Driving Financial Inclusion Through Technology in Africa

Explore how technology is revolutionizing access to finance in Africa through presentations and initiatives by Mrs. Clarissa Kudowor from the Bank of Ghana. Discover key strategies, government policies, and collaborative efforts aimed at formalizing financial services for the last mile, supported by the central bank and financial service providers.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

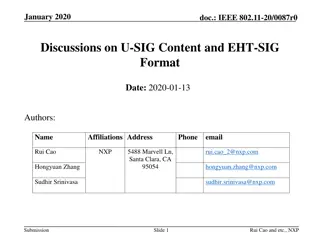

FROM INFORMAL TO FORMAL: HARNESSING THE POTENTIAL OF TECHNOLOGY TO DRIVE ACCESS TO FINANCE FOR THE LAST MILE IN AFRICA PRESENTATION BY MRS. CLARISSA KUDOWOR, ASST. DIRECTOR, PAYMENT SYETSMS DEPT. BANK OF GHANA 25THAPRIL 2018 BANK OF GHANA EST. 1957

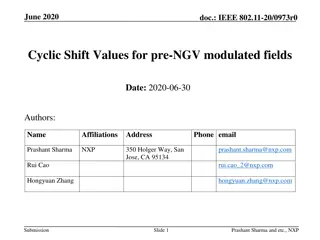

ECOSYSTEM GOVERNMENT CENTRAL BANK FINANCIAL SERVICE PROVIDERS MOBILE MONEY OPERATORS AGENT NETWORK MANAGERS TECHNOLOGY DEVELOPMENT PARTNERS BANK OF GHANA EST. 1957

GOVERNMENT POLICY INITIATIVES NFIDS linking SGs/VSLAs to formal financial institutions with technical support from the World Bank. Identify existing SGs, promote, and establish new SGs/VSLAs Financial capacity building of SGs/VSLAs Sensitization on linkages to formal FSP Financial literacy Develop and facilitate relationships with the formal FSPs BANK OF GHANA EST. 1957

GOVERNMENT POLICY INITIATIVES Digital Address system National Identification system Interoperable retail payment systems BANK OF GHANA EST. 1957

CENTRAL BANK Enabling regulatory environment Promote innovation to accelerate financial inclusion and extend reach of financial services Support in the provision the necessary infrastructure (agent registry, collateral registry, credit market development, etc) Consumer protection in a DFS BANK OF GHANA EST. 1957

FINANCIAL SERVICE PROVIDERS ACCESS POINTS TIERED KYC REQUIREMENTS SIMPLE LOW KYC ACCESS TO AFFORDABLE FINANCIAL PRODUCTS AND SERVICES FINANCIAL LITERACY ACCESS TO NANO & MICRO LOANS USE OF DATA ANALYTICS BANK OF GHANA EST. 1957

MOMOs Massive deployment of agent network across the country (200k) Over 20 participating partner banks Growing number of payment service providers/aggregators GHS 2.32 bn float balance as at December, 2016 24.8 Million registered subscribers as at December, 2016 (8.3 mil active) 78% annual growth rate in transaction vol (2017)from 2016 BANK OF GHANA EST. 1957

AGENT NETWORK MANAGERS AGENT ACQUISITION PRODUCT ACQUISTION AGENT MANAGEMENT PROFITABILITY VILLAGE AGENTS BANK OF GHANA EST. 1957

TECHNOLOGY -3RDPARTIES Aggregation platforms Merchant services Value added services BANK OF GHANA EST. 1957

DEVELOPMENT PARTNERS CARE INTERNATIONAL UNCDF PLAN INTERNATIONAL BANK OF GHANA EST. 1957

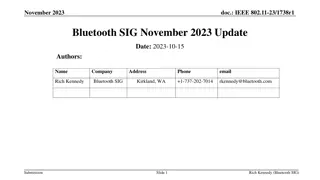

Informal 2 Formal THANK YOU! CLARISSA KUDOWOR BANK OF GHANA