CsI - Tax Considerations for Cypriots Doing Business in the UK

Explore the tax implications for Cypriots conducting business in the UK, including key areas such as REIT, ATAD, WHT, and more. Caesium International LLP provides expert advice on UK tax legislation and practices, emphasizing the importance of legal considerations in tax matters.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CsI CsI GBCY Stars before your eyes 2011 to 2022

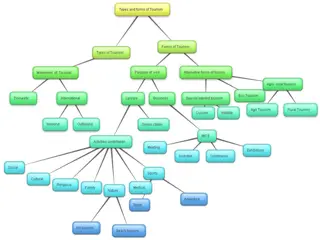

2011 for Cypriots doing business in the UK there were only stars coloured teal IHT PSC 0% REIT ATAD WHT DAC6 AEOI CRS CGT SDLT ATED VAT etc at border TRS Caesium International LLP (CsI) is a Limited Liability Partnership incorporated in England under number OC 386718 and whose registered office is at Suite 13, Churchill House, 137-139 Brent Street, LONDON, NW4 4DJ 24/08/2025 2

2021 for Cypriots doing business in the UK there is No FMoG 15% REIT IHT on Resi UK had pre- empted inc DOTAS (2003) No RID or PSD WHT DAC6 lite CRS AEOI DTT with NDA TRS PSC CGT on UK land and property rich companies SDLT plus 2% ATED Caesium International LLP (CsI) is a Limited Liability Partnership incorporated in England under number OC 386718 and whose registered office is at Suite 13, Churchill House, 137-139 Brent Street, LONDON, NW4 4DJ 24/08/2025 3

2022 Act now TRS for all express trusts TRS for all trusts directly owning UK land Freeports 100% FYA & 0% SDLT UBO register of all UK Land Caesium International LLP (CsI) is a Limited Liability Partnership incorporated in England under number OC 386718 and whose registered office is at Suite 13, Churchill House, 137-139 Brent Street, LONDON, NW4 4DJ 24/08/2025 4

CsI Important Notice Important Notice You are reminded that non-legal considerations such as accounting treatment and valuations are excluded from our remit. This presentation does not constitute advice, or advice on anything at all, as advice is only provided on the terms of a signed engagement letter, Caesium International LLP s advice relates solely to UK tax legislation and case law and H.M. Revenue & Customs published practice as at the date of the finalised version of written advice. To the extent that the tax treatment of another jurisdiction is referred to, then you acknowledge that this is not authoritative unless it has been approved by tax advisers in the relevant jurisdictions in relation to your matter and at your expense. References to the law of the European Union are references to how that law is applied in the UK. Tax legislation or practice is subject to change, possibly with retrospective effect and any such change could affect the validity of our conclusions. We have no responsibility to update our presentation to reflect changes in law or tax authority practice after the date of this presentation unless specifically requested to do so by a fee paying client who has signed an engagement letter with us. We accept no responsibility for matters not covered in this presentation or omitted from this presentation due primarily to the fact that we have no idea what your facts and circumstances are or whether you have represented them correctly or with all relevant (according to us) information. For the avoidance of doubt, we are not mind readers or psychics. For the avoidance of doubt, no person other than our Client is entitled to place any reliance on what we say. Any party other than our Client who obtains access to these slides or a copy and chooses to rely on it (or any part of it) should (i) have their head examined and (ii) will do so at their own risk. To the fullest extent permitted by law, we will accept no responsibility, duty of care or liability in respect of these slides to any other party whether in contract, tort (including negligence) or otherwise. Caesium International LLP is a limited liability partnership registered in England under number OC386718 and whose registered office is at Suite 13, Churchill House, 137-139 Brent Street, LONDON NW4 4DJ. Caesium International LLP (CsI) is a Limited Liability Partnership incorporated in England under number OC 386718 and whose registered office is at Suite 13, Churchill House, 137-139 Brent Street, LONDON, NW4 4DJ 24/08/2025 5