Cross-Border Reinsurance Guidelines in Indian Life Insurance Market

Explore the impact of Cross-Border Reinsurance Guidelines on risks in the Indian Life Insurance market at the India Fellowship Seminar 2016. Learn about the implications, benefits, and regulations affecting the reinsurance market in India.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

India Fellowship Seminar, 2016 Topic Cross Border Reinsurance Guidelines and first right of refusal to Indian reinsurers (draft) How it will change the risks in the Indian Life Insurance market Guide Name Mr. NIDUMULA SAI KRISHNA PRABHAKAR Presenters Names ADITYA JAIN NEHA SINGH PRANAV SAKLECHA 9th & 10thof June 2016 Mumbai Indian Actuarial Profession Serving the Cause of Public Interest

Agenda Need for Reinsurance Reinsurance market for life insurance in India Reinsurance Regulations: Over the Years Overview of Cross Border Reinsurance Guidelines Overview of Branch Office Regulations Reinsurance Regulations & Implications Summary www.actuariesindia.org 2

Agenda Need for Reinsurance Reinsurance market for life insurance in India Reinsurance Regulations: Over the Years Overview of Cross Border Reinsurance Guidelines Overview of Branch Office Regulations Reinsurance Regulations & Implications Summary www.actuariesindia.org 3

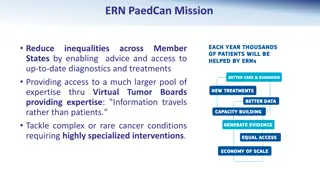

Need for Reinsurance Assist in Product Innovation Access to Expertise Hedge Against Claim Volatility Benefits of Reinsurance Help achieve capital efficiency Help reduce parameter risk Hedge against exposure to large risks Help smooth annual returns www.actuariesindia.org 4

Need for Reinsurance Paradigm shift in Life Insurance market Post linked and Non-Linked Regulation (Feb 2013), substantial increase in death benefit Movement towards protection business (term and health) Require more reinsurance support because of: Competitive reinsurance rates Underlying mortality/morbidity risk Initial & claim underwriting guidelines Contract design www.actuariesindia.org 5

Need for Reinsurance Reinsurer as an enabler of product innovation Long term health insurance Setting/Review of rating factors Online Term Insurance Access to reinsurer data Competitive reinsurance rates Credibility of population data Sharing of parameter risk Access to reinsurer s expertise Reliance on reinsurers expertise Contract design and underwriting policy www.actuariesindia.org 6

Agenda Need for reinsurance Reinsurance market for life insurance in India Reinsurance Regulations: Over the Years Overview of Cross Border Reinsurance Guidelines Overview of Branch Office Regulations Reinsurance Regulations & Implications Summary www.actuariesindia.org 7

Reinsurance Market for Life Insurance in India Reinsurance market for life insurance in India Steady growth in Reinsurance Premium 1,200 88.4% 90.2% 1,000 Reinsurance premiums (in Rs. crores) 95.3% 800 Foreign Reinsurers contribute to ~90% of the business 600 400 Share of GIC Re steadily increasing, crossed 10% in FY14-15 200 11.6% 9.8% 4.7% - FY12-13 FY13-14 FY14-15 GIC Re Other reinsurers *Source: Public Disclosures (L1) of 24 Life insurance companies and GIC Re www.actuariesindia.org 8

Agenda Need for reinsurance Reinsurance market for life insurance in India Reinsurance Regulations: Over the Years Overview of Cross Border Reinsurance Guidelines Overview of Branch Office Regulations Reinsurance Regulations & Implications Summary www.actuariesindia.org 9

Reinsurance Regulations: Over the Years 2015 IRDAI Registration and Operations of Branch Offices of Foreign Reinsurers other than Lloyd's Regulations, 2015: Regulation for reinsurers 2013 regulations: Limits on reinsurance ceded IRDA Life Insurance (Reinsurance) Regulations ,2000: Additional controls introduced Insurance Act 1938, Section (101): no limit on reinsurance ceded Reg. changes in 2013 Reg. changes in 2013 www.actuariesindia.org 10

Agenda Need for reinsurance Reinsurance market for life insurance in India Reinsurance Regulations: Over the Years Overview of Cross Border Reinsurance Guidelines Overview of Branch Office Regulations Reinsurance Regulations & Implications Summary www.actuariesindia.org 11

Overview of Cross Border Reinsurance Guidelines "Cross Border Reinsurers (CBR)" means reinsurers who do not have any physical presence in India and carry on reinsurance business with Indian insurance/reinsurance companies. Eligibility Criteria for CBR Credit rating of at least BBB (S&P) or equivalent Satisfactory past claims performance Legal entity in home country and regulated by home regulator for the following: Adequate solvency margin/capital Adequacy of technical reserving methodologies, financial strength/ quality of management Registered and/or certified in National Regulatory environment with which Govt. of India has signed Double Taxation Agreement www.actuariesindia.org 12

Overview of Cross Border Reinsurance Guidelines Filing of Information Cross Border Reinsurer Insurer IRDAI File Information sheet in prescribed format Conduct required due diligence Ensure strict compliance with eligibility criteria File the documents with the Authority Through Online Portal On successful filing - valid up to 1 year Duty of the Insurer Shall maintain all records of CBR for inspection Ensure CBR meets requirements as specified by Authority from time to time &report anomalies Placement with Cross Border Reinsurer not compliant with eligibility criteria No insurer shall place reinsurance business with CBRs that are non-compliant Insurer places business with Non- Complaint CBRs: Make specific request to Authority Seek Board Approval File information sheet (duly signed by CBR) along with necessary documents www.actuariesindia.org 13

Agenda Need for reinsurance Reinsurance market for life insurance in India Reinsurance Regulations: Over the Years Overview of Cross Border Reinsurance Guidelines Overview of Branch Office Regulations Amendments in Regulations Implications www.actuariesindia.org 14

Need for Branch Office Regulations, 2015 Increase Foreign Direct Investment Deepen reinsurance market Pave way for new players Maximizing local retention Define registration procedure Give boost to Indian reinsurers Simplify administration www.actuariesindia.org 15

Overview of Branch Office Regulations, 2015 Key Areas under Branch Office Regulations Branch Office Regulations Operations of branch offices of foreign reinsurer Registration procedure Procedure for action in case of default Fees www.actuariesindia.org 16

Overview of Branch Office Regulations, 2015 Order of preference Indian Reinsurers OR Foreign Reinsurers with Branch in India (with minimum retention of 50%) Foreign Reinsurers with Branch in India (min 30% retention) To offices of insurers set up in SEZ Balance to overseas reinsurers Regulation 2015 Impact Order of preference Obtain best terms from Indian reinsurers AND THEN foreign reinsurers with Branch in India (with minimum retention of 50%) Foreign Reinsurers with Branch in India (min 30% retention) To offices of Foreign Reinsurers set up in SEZ Balance to Indian Insurers and overseas reinsurers Amendment 2016 www.actuariesindia.org 17

Overview of Branch Office Regulations, 2015 Order of preference Indian Reinsurers OR Foreign Reinsurers with Branch in India (with minimum retention of 50%) Foreign Reinsurers with Branch in India (min 30% retention) To offices of insurers set up in SEZ Balance to overseas reinsurers Regulation 2015 Impact Order of preference Obtain best terms from Indian reinsurers AND THEN foreign reinsurers with Branch in India (with minimum retention of 50%) Foreign Reinsurers with Branch in India (min 30% retention) To offices of Foreign Reinsurers set up in SEZ Balance to Indian Insurers and overseas reinsurers Amendment 2016 www.actuariesindia.org 18

Impact of Amendments in Regulations Impact on Foreign Reinsurers Right of first refusal for Indian reinsurers may not be viewed as a level playing field Global reinsurers may rethink their applications for setting up Branch office in India No incentive to help develop life insurance market in India Impact on Indian Reinsurers Domestic Reinsurers would enjoy preference over other Reinsurers Increased revenue for Domestic Reinsurers Encourage Indian entities to enter the reinsurance market Assist in growth of Indian Reinsurance market Strong Indian Reinsurance industry will benefit the life insurance market www.actuariesindia.org 19

Impact of Amendments in Regulations Impact on Life Insurance Companies Increase in concentration risk Reduction in benefits of geographical diversification No incentive for foreign reinsurers to share best in class practices Restriction on educating/training of employees of insurers systems management, effective risk Impact on Product Innovation Recent innovation in life insurance included product covering Cancer Need expertise of Global Reinsurers to help in product innovation Indian Reinsurers have limited data Non level playing field to have negative impact on such innovations www.actuariesindia.org 20

Impact of Amendments in Regulations Impact on Policyholder Cover may become expensive Exclusions in policy terms and conditions may increase Proposal underwriting may become stringent Protection against some risks may no longer be available Impact on Macro-Economic Environment Consistency with Government & Regulator s objective of increasing reinsurance and insurance penetration in India Increased revenue for domestic reinsurers meaning higher profits for government to be used for national building exercises Higher retention within India to flow back into the economy, positive impact on GDP growth Impact on India s image as an investment friendly destination? Implications for other economic reforms (FDI) www.actuariesindia.org 21

Summary Increased importance of reinsurance in Indian market Reinsurance regulation and changes Positive move by the Regulator and the Government Overall impact www.actuariesindia.org 22

Thank you Questions www.actuariesindia.org 23

Impact of 2015 Regulations Level playing field to both Indian Reinsurer & Foreign Reinsurers with Branch in India (min 50% retention) Significant upside for foreign reinsurers to open branches in India Application submitted by several foreign reinsurers Post Intervention from Govt. of India Back Back www.actuariesindia.org 24

History of Reinsurance Regulations Minimum proportion of sum assured ceded to Indian reinsurers No upper limit on amounts ceded Principle based approach Up till 2013 Higher retention requirements Justification to IRDAI if retention below prescribed limits Eliminate fronting Board approved comprehensive reinsurance programme to be submitted to Authority Restrictions on quota share Post 2013 Regulations Back Back www.actuariesindia.org 25