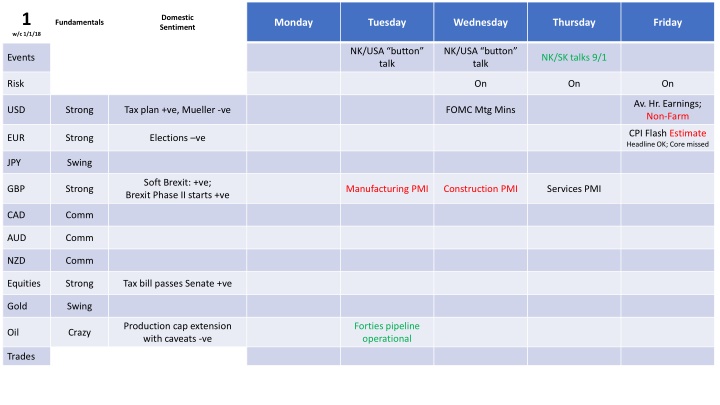

Domestic Sentiment and Events Update: Week of 1/1/18 to 29/1/18

Stay updated on the week's key events impacting global markets, including discussions on North Korea, US tax plan developments, Brexit updates, economic indicators, and commodity market trends.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

1 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 1/1/18 NK/USA button talk NK/USA button talk Events NK/SK talks 9/1 Risk On On On Av. Hr. Earnings; Non-Farm USD Strong Tax plan +ve, Mueller -ve FOMC Mtg Mins CPI Flash Estimate Headline OK; Core missed EUR Strong Elections ve JPY Swing Soft Brexit: +ve; Brexit Phase II starts +ve GBP Strong Manufacturing PMI Construction PMI Services PMI CAD Comm AUD Comm NZD Comm Equities Strong Tax bill passes Senate +ve Gold Swing Production cap extension with caveats -ve Forties pipeline operational Oil Crazy Trades

2 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 8/1/18 Events NK/SK talks Risk On On Off On On China/US Bonds fake news USD Strong Tax plan +ve, Mueller -ve CPI, Retail Sales ECB Monetary Policy Mtg Mins; Coalition talks deadline EUR Strong Elections ve JPY Swing Bank Holiday Soft Brexit: +ve; Brexit Phase II starts +ve Spanish/Dutch want soft Brexit GBP Strong Manu Production CAD Comm AUD Comm Retail Sales NZD Comm Equities Strong Tax bill passes Senate +ve Gold Swing Production cap extension with caveats -ve Oil Crazy Trades

3 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 15/1/18 Events Risk On/quiet Neutral On Neutral Neutral USD Strong Tax plan +ve, Mueller -ve Holiday Gov shutdown Coalition talks progressing +ve EUR Strong Final CPI SPD Congress (21 Jan) JPY Swing Soft Brexit: +ve; Brexit Phase II starts +ve GBP Strong CPI Retail Sales CAD Comm Overnight Rate CNY GDP; AUD Comm Industrial Production NZD Comm GDT Price Index Equities Strong Tax bill passes Senate +ve Gold Swing Production cap extension with caveats -ve Oil Crazy Trades

4 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 22/1/18 Events Risk On Neutral Off Neutral On Gov re-opens until 8thFeb Mnuchinprotectionism at Davos. Trump wants strong USD. USD Strong Tax plan +ve, Mueller -ve Adv GDP Coalition talks progressing +ve EUR Strong ECB Rate SPD Congress (21 Jan) JPY Swing BoJ Rate Tokyo Core CPI Emollient Macron; Norway transition deal agreed in principle Soft Brexit: +ve; Brexit Phase II starts +ve GBP Strong Average Earnings Prelim GDP CAD Comm AUD Comm NZD Comm CPI Equities Strong Tax bill passes Senate +ve Gold Swing Production cap extension with caveats -ve Oil Crazy SP500 long; USDJPY long out for -0.75%. SP500 long; USDJPY long SP500 long; USDJPY long Trades SP500 long SP500 long

5 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 29/1/18 Month end Facebook, MS earnings Apple, Amazon and Google earnings Events Month end Month end Risk Sell-off Sell-off Neutral Neutral/off Sell-off Tax plan +ve, Davos emollience +ve Mueller, protectionism ve Fed Funds Rate and Statement; Trump SotN Ave Hourly Earnings and NFP USD Strong Core PCE EUR Strong Coalition talks +ve CPI Flash Est JPY Swing Brexit +ve; Pressure on May ve GBP Strong Manu PMI Const PMI CAD Comm GDP AUD Comm CPI NZD Comm Equities Strong QE, Tax bill; earnings: all +ve Gold Swing Production cap extension with caveats -ve Oil Crazy SP500 long exit at breakeven SP500 long GBPUSD short -0.5% Trades SP500 long SP500 long SP500 long

6 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 5/2/18 Events Risk Sell-off Equity recovery Neutral Sell-off Tax plan +ve, Davos emollience +ve Mueller, protectionism ve USD Strong Coalition talks continue through yesterday s deadline. Draghi Speaks No coalition breakthrough Coalition agreement, ratification required EUR Strong Coalition talks +ve JPY Swing Brexit +ve; Pressure on May ve GBP Strong Services PMI Super Thursday Manu Production CAD Comm Trade Balance Retail Sales; Lowe Speaks; CNY Trade Balance RBA Monetary Policy Statement AUD Comm Cash Rate and Statement; Trade Balance Cash Rate and Statement NZD Comm Employment Spencer Speaks QE, Tax bill; earnings: all +ve; Current sell-off unsettling -ve Equities Strong Gold Swing Production cap extension with caveats -ve Oil Crazy SP500 long; WTI long SP500 long -1.0%; WTI long Trades WTI long

7 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 12/2/18 Events Risk Neutral Neutral Neutral Neutral Neutral Tax plan +ve, Davos emollience +ve Mueller, protectionism ve USD Strong CPI and Retail Sales PPI EUR Strong Coalition talks +ve Flash GDP (2/3) JPY Swing Holiday Brexit +ve; GBP Strong Pressure on May ve; Road to Brexit begins CPI Retail Sales CAD Comm Employment; RBA Gov Lowe speaks AUD Comm Inflation Expectations NZD Comm QE, Tax bill; earnings: all +ve; Current sell-off unsettling -ve Equities Strong Gold Swing Production cap extension with caveats -ve EIA forecast increased shale production Oil Crazy API Weekly Stocks WTI exit at BE; SP500 long Trades WTI short WTI short SP500 long SP500 long

8 Domestic Sentiment Monday Tuesday Wednesday Thursday Friday Fundamentals w/c 19/2/18 Events China holiday China holiday China holiday Risk Neutral/off Neutral/off Holiday; 13 Russians indicted; threat of Al tariffs Tax plan +ve, Davos emollience +ve Mueller, protectionism, deficit, debt ve USD Strong FOMC Mtg Mins Monetary Policy Mtg Mins EUR Strong Coalition talks +ve JPY Swing Average Earnings Index; Inflation Report Hearings Brexit +ve; Chequers Away Day; GDP (2/3) GBP Strong Pressure on May ve; Road to Brexit begins CAD Comm Core Retail Sales CPI Monetary Policy Mtg Mins AUD Comm Wage Price Index NZD Comm Retail Sales QE, Tax bill; earnings, Vix drops: all +ve; Equities Strong Gold Swing Production cap extension with caveats -ve Oil Crazy Trades SP500 long SP500 long SP500 long

This Weeks Trading Themes - 2018 week 8 1. A quiet week US Presidents Day and Chinese Lunar New Year 2. USD oversold, at 62% Fib 3. Equities watch the Vix; SP500 at 62% Fib 4. GOLD depends on USD and Fed Mins

This Weeks Trading Profile - 2018 week 8 1. #USSPX500 2. #UK 100 3. #UK_Mid250 4. WTI 5. EURJPY 6. USDJPY 7. GBPJPY 8. EURUSD 9. EURGBP 10.GBPUSD 11.GOLD