Corporate Level Strategy in Tourism and Hospitality

Explore corporate-level strategies, mergers, acquisitions, and diversification in the tourism and hospitality industry. Learn about Blue Ocean strategy, market development, product innovation, and the value of diversification in creating new markets and enhancing business performance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

HOS801 Strategic Management in Tourism and Hospitality Week Seven Corporate Level Strategy, Mergers and Acquisitions

6 Blue Ocean Strategy Blue Ocean strategy is a re-constructionist approach that pursues both cost leadership and differentiation simultaneously to create new markets. Value Innovation is the nexus between cost savings and buyer value. Three tiers of noncustomers soon-to-be, refusing and unexplored. The Four Actions framework seeks to eliminate and reduce undesirable value elements and raise and create desirable value elements from the Value Curve. The Strategy Canvas plots key strategic value elements in conjunction with the Four Actions framework to redefine the Value Curve. Red Ocean focus is on existing market and industry constructs and competitive positioning, this is the structuralist view or environmental determinism. 2

Learning Objectives Define Corporate-level Strategy and discuss its purpose. Describe different levels of diversification with different corporate-level strategies. Explain the reasons why firms diversify. Describe how firms can create value by using a related diversification strategy. Explain how value can be created with an unrelated diversification strategy. Discuss the incentives and resources that encourage diversification. Describe motives that can encourage managers to over diversify a firm. 3

Corporate Level Strategy There are two key questions that must be answered 1. In what product markets and businesses should the firm compete? 2. How should corporate headquarters manage those businesses? 4

Corporate Level Strategies Market Development moving into different geographic markets . Product Development developing new products and/or significantly improving on existing products. Horizontal Integration acquiring competitors, horizontal movement across the value chain. Vertical Integration becoming your own supplier or distributor through acquisition, movement up or down the value chain. 5

Diversification Growing into new business areas either related (similar) or unrelated (different) to the existing business. Allows a firm to create value by productively using excess resources. Diversified firms - operate in several different and unique product markets and likely in several businesses. - use two types of strategies corporate-level (or company-wide) and business-level (or competitive). - must select a business-level strategy for each one of its businesses. 6

Diversification The ideal portfolio of businesses balancesdiversification s costs and benefits - profitability variability is reduced as earnings are generated from different businesses. - it offers the independence, or flexibility, to shift investments to those markets with the greatest returns. In financial markets diversification is the key to minimising risk. 7

Levels of Diversification A firm s diversified businesses are related when they share links across - products (goods or services). - technologies. - distribution channels. The more links among businesses, the more constrained is the relatedness of diversification. Unrelated refers to the absence of direct links between businesses. 8

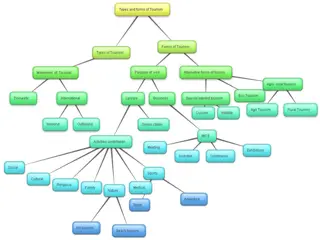

Levels of Diversification FIGURE 6.1 LEVELS AND TYPES OF DIVERSIFICATION 9

Low Levels of Diversification Single Business Strategy - the firm generates 95 per cent or more of its sales revenue from its core business area. - De Beers. Dominant Business Strategy - the firm generates 70 95 per cent of its total sales revenue within a single business area. - Coca Cola. 10

Moderate Levels of Diversification Related Constrained Strategy - less than 70 per cent of revenue comes from the dominant business. - there are direct links (i.e. shared products, technology and distribution linkages) between the firm s businesses. - BHP Billiton Related Linked Strategy - less than 70 per cent of revenue comes from the dominant business. - there are only limited links between businesses. - Wesfarmers. 11

High Levels of Diversification Unrelated Diversification Strategy - less than 70 per cent of revenue comes from the dominant business. - there are no relationships between businesses. - General Electric. 12

Unrelated Diversification Unrelated diversification creates value through two types of financial economies - cost savings realised through improved allocations of financial resources based on investments inside or outside firm. - the restructuring of acquired assets. 13

Operational And Corporate Relatedness FIGURE 6.2 VALUE-CREATING DIVERSIFICATION STRATEGIES: OPERATIONAL AND CORPORATE RELATEDNESS 14

Operational Relatedness Operational Relatedness - sharing activities. - can gain economies of scope. - involves sharing primary or support activities in the value chain. 15

Corporate Relatedness Corporate Relatedness - transferring skills or corporate core competencies among units. businesses through managerial and technological knowledge, experience and expertise. - complex sets of resources and capabilities linking different imitate, so there is an immediate competitive advantage over competition. - intangible resources are difficult for competitors to understand and 16

Simultaneous Operational Relatedness and Corporate Relatedness The ability to simultaneously create economies of scope by - sharing activities operational relatedness and - transferring core competencies corporate relatedness that are difficult for competitors to understand and learn how to imitate. 17

Reasons For Diversification TABLE 6.1 REASONS FOR DIVERSIFICATION 18

Value Creating Diversification Market Power - exists when a firm is able to sell its products above the existing competitive level, or to reduce costs of primary and support activities below the competitive level, or both. Vertical Integration - backward integration a firm produces own inputs. - forward integration a firm operates its own distribution system for delivering outputs. De-integration - the development of independent supplier networks, which is the focus of many manufacturing firms like Dell and General Motors. 19

Value Neutral Diversification The quality of the firms resources may permit only diversification that is value neutral rather than value creating. External incentives - Regulations and legislation media ownership. - Taxation law. Internal incentives - low performance. - uncertain future cash flows. - synergy and firm risk reduction. 20

Value Reducing Diversification Top-level executives may diversify in order to diversify their own employment risk, as long as profitability does not suffer excessively - diversification adds benefits for top-level managers but not shareholders. - this strategy may be held in check by governance mechanisms or concerns for one s reputation. 21

Incentives To Diversify Low Performance Low performance is an incentive for diversification as corporations chase profitable firms or divest poor performers. 22

Incentives To Diversify Low Performance Diversification may be a defensive strategy if - the product line matures. - the product line is threatened. - the firm is small and is in a mature or maturing industry. Uncertain Future Cash Flows 23

Incentives To Diversify Synergy exists when the value created by businesses working together exceeds the value created by them working independently. Low Performance Uncertain Future Cash Flows A firm may become risk averse, constrain its level of activity sharing and forgo potential benefits of synergy, resulting in more unrelated types of diversification. Synergy and Risk Reduction 24

The Relationship Between Diversification and Performance FIGURE 6.3 THE CURVILINEAR RELATIONSHIP BETWEEN DIVERSIFICATION AND PERFORMANCE 25

Learning Objectives Explain the popularity of merger and acquisition strategies in firms competing in the global economy. Discuss reasons why firms use an acquisition strategy to achieve strategic competitiveness. Describe seven problems that work against achieving success when using an acquisition strategy. Name and describe the attributes of effective acquisitions. Define the restructuring strategy and distinguish among its common forms. Explain the short and long term outcomes of the different types of restructuring strategies. 26

Merger and Acquisition Strategies Are a source of firm growth and above-average returns and have been popular for many years. Are heavily influenced by the external environment and in particular - Financial markets and the availability of credit. - Political views in foreign countries towards M&A activity. Cross-border acquisitions increase during currency imbalances, from strong currency countries to weaker currency countries, such as from Germany to the USA. 27

M&A Strategies and Investor Success Acquiredfirms shareholders often earn above-average returns from acquisitions whereas by contrast acquiringfirms shareholders often earn below-average returns from acquisitions. In two-thirds of all acquisitions, the acquiring firm s stock price fell immediately after the intended transaction was announced. This negative response reflects investors skepticism about projected synergies being captured. 28

Mergers, Acquisitions and Takeovers A merger is where two firms agree to integrate their operations on a relatively co-equal basis however there are few true mergers because one firm usually dominates in terms of market share, size or asset value. An acquisition is where one firm buys a controlling, 100 per cent interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio. A takeoveris a special type of acquisition strategy wherein the target firm does not solicit the acquiring firm s bid and a hostile takeover is an unfriendly takeover that is undesired by the target firm. 29

Reasons for Acquisitions FIGURE 7.1 REASONS FOR ACQUISITIONS AND PROBLEMS IN ACHIEVING SUCCESS 30

Reasons for Acquisitions Market power is increased by - Horizontal acquisitions acquisitions of other firms in the same industry. - Vertical acquisitions acquisitions of suppliers or distributors of the acquiring firm. - Related acquisitions acquisitions of firms in related industries. - market leadership results from market power. Overcome entry barriers - entry barriers are factors associated with the market or with the firms operating in it that increase the expense and difficulty faced by new ventures trying to enter that market. - barriers include economies of scale and differentiated products. 31

Reasons for Acquisitions Cost of new product development and increased speed to market - acquisition strategies are a common means of avoiding risky internal ventures and risky R&D investments and become a substitute for innovation. Learning and developing new capabilities - an acquiring firm can reduce inertia and gain capabilities that it does not currently possess, such as a special technological capability or a broader knowledge base. Lower risk compared to developing new products - acquisition strategies can avoid the duplication of costly errors. 32

Reasons for Acquisitions Increased diversification - using acquisitions to diversify a firm is the quickest and easiest way to change its portfolio of businesses. Reshaping a firm s competitive scope - reducing a company s dependence on specific products or markets alters the firm s competitive scope. 33

Reasons for Acquisitions Take the competition out of the market !!

Problems Achieving Acquisition Success Acquisition strategies are not free of problems, even when pursued for value creating reasons, research suggest - 20 per cent of all mergers and acquisitions are successful. - 60 per cent produce disappointing results. - 20 per cent are clear failures, with technology acquisitions reporting even higher failure rates. Greater acquisition success accrues to firms that are able to - select the right target. - avoid paying too high a premium (by doing appropriate due diligence). - integrate the operations of the acquiring and target firm effectively. - retainthe target firm s human capital. 35

Problems Achieving Acquisition Success Integration difficulties - melding two disparate corporate cultures. - linking different financial and control systems. - building effective working relationships, particularly when management styles differ and resolving problems regarding the status of the newly acquired firm s executives. - loss of key personnel weakening the acquired firm s capabilities and reducing its value. Inadequate evaluation of the target company - ineffective due diligence may result in paying an excessive premium for the target company. 36

Problems Achieving Acquisition Success Large or extraordinary debt - increase the likelihood of bankruptcy. - lead to a downgrade of the firm s credit rating. - preclude investment in activities that contribute to the firm s long term success such as research and development, human resource training and marketing. Inability to achieve synergy - occurs when assets are not worth more when used in conjunction with each other than when they are used separately. - failure to achieve efficiencies derived from economies of scale and economies of scope by sharing resources across the businesses in the merged firm. 37

Problems Achieving Acquisition Success Too much diversification - acquisitions may become substitutes for innovation. - strategic focus shifts to short-term performance. - over-diversification can lead to a decline in performance, after which business units are often divested. Managers are overly focused on acquisitions and invest substantial time and energy in acquisition strategies in order to - search for viable acquisition candidates. - complete effective due-diligence processes. - prepare for negotiations. - manage the integration process after the acquisition is completed. 38

Problems in Achieving Acquisition Success Too big. The complexity and additional costs of management may exceed the benefits of the economies of scale, economies of scope and additional market power achieved through the acquisition - formal rules and policies ensure consistency of decisions and actions however, formalised controls often lead to relatively rigid and standardised managerial behaviour. - the firm may produce less innovation. 39

TABLE 7.1 ATTRIBUTES OF SUCCESSFUL ACQUISITIONS Attributes of Successful Acquisitions 40

Restructuring Restructuringis a strategy through which a firm changes its set of businesses or financial structure - failure of an acquisition strategy often precedes a restructuring strategy. - restructuring may occur because of changes in the external or internal environments. Restructuring strategies include - Downsizing. - Down-scoping. - Leveraged Buyouts. 41

Restructuring Downsizing - reductionin the number of a firm s employees and in the number of its operating units, but it does not change the essence of the business. Down-scoping - refers to divestiture, spin-off or some other means of eliminating businesses that are unrelated to a firm s core businesses. Leveraged Buyout - when a party buys all of the assets of a business, financed largely with debt, and takes the firm private. 42

Restructuring Outcomes Short term outcomes - reduced labour and debt costs. - emphasis on strategic controls. Long term outcomes - loss of human capital. - higher or lower performance. - higher risk. 43

FIGURE 7.2 RESTRUCTURING OUTCOMES Restructuring Outcomes 44