Decision-Making Under Risk & Uncertainty: Probability, Risk, Uncertainty Models

Probability, risk, and uncertainty play crucial roles in decision-making. Understand the concepts and models, including subjective and objective probabilities, expected value calculations, and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Decision making Under Risk & Uncertainty. PAWAN MADUSHANKA MADUSHAN WIJEMANNA

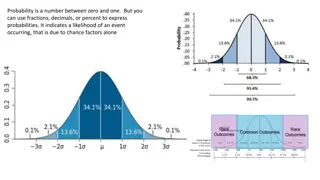

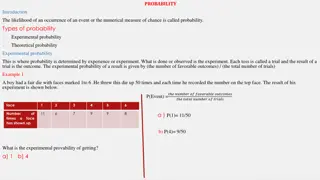

Probability The term of Probability refer to the likelihood or change that certain event will occur, with potential values ranging from 0 (the event will not occur) to 1 (the event will definitely occur).

What is risk and uncertainty ? Risk We don t know what is going to happen next, but we do know what the distribution looks like. There is a relevant past experiences with statistical evidence enabling a qualified degree of possible outcome. Uncertainty We don t know what is going to happen next and we don t know what the possible distribution looks like. There is little previous statistical evidence to enable the possible outcomes to be predicted.

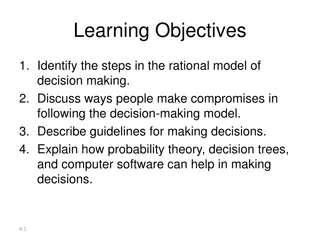

Decision Making models Identified Objective Identified alternatives Identified states of nature Possible outcomes Measurement of the value of payoffs Select the best course of action

Subjective Probability A probability derived from an individual's personal judgment about whether a specific outcome is likely to occur. Subjective probabilities contain no formal calculations and only reflect the subject's opinions and past experience. http://www.investopedia.com/terms/s/subjective_probability.asp

Objective Probability The probability that an event will occur based an analysis in which each measure is based on a recorded observation, rather than a subjective estimate. Objective probabilities are a more accurate way to determine probabilities than observations based on subjective measures, such as personal estimates. http://www.investopedia.com/terms/o/objective-probability.asp

Expected Value n = = = = E( X ) Expected value of X p X i i = = i 1 where Xi is the it h outcome of a decision, pi is the probability of the i t h outcome, and n is the total number of possible outcomes in the probability distribution The expected value of a distribution does not give the actual value of the random outcome, but rather indicates the average value of the outcomes if the risky decision were to be repeated a large number of times

Variance The variance (a measure of absolute risk) of a probability distribution measures the dispersion of the outcomes about the mean or expected outcome. The variance is calculated as n = = 2 X 2 Variance(X) = p ( X E( X )) i i = = i 1 The higher the variance, the greater the risk associated with a probability distribution.

Standard Deviation The standard deviation is the square root of the variance: = = Variance( X ) X The higher the standard deviation, the greater the risk

Coefficient of Variance Standard deviation Expected value = = = = E( X ) When the expected values of outcomes differ substantially, managers should measure the riskiness of a decision relative to its expected value using the coefficient of variation (a measure of relative risk)

Summary of Decision Rules Under Conditions of Risk While no single decision rule guarantees that profits will actually be maximized, there are number of decision rules that managers can use to help them make decisions under risk. Decision rules do not eliminate the risk surrounding a decision, they just provide a method of systematically including risk in the process of decision making. The three rules presented in this presentation are (1) the expected value rule, (2) the mean-variance rules, and (3) the coefficient of variation rule. These three rules are summarized below:

Expected value rule Choose decision with highest expected value Mean-variance rules Given two risky decisions A & B: If A has higher expected outcome & lower variance than B, choose decision A If A & B have identical variances (or standard deviations), choose decision with higher expected value If A & B have identical expected values, choose decision with lower variance (standard deviation) Coefficient of variation rule Choose decision with smallest coefficient of variation

Expected Utility Theory Expected utility theory postulates that managers make risky decisions in a way that maximizes the expected utility of the profit outcomes, where the expected utility of a risky decision is the sum of the probability-weighted utilities of each possible profit outcome = = + + + + + + E U( ) pU( ) p U( ) ... p U( ) n n 1 1 2 2

Payoff Table The application of probability concept to business decision making, pay off table refer to a matrix that provides pay-offs for all the possible combinations of decision alternatives and events decision variable. This can be used to solve problems that involve only one

1,500,000 5,000,000 2,000,000 3,000,000 3,000,000 6,000,000 0.2 2,500,000 5,500,000 9,000,000 0.3 8,500,000 3,000,000 6,000,000 0.4 0.1 9,000,000 12,000,000 3,000,000 6,000,000 6,550,000 6,400,000 3,000,000 5,300,000