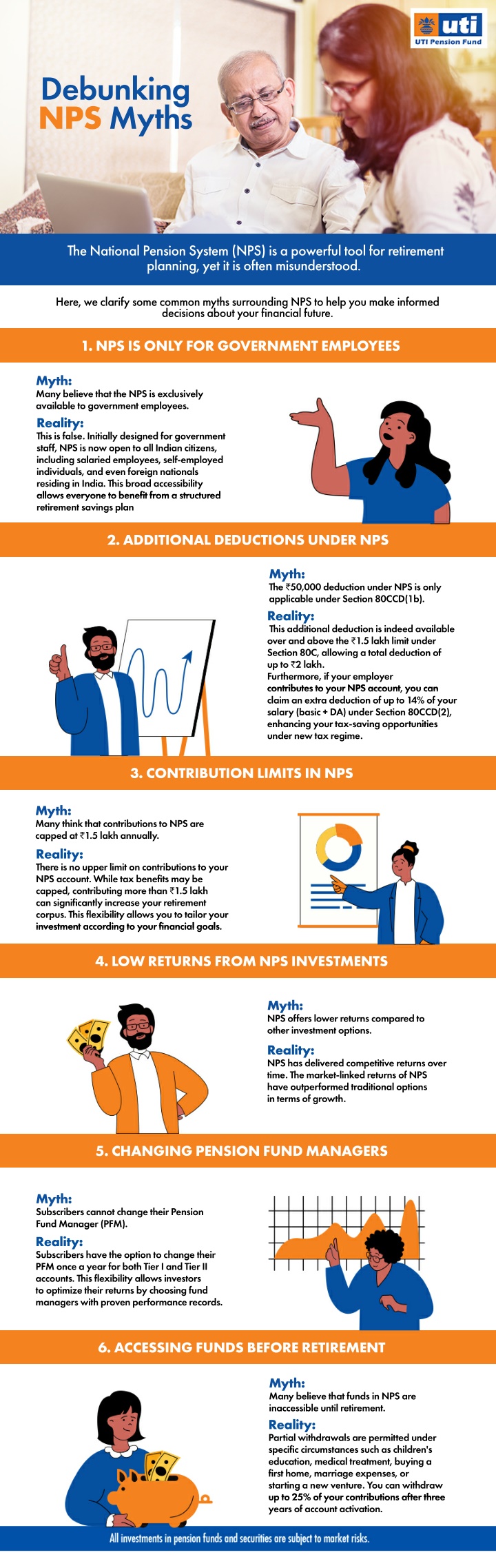

Debunking National Pension System (NPS) Myths

The National Pension System (NPS) is a powerful tool for retirement planning, yet it is often misunderstood. Here, we clarify some common myths surrounding NPS to help you make informed decisions about your financial future.rnrn Visit - https://www.utipension.com/blog/7-myths-about-national-pension-system-nps

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Debunking NPS Myths The National Pension System (NPS) is a powerful tool for retirement planning, yet it is often misunderstood. Here, we clarify some common myths surrounding NPS to help you make informed decisions about your financial future. 1. NPS IS ONLY FOR GOVERNMENT EMPLOYEES Myth: Many believe that the NPS is exclusively available to government employees. Reality: This is false. Initially designed for government staff, NPS is now open to all Indian citizens, including salaried employees, self-employed individuals, and even foreign nationals residing in India. This broad accessibility allows everyone to benefit from a structured allows everyone to benefit from a structured retirement savings plan 2. ADDITIONAL DEDUCTIONS UNDER NPS Myth: The 50,000 deduction under NPS is only applicable under Section 80CCD(1b). Reality: This additional deduction is indeed available over and above the 1.5 lakh limit under Section 80C, allowing a total deduction of up to 2 lakh. Furthermore, if your employer contributes to your NPS account, you can contributes to your NPS account, you can claim an extra deduction of up to 14% of your salary (basic + DA) under Section 80CCD(2), enhancing your tax-saving opportunities under new tax regime. 3. CONTRIBUTION LIMITS IN NPS Myth: Many think that contributions to NPS are capped at 1.5 lakh annually. Reality: There is no upper limit on contributions to your NPS account. While tax benefits may be capped, contributing more than 1.5 lakh can significantly increase your retirement corpus. This flexibility allows you to tailor your investment according to your financial goals. investment according to your financial goals. 4. LOW RETURNS FROM NPS INVESTMENTS Myth: NPS offers lower returns compared to other investment options. Reality: NPS has delivered competitive returns over time. The market-linked returns of NPS have outperformed traditional options in terms of growth. 5. CHANGING PENSION FUND MANAGERS Myth: Subscribers cannot change their Pension Fund Manager (PFM). Reality: Subscribers have the option to change their PFM once a year for both Tier I and Tier II accounts. This flexibility allows investors to optimize their returns by choosing fund managers with proven performance records. 6. ACCESSING FUNDS BEFORE RETIREMENT Myth: Many believe that funds in NPS are inaccessible until retirement. Reality: Partial withdrawals are permitted under specific circumstances such as children's education, medical treatment, buying a first home, marriage expenses, or starting a new venture. You can withdraw up to 25% of your contributions after three up to 25% of your contributions after three years of account activation.