Double Declining Balance Depreciation Calculation Example

Learn to calculate double declining balance depreciation for a machine with a cost of $7000, a useful life of 3 years, and a salvage value of $1000. Understand the depreciation amounts and ending bases for the first and second years. Adjustments are made to ensure the asset is fully depreciated by the end of the useful life.

Uploaded on | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

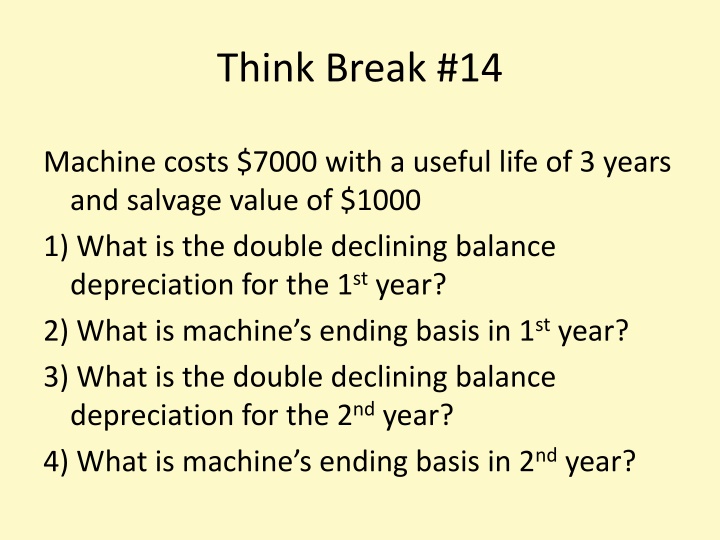

Think Break #14 Machine costs $7000 with a useful life of 3 years and salvage value of $1000 1) What is the double declining balance depreciation for the 1styear? 2) What is machine s ending basis in 1styear? 3) What is the double declining balance depreciation for the 2ndyear? 4) What is machine s ending basis in 2ndyear?

Think Break #14 Answer Double declining balance depreciation rate RDB= 2 x (1/3) = 2/3 (= 66.67%) 1) Year 1 Depreciation = $7,000 x 2/3 = $4,667 2) Ending basis in 1styear = $7,000 $4,667 = $2,333 3) Year 2 Depreciation = $2,333 x 2/3 = $1,555 4) Ending basis in 2ndyear = $ 2,333 $1,555 = $788

Think Break #14 Answer Cannot take $1,555 depreciation in year 2 since implies ending basis < salvage value Set year 2 depreciation so asset fully depreciated during year 2 3) Year 2 Depreciation $2,333 $1,333 = $1,000 Depreciation = $1,333 4) Ending basis in 2ndyear = $ 2,333 $1,333 = $1,000

Think Break #14 Answer Beginning Basis 7,000 2,333 Ending Basis 2,333 778 1,000 1,000 Year 1 2 Depreciation 4,667 1,555 1,333 0 3 1,000