Decomposition of Monetary Policy Shocks: Identification & Comments

Explore Daniel Lewis' work on unconventional monetary policy shocks, their decomposition, and macroeconomic effects. Comments on sample expansion and speculative results in related research are discussed, urging broader considerations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Discussion of Daniel Lewis Announcement-Specific Decompositions of Unconventional Monetary Policy Shocks & Their Macroeconomic Effects Eric T. Swanson University of California, Irvine Society for Computational Economics Meetings Allied Social Science Association Meetings (online) January 7, 2022

Idea of the Identification Each FOMC announcement day is a separate sample Simple version: Cieslak and Schrimpf (2018 JIE) classification: Cov(stocks, yields) < 0 Cov(stocks, yields) > 0 Information about economy Var(short yields) > Var(long yields) Conventional monetary policy Var(short yields) < Var(long yields) Risk appetite (risk on/off) Forward guidance/QE

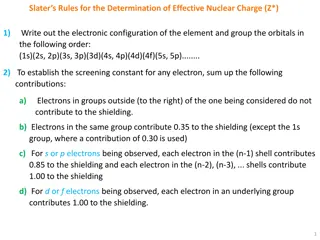

Lewis Identification This paper generalizes the idea: Four asset price factors/PCs (not just short rates, long rates, & stocks) Number of structural shocks present can be >1, importances can vary over course of afternoon after FOMC announcement Statistical tests for determining number of structural shocks Structural shocks identified/estimated using heteroskedasticity/linearity Statistical criteria for assigning identities to estimated shocks Key assumption is linearity of factors/PCs in the structural shocks together with heteroskedasticity of the structural shocks: observed asset price factors/PCs structural shocks (heteroskedastic)

Comment #1: Sample Should Be Expanded Paper s sample is all scheduled FOMC announcements from 2007-2019: 1. Why not begin the sample earlier? Forward guidance was important before 2007 (Gurkaynak-Sack-Swanson 2005) There are many more federal funds rate surprises before 2007 numbers are way too small, estimated poorly 2. Why not include intermeeting FOMC announcements? They are typically larger, econometrically more informative Kuttner (2001), Bernanke-Kuttner (2005), Gurkaynak et al. (2005), etc. all include them

Comment #2: LP Results Are Too Speculative Paper estimates effects of monetary policy surprises on macroeconomic variables using local projections Sample period is very short: 2008-2017 sample also dominated by Great Recession, ZLB Ramey (2016 HbMacro) discusses how fragile these types of estimates are after 1990, even over longer samples that exclude ZLB Specification includes unusual additional control variables (S&P 500)

Comment #3: Do Announcement-Specific Results Matter Much? Previous research (Kuttner 2001, Gurkaynak-Sack-Swanson 2005, Swanson 2021) estimates average effects of monetary policy changes on financial markets The announcement-specific decomposition in this paper is interesting The Fed s forward guidance and asset purchases have differed somewhat from announcement to announcement But is difference between 2-year-horizon forward guidance and 3-year horizon forward guidance very important? Announcement-specific effects of changes in policy are hard to estimate, hard to predict ex ante In the end, the paper mostly focuses on average effects of each type of monetary policy shock on financial markets, macro variables

Summary Summary of Paper: 1) Treats every FOMC announcement day as a separate sample 2) Estimates and identifies structural monetary policy shocks for each date using heteroskedasticity, linearity 3) Classifies shocks as fed funds rate , forward guidance , asset purhcases , or information 4) Estimates effects of each type of shock on financial markets, macro variables Summary of My Comments: 1) Sample should be expanded to pre-2007 and unscheduled FOMC announcements 2) Local Projections results for macro variables are too speculative 3) Do announcement-specific results matter much?