, for which firms, in which countries We have. . . Different overall index in each country Different subindices in each country Very different subindex elements in each country 23

Tobins q is a construct too Common approach: q as dependent var. One possible definition: BVE = book value of equity MVE = market value of equity Problem: q captures many things: Growth opportunities Intangible assets (not included in book assets) Real and quasi rents (not captured in book assets) Other book-to-market differences in assets Value of share liquidity And value of governance (higher market value for same assets) Empirical strategy: control for other factors hope that q captures value of gov + ( ) book assets MVE BVE = q book assets 24

So what do we do? We give subindices similar names We thenhope (pretend?) they measure a common construct OK, what do we see? 25

Simple cross-section results across countries Country Overall Governance Index Russia 0.198*** (5.45) alone Brazil 0.145*** (2.83) India 0.101*** (2.91) Korea 0.097*** (6.39) Turkey 0.112*** (2.77) together 0.066* (1.80) Subindices Board Structure 0.042*** (2.79) 0.045*** (3.61) 0.018 (1.25) 0.023*** 0.089** (2.68) -0.091 (-1.55) 0.076* (2.00) 0.136*** (2.66) -0.008 (-0.11) -0.067 (-1.31) 0.142*** (2.90) 0.026 (0.69) Ownership Structure 0.045 (1.25) 0.069* (1.80) 0.022 (0.63) 0.064** (1.99) 0.040 (1.20) Board Procedure 0.355*** (7.98) Disclosure (1.99) Related Party Transactions 0.022** (2.03) 0.011 (0.40) Minority Shareholder Rights Control Variables Observations (Firms if different) Time Period Vary by country 252 2006 228 (99) 2001 66 2005 495 2001 135 2006 26

Firm fixed effects across countries Country Overall Governance Index Russia 0.067*** To come To come 0.0396*** -0.021 (2.75) alone Brazil India Korea Turkey (4.60) (-0.70) together 0.0102*** (6.65) 0.0044 (0.45) 0.0025 (0.33) 0.0136* (1.93) -0.0065 (-1.09) Subindices Board Structure -0.032 (-1.60) Ownership Structure Board Procedure -0.015 (-0.85) -0.019 (-0.58) 0.034 (1.41) 586 (178) 06-09 Disclosure 0.071** (2.21) Minority Shareholder Rights Observations (Firms if different) Time Period 964 (99) 99-05 3,693 (656) 98-04 28

Firm FE summary Turkey results are fragile vanish completely with firm FE or RE vanish without control variables Russia results weaken, but survive Korea: Results remain strong for board structure index Good causal inference (1999 legal reforms) Shareholder rights vanishes Brazil, India: results to come 29

Pretend all indices & subindices created equal Pooled OLS (Brazil, India, Korea, Russia) 0.099*** (5.36) Overall Governance Index Subindices (excl. Russia) All in One Regression 0.036** (2.08) 0.034** (2.34) 0.027 (1.58) 0.036** (2.40) -0.014 (-0.30) 0.031** (2.02) Board Structure Ownership Structure (Brazil and Korea Only) Board Procedure Disclosure Related Party Transactions (Brazil and India Only) Shareholder Rights Decent control variables, but lose some from country regressions 30

Compare OLS to Fixed Effects (Korea, Russia, Turkey) Fixed Effects 0.031*** (4.39) Pooled OLS 0.099*** (5.36) Overall Governance Index Subindices 0.036** (2.08) 0.034** (2.34) 0.027 (1.58) 0.036** (2.40) -0.014 (-0.30) 0.031** (2.02) 0.021*** (4.89) -0.004 (-0.51) 0.003 (0.53) 0.024*** (4.02) Board Structure Ownership Structure (Brazil and Korea Only) Board Procedure Disclosure RPTs (Brazil, India) -0.002 (-0.36) Shareholder Rights Caveat: Board structure results driven by Korea; opposite in Brazil Little time variation in ownership, so FE is weak 31

Next steps to see what survives Firm FE, RE in all countries Effects for interesting subsamples: Large versus small Manufacturing vs. other High vs. low growth rate High vs. low profitability Business group or not Old vs. young firms 32

Next steps II Use common index elements As in multicountry indices Construct validity issue changes, doesn t go away Use only the limited control variables available in multi-country studies 33

Is Everything Endogenous (or Irrelevant)? Russia (1999 data) Regress: Ln(Value Ratio) on Governance Score n = 21 firms r = -0.90 R2 = 0.81 t = -8.97 -1 -3 ln(value ratio) -5 -7 -9 7 18 29 40 51 governance ranking Source: Black (EMR, 2001) (high ranking implies worse governance) Worst-to-best = factor of 700 increase in value ratio! 34

Is Everything Endogenous or Irrelevant II: Bulgaria (2002) response to anti-tunneling reform 0.8 Relative Percentage Change of Tobin's q 0.6 0.4 0.2 0.0 -0.2 2001-Q1 2001-Q2 2001-Q3 2001-Q4 2002-Q1 2002-Q2 2002-Q3 2002-Q4 Quarter Tunneling Risk Defined Using Tunneling Propensities Tunneling Risk Defined Using Ownership High vs. low tunneling propensity firms Source: Atanasov, Black, Ciccotell, Gyoshev (JFE 2010) 35

Korea: RPTs and Expropriation Risk 40% Large-plus Positive ERI 35% Large-plus Negative ERI 30% CMAR (%) 25% Large-plus Missing ERI 20% 15% 10% 5% 0% -5% -10% 19990719 19990520 19990525 19990528 19990602 19990607 19990610 19990615 19990618 19990623 19990628 19990701 19990706 19990709 19990714 19990722 19990727 19990730 19990804 19990809 19990812 19990817 19990820 19990825 19990830 19990903 19990908 Event study: Large firm reform in June-August 1999) Large-plus (1-4T won) vs. mid-sized index (0.5-1T won) Source: Black, Kim, Jang and Park (working paper 2012) 36