Crop Protection Chemicals Market Size, Share, Trends and Growth Forecast to 2032

The global crop protection chemicals market was valued at USD 64.18 billion in 2024 and is projected to expand from USD 67.18 billion in 2025 to USD 97.01 billion by 2032, registering a CAGR of 5.39% between 2025 and 2032. I

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

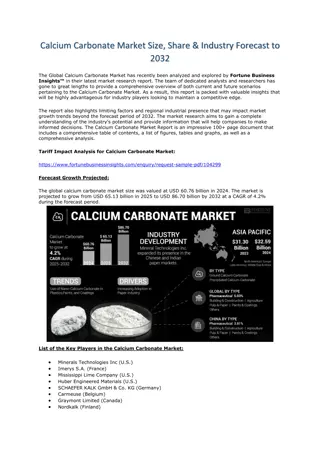

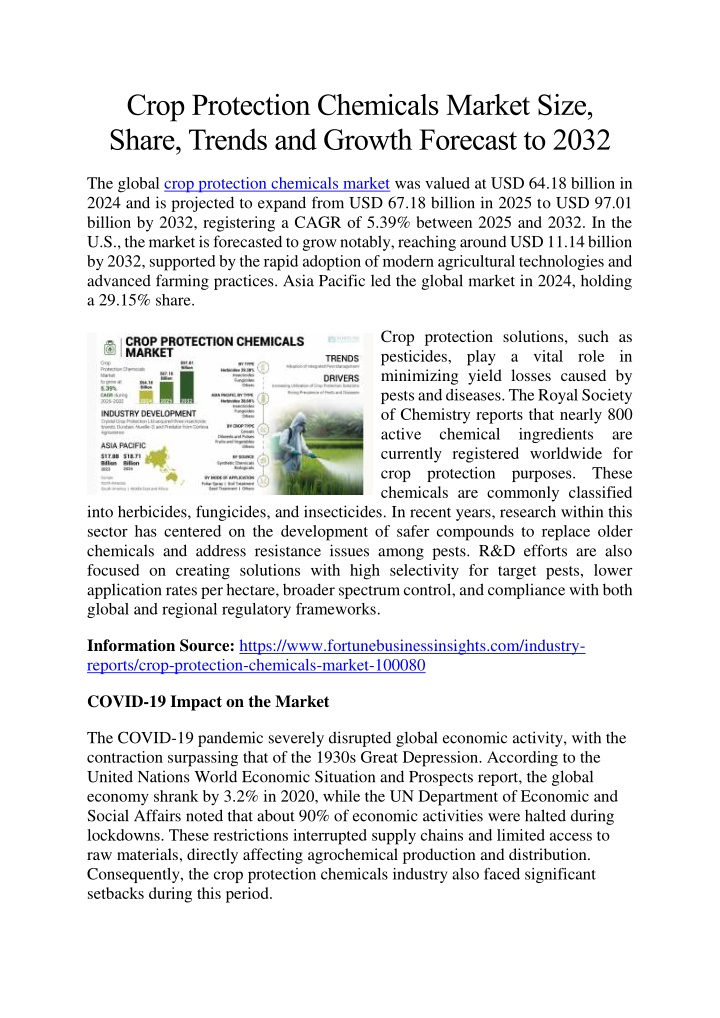

Crop Protection Chemicals Market Size, Share, Trends and Growth Forecast to 2032 The global crop protection chemicals market was valued at USD 64.18 billion in 2024 and is projected to expand from USD 67.18 billion in 2025 to USD 97.01 billion by 2032, registering a CAGR of 5.39% between 2025 and 2032. In the U.S., the market is forecasted to grow notably, reaching around USD 11.14 billion by 2032, supported by the rapid adoption of modern agricultural technologies and advanced farming practices. Asia Pacific led the global market in 2024, holding a 29.15% share. Crop protection solutions, such as pesticides, play a vital role in minimizing yield losses caused by pests and diseases. The Royal Society of Chemistry reports that nearly 800 active chemical ingredients are currently registered worldwide for crop protection purposes. These chemicals are commonly classified into herbicides, fungicides, and insecticides. In recent years, research within this sector has centered on the development of safer compounds to replace older chemicals and address resistance issues among pests. R&D efforts are also focused on creating solutions with high selectivity for target pests, lower application rates per hectare, broader spectrum control, and compliance with both global and regional regulatory frameworks. Information Source: https://www.fortunebusinessinsights.com/industry- reports/crop-protection-chemicals-market-100080 COVID-19 Impact on the Market The COVID-19 pandemic severely disrupted global economic activity, with the contraction surpassing that of the 1930s Great Depression. According to the United Nations World Economic Situation and Prospects report, the global economy shrank by 3.2% in 2020, while the UN Department of Economic and Social Affairs noted that about 90% of economic activities were halted during lockdowns. These restrictions interrupted supply chains and limited access to raw materials, directly affecting agrochemical production and distribution. Consequently, the crop protection chemicals industry also faced significant setbacks during this period.

Market Segmentation The market is segmented by type into herbicides, fungicides, insecticides, and others; by crop type into cereals, fruits & vegetables, oilseeds & pulses, and others; by application into seed treatment, soil treatment, foliar spray, and others; and by region into North America, South America, Europe, Asia Pacific, and the Middle East & Africa. Key Market Drivers and Challenges Growing Demand for Higher Agricultural Yields Farmers are increasingly adopting Integrated Pest Management (IPM) techniques that combine biological control, pest-resistant crop varieties, and improved farming methods. These practices enhance crop productivity while minimizing risks to human health and the environment. According to India s Directorate of Plant Protection, Quarantine & Storage, IPM adoption has improved yields by 40.14% in rice and 26.63% in cotton. While crop losses due to pests have declined from 13.6% after the Green Revolution to 10.8% in the early 21st century, the rise of pesticide-resistant pest species remains a major challenge for the industry. Regional Insights Asia Pacific Dominance Driven by Agricultural Dependence Asia Pacific, valued at USD 16.54 billion in 2020, is expected to maintain its leading position throughout the forecast period. The region s reliance on agriculture, rapid population growth, and food security concerns are driving demand for crop protection solutions. Conversely, North America and Europe are shifting toward sustainable agricultural practices, emphasizing bio-based and eco-friendly alternatives. Competitive Landscape Strategic Partnerships and Acquisitions Fuel Market Expansion Leading companies are actively pursuing mergers, acquisitions, and collaborations to expand their crop protection portfolios and strengthen market positioning. These initiatives focus on introducing advanced and sustainable pest management solutions. Key Companies Profiled

Rotam CropSciences Ltd. (China) UPL Ltd. (India) ChemChina (China) Corteva, Inc. (U.S.) Syngenta AG (Switzerland) Nufarm (Australia) Sumitomo Chemicals (Japan) FMC Corporation (U.S.) BASF SE (Germany) Bayer CropScience (Germany) Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample- pdf/crop-protection-chemicals-market-100080 Industry Updates May 2020: FMC Corporation purchased intellectual property rights and technology for Fluindapyr, a novel fungicide, from Isagro S.p.A. for USD 60 million. March 2020: Corteva Agriscience entered a multi-year partnership with AgPlenus to co-develop next-generation herbicides, strengthening its innovation pipeline.