Disadvantages of Inadequate Working Capital in Business Operations

Learn about the drawbacks of insufficient working capital, including missed business opportunities, underutilization of production capacity, decreased credit worthiness, and more. Discover how it impacts liquidity, asset utilization, and overall business objectives.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

DISADVANTAGES OF INADEQUATE WORKING CAPITAL DISADVANTAGES OF INADEQUATE WORKING CAPITAL Prof. Pooja Dudeja Department of commerce.

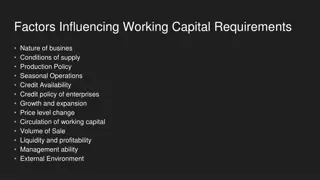

SOMETIMES, BUSINESS OPPORTUNITIES ARE NOT UTILIZED DUE TO NON AVAILABILITY OF ADEQUATE WORKING CAPITAL.

REASON IS THAT THE BUSINESS CONCERN IS NOT IN A POSITION TO TAKE UP A PROFITABLE VENTURE DUE TO UNAVAILBILTY OF WORKING CAPITAL FUNDS.

PRODUCTION CAPACITY IS NOT USED FULLY. IT RESULTS IN THE LOW LEVEL OF PRODUCTION. THIS LEADS TO FAILURE TO MEET THE REGULAR DEMANDS.

WHENEVER THE GOODWILL OF THE COMPANY IS AFFECTED, THE CREDIT WORTHINESS OF THE COMPANY IS DECREASED TO SOME EXTENT AMONG THE BANKS AND FINANCIAL INSTITUTIONS.

THE MARKET OPPORTUNITIES LIKE CASH DISCOUNT AND TRADE DISCOUNT CANNOT BE AVAILED BY THE BUSINESS CONCERN.

THE OBJECTIVES OF THE BUSINESS CONERN CANNOT BE ACHIEVED. MOROVER, AVERAGE RATE OF RETURN CANNOT BE EARNED BY THE COMPANY.

IT DIRECTLY AFFECTS THE LIQUIDITY POSITION OF THE BUSINESS FIRM.

FIXED ASSETS CANNOT BE USED PROPERLY DUE TO INADEQUATE WORKING CAPITAL.