Cost of Equity and Capital Structure in Finance

Explore the concepts of cost of equity, required rate of return, and capital structure in finance. Learn about methods to determine cost of common equity, such as the dividend growth model and SML, and understand the difference between required rate of return, appropriate discount rate, and cost of capital. Dive into estimating future growth rates and analyzing dividend payments to calculate the cost of equity for a company.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

COST OF CAPITAL CHAPTER 14

Required return VS cost of capital Any returns for investors are costs for the company NPV What is the required rate of return? What does it mean? What is the difference between: required rate of return / appropriate discount rate and cost of capital?

Capital structure Preferred stock Common stock Debt

Cost of equity Cost of common equity (Re) is the rate of return that an investor requires when investing in common shares of a company The cost of common equity is the return required by equity investors given the risk of the cash flows from the firm Business risk Financial risk

Cost of equity There are two major methods for determining the cost of common equity Dividend growth model 1. SML 2.

Reminder Interest Debt Preferred dividends Preferred stock Dividends Capital gain Common stock

Cost of equity Dividend growth model 1. + = 0 ( 1 ) D g 0 P Re g D = + 1 RE g P 0 D1: expected dividend for upcoming year Po: current share price g: growth rate

Cost of equity Suppose STC paid a dividend of 4$ per share last year. The stock is currently sells for 60 $ per share. You estimate that the dividend will grow steadily at a rate if 6% per year into the infinite future. What is the cost of equity for STC?

Cost of equity Suppose that your company is expected to pay a dividend of $1.50 per share next year. You bought the common stock for 20 and expect to sell it next year worth $25. What is your required rate of return?

Cost of equity Estimating g: There are two ways of estimating g Use historical growth rates 1. Use analysts forecasts of future growth rates 2. Year 2005 2006 2007 2008 2009 dividend 1.10$ 1.20 1.35 1.40 1.55

Cost of equity Advantages and Disadvantages of Dividend Growth Model Advantages: simplicity Disadvantages: Only applicable to companies currently paying dividends 1. Not applicable if dividends aren t growing at a reasonably 2. constant rate Extremely sensitive to the estimated growth rate an 3. increase in g of 1% increases the cost of equity by 1% Does not explicitly consider risk 4.

Cost of equity 2. The Security Market Line Approach (SML) The SML essentially tells us the reward (return) for bearing risk in financial markets what return is expected for a given level of risk required return is a function of 3 things: risk free rate 1. market risk premium 2. systematic risk of the asset relative to the average risk - called 3. the beta coefficient

Cost of equity risk free rate: return on a risk free asset 1. market risk premium - reflecting the return associated 2. with the market as a whole e.g. the Saudi market return systematic risk of the asset relative to the average risk called 3. the beta coefficient : A measure of the systematic risk, of a security or a portfolio in comparison to the market as a whole - so if the stock historically is much more volatile (risky) than the market then the return should reflect that incremental risk

Cost of equity From the SML comes the Capital Asset Pricing Model (CAPM) According to the CAPM: RE= Rf+ E (ERM- Rf) Rf= risk free rate of return Rm= expected market return Rm-RF = market risk premium BE = estimate of systematic risk, the risk for an individual security relative to the market risk as a whole

Cost of equity Get the risk-free rate (Rf) from financial press many use the 1-year Treasury bill rate, T-bond rates Get estimates of market risk premium and security beta. Historical risk premium RM- Rf= Beta historical (1) Investment information services (2) Estimate from historical data

Cost of equity Suppose your company has an equity beta of .58 and the current risk-free rate is 6.1%. If the expected market risk premium is 8.6%, what is your cost of equity capital?

Cost of equity Advantages and Disadvantages of SML Advantages Explicitly adjusts for systematic risk Applicable to all companies, as long as we can estimate beta Disadvantages Have to estimate the expected market risk premium, which does vary over time Have to estimate beta, which also varies over time We are using the past to predict the future, which is not always reliable

Ex 1 Page 465 The Down and Out Co. just issued a dividend of 2.40$ per share on its common stock. The company is expected to maintain a constant 5.5 percent growth rate in its dividends indefinitely. If the stock sells for 52$ a share , what is the company s cost of capital?

Ex3 Page 465 Stock in Country Road Industries has a beta of 0.85. the market risk premium is 8 percent, and T-bills are currently yielding 5 percent. The company s most recent dividend was 1.6$ per share, and dividends are expected to grow at a 6 percent annual rate indefinitely. If the stock sells for 37$ per share, what is your best estimate of the company s cost of capital?

Ex4 Page 465 Suppose In a Found Ltd. Just issued a dividend of 1.43$ per share on its common stocks. The company paid dividends of 1.05$ , 1.12$, 1.19$, and 1.30$ per share in the last four years. If the stock currently sells for 45$, what is your best estimate of the company s cost of equity?

Reminder Debt Bank loans 1. 2. Bonds Equity Preferred stock 1. 2. Common stock

Cost of Debt Cost of capital is the rate that must be earned to satisfy the required rate of return of the firm's investors ( fund providers) Required return Cost

Cost of Debt What is rate of return? Required rate of return versus expected rate of return RRR : The minimum annual percentage earned by an investment that will induce individuals or companies to put money into a particular security or project.

Cost of Debt Do you accept the project? ERR 20% RRR 25%

Cost of Debt Do you accept the project? ERR 30% RRR 25%

Cost of Debt What is required rate of return based on? The required rate of return is used to determine if the reward is worth the risk. Risk free rate is required return on a risk-free asset, it is implied that any additional risk taken by an investor should be rewarded with an interest rate higher than the risk-free rate

Cost of Debt Cost of debt is simply the interest rate the firm must pay on new borrowing. The current interest rate in the market The cost of debt is the required return on a company s liabilities

Cost of Debt Loans: Decreasing interest Bonds: Fixed interest

Cost of debt Loans Ki= 2mD/ P(n+1) m= number of payments per-year D= total interest amount P= value of loan n= total number of payments throughout loan period

Example You borrowed 10m$ with a 5% interest rate for 5 years from a bank were you will be repaying the loan as fixed payments. These payments include the principal and interest of the loan. What is the cost of your debt if you are to pay the payments every 3 months across the 5 year period.

Bonds Bond: is an interest only loan Bonds features and prices: For example: suppose the Beck Corporation wants to borrow 1,000$ for 30 years. The interest rate on similar corporation is 12 percent.

Bonds Features: Coupon: the stated interest payment made on a bond 1. (120$) 2. Face value: the principle amount of a bond that is repaid at the end of the term. Also called par value (1,000$) 3. Coupon rate: the annual coupon divided by the face value of a bond. 120$/ 1,000$ = (12%) 4. Maturity: the specified date on which the principle amount of a bond is paid.

Bond values and yields There is an inverse relation ship between interest rates and the present value of a bond To determine the value of a bond we need to know: The number of periods left to maturity 1. 2. Par value 3. Interest rate 4. coupon

Bond values and yields Yield to maturity (YTM): the rate required in the market on a bond 1 1 ( k ) N + 1 k FV k + = + d V Pmt ( ) B N 1 d d

Bond values and yields Example: suppose a company were to issue a bond with 10 years to maturity. This company has an annual coupon of 80$. Similar bonds have a yield of maturity of 8%. What will the bond sell for? Suppose a year has gone by. And interest rate has risen to 10 percent, what will the bond be worth? What would the bond sell for if interest rates had dropped by 2 percent?

Cost of debt The required return is best estimated by computing the yield-to-maturity on the existing debt The cost of debt is NOT the coupon rate What is the cost of new debt Rd for a company if the current interest rate is 12%?

Cost of debt Trial and Error Suppose we have a bond issue currently outstanding that has 10 years left to maturity and a face value of $1,000. The coupon rate is 10% and coupons are paid annually. The bond is currently selling for $941. What is the cost of debt Rd?

Cost of debt If the Price is lower than face value Rd= YTM = int +( d/n) (p+FV) / 2 int= interest payment d= decrease in value of bond n= years to maturity p= market value of bond FV= face value of bond

Cost of debt Trial and Error Suppose we have a bond issue currently outstanding that has 10 years left to maturity and a face value of $1,000. The coupon rate is 10% and coupons are paid annually. The bond is currently selling for $1,134. What is the cost of debt Rd?

Cost of debt If the Price is Higher than face value Rd= YTM = int - ( rs/n) (p+FV) / 2 int= interest payment rs= raise in value of bond n= years to maturity p= market value of bond FV= face value of bond

Cost of debt Suppose we are interested in a six-year , 8 percent coupon bond that is paid annually with a face value of 1,000$. The current price is 955.14$. What is the yield to maturity on this bond? Suppose that the current price for the bond is 1250$. What is the yield to maturity on this bond?

Cost of debt Tax Deduction: An item or expense subtracted from gross income to reduce the amount of income subject to tax. Interest expense is tax deductible Therefore, when a company pays interest, the actual cost is less than the expense

Cost of debt Note that Rdis not the appropriate cost of debt to use in calculating the WACC, instead we should use the after-tax cost of debt Rdt = Rd ( 1- T)

Cost of preferred stocks Reminders Preferred stock generally pays a constant dividend each period Dividends are expected to be paid every period forever Preferred stock is a perpetuity, so we take the perpetuity formula, rearrange and solve for RP po= Dp/Rp Rp = required return on preferred stock

Cost of preferred stocks RP= DP / P0 Rp cost of preferred stock Dp dividends paid Po current price not face value

Example 14.3 On May 30,2008 Alabama Power Co. had two issues of ordinary preferred stock with a 25$ par value that traded on the NYSE. One issue paid 1.30$ annually per share and sold for 21.05$ per share. The other paid 1.46$ per share annually and sold for 24.35$ per share. What is Alabama Power s cost of preferred stock?

Ex5 Page 465 Holdup bank has an issue of preferred stock with a 6$ stated dividend that just sold for 96$ per share. What is the bank s cost of preferred stock?

Why Cost of Capital Is Important We know that the return earned on assets depends on the risk of those assets The return to an investor is the same as the cost to the company Our cost of capital provides us with an indication of how the market views the risk of our assets

Reminder We said previously that the capital of a company composes of different elements, debt preferred stock common stock As we have seen, a given firm may have more than one provider of capital, each with its own required return The question here is what is the total cost of capital for a firm putting into consideration all the types of capital that a firm uses

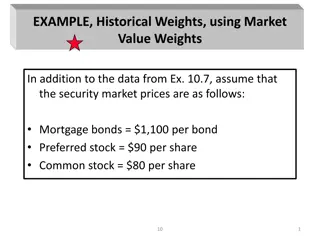

The Weighted Average Cost of Capital We can use the individual costs of capital that we have computed to get our average cost of capital for the firm. This average is the required return on the firm s assets, based on the market s perception of the risk of those assets The weights are determined by how much of each type of financing is used