Earnings Releases 2022 - Boz Bostrom, CPA

Explore the key components of earnings releases in 2022 with Boz Bostrom, a CPA professor. Understand the impact of earnings information on stock value and the importance of company-provided guidance. Gain insights on navigating earnings releases effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Understanding Earnings Releases (2022) Boz Bostrom, CPA Professor of Accounting and Finance Saint Ben s / Saint John s bbostrom@csbsju.edu / (612) 414-9629 https://www.linkedin.com/in/bozbostrom/ June 30, 2022 1 1

Logistics Polling questions throughout the meeting Required for CPE If you have issues answering the polling questions, please chat or email across your answer 2.0 CPE Hours (Finance - Technical) Partial credit available minimum of 1.0 hour Questions (and tips) are very welcome, submit through chat at any time Course evaluation and CPE certificate will be emailed shortly after the session 2

Learning objectives / Agenda Understand the critical components of a company s press release Understand the importance of company provided guidance or outlook Understand how investors incorporate earnings information, guidance, and one-time items in determining how a press release impacts the value of a stock

Overview Background in earnings releases What s included in earnings releases? Comparing earnings releases What happens when the news is bad? Impact of adjustments One-time events Changes due to COVID-19 How NOT to use earnings releases!

The basics 10-K s and 10-Q s are required by the SEC Filing due within ___ days of the end of the reporting period Large accelerated filer Accelerated filer Non-accelerated filer Press releases announcing earnings are not required Earnings calls are also not required The vast majority of companies still use press releases and earnings calls to appease investors 10-K 60 75 90 10-Q 40 40 45

Polling Question #1: Pfizer is a very large calendar year company. When did it release 2021 4th quarter earnings? A. December 31, 2021 B. January 1, 2022 C. February 8, 2022 D. February 24, 2022 E. March 16, 2022 F. March 31, 2022

Typical pattern Companies will issue a press release indicating the date and time of their earnings release. Also will announce timing of earnings call Company will publish earnings on their website at time indicated Selected financial information and commentary For most companies, this is about 3-5 weeks after the quarter/year end Often a little bit quicker with a quarter Company will have an earnings call an hour or two later

When to release? There are about 4,000 public companies in the US in 2020 (McKinsey study) Researchers found that about 95% of them release earnings when the markets are closed Markets open 930am 4pm Eastern Time, 830am 3pm Central Time 53% of those released in the late afternoon, 47% in the early morning Thus, Minnesota companies may release earnings: Around 6am central and have a call around 7am central, or Around 4pm central and have a call around 5pm central https://www.cfo.com/accounting-tax/2018/01/whats-the-best-time-to-announce-earnings-announcements/

Yahoo Finance Earnings Calendar During Quieter times

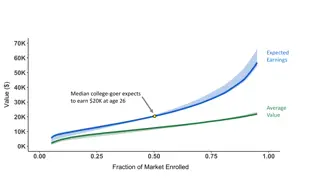

Stock market impact Volumes often are higher the day or two before earnings, and stock price may creep one way vs. the other Investors trying to predict market reaction Volumes will generally be higher once the market opens How much higher depends on whether investors were surprised by the earnings release Stock prices can be steady or extremely volatile, depending on what was reported vs. what was expected

Timing of market reaction When did Harley Davidson release its earnings? Before the markets opened on February 8th

Timing of market reaction When did Skechers release its earnings? After markets closed on February 3rd

Guidance Companies are not required to provide guidance (often referred to as an Outlook) Many do, but forms vary

Whats included in an earnings press release?

Polling Question #2: Similar to a 10-K, earnings releases are fairly comparable across companies. A. True B. False C. I don t know

Minnesota Examples Best Buy https://s2.q4cdn.com/785564492/files/doc_financials/2022/q4 /Best-Buy-Reports-Fiscal-Fourth-Quarter-Results.pdf US Bank https://ir.usbank.com/static-files/c1eceb62-ff72-4560-88c7- b1110821f62d

Skechers releases 2021 1st quarter earnings on April 22, 2021

Skechers releases 2021 2nd quarter earnings on July 22, 2021 actual results

Skechers releases 2021 1st quarter earnings on April 22, 2021

Skechers releases 2021 2nd quarter earnings on July 22, 2021 updated outlook

Market reaction? 5% increase!

Comparing earnings releases more complex

Ralph Lorens Fiscal 2022 2nd quarter release For Fiscal 2022, the Company now expects constant currency revenues to increase approximately 34% to 36% to last year on a 53-week reported basis. Foreign currency is expected to negatively impact revenue growth by approximately 20 basis points. The 53rd week is still expected to represent approximately 140 basis points of this year s revenue growth. The Company continues to expect operating margin for Fiscal 2022 of about 12.0% to 12.5%. This compares to operating margin of 4.8% in the prior year period and 10.3% in Fiscal 2020. Gross margin is now expected to increase at the high end of previous guidance of 50 to 70 basis points to last year, with stronger AUR growth and favorable product mix more than offsetting increased freight headwinds. Operating expenses continue to reflect the Company's plans to increase marketing and other strategic investments to support long-term growth, including a higher level of spend in the second half of the fiscal year. For third quarter Fiscal 2022, revenues are expected to increase approximately 14% to 16% in constant currency to last year. Foreign currency is expected to negatively impact revenue growth by approximately 140 basis points. Operating margin for the third quarter is expected in the range of 13.0% to 13.5%, roughly in-line with last year, with modest gross margin expansion partly offset by a shift in the timing of investments from the second quarter, increased freight expenses, normalizing channel mix shift compared to the prior year s COVID disruptions and about 30 basis points of negative impact from foreign currency. The full year Fiscal 2022 tax rate is now expected to be approximately 21% to 22%, assuming a continuation of current tax laws. Third quarter Fiscal 2022 tax rate is expected to be approximately 22% to 23%.

Full year revenues (compare to 3rd quarter release) For Fiscal 2022, the Company now expects constant currency revenues to increase approximately 34% to 36% to last year on a 53-week reported basis. Foreign currency is expected to negatively impact revenue growth by approximately 20 basis points. The 53rd week is still expected to represent approximately 140 basis points of this year s revenue growth. For Fiscal 2022, the Company now expects constant currency revenue growth of approximately 39% to 41% to last year on a 53-week reported basis, compared to its previous outlook of 34% to 36% growth. Foreign currency is expected to negatively impact revenue growth by approximately 70 basis points. The 53rd week is still expected to represent approximately 140 basis points of this year s revenue growth Good news outweighs the bad news

Full year operating margins The Company continues to expect operating margin for Fiscal 2022 of about 12.0% to 12.5%. This compares to operating margin of 4.8% in the prior year period and 10.3% in Fiscal 2020. Gross margin is now expected to increase at the high end of previous guidance of 50 to 70 basis points to last year, with stronger AUR growth and favorable product mix more than offsetting increased freight headwinds. The Company also raised its outlook for operating margin for Fiscal 2022 to approximately 13% on both a reported and constant currency basis, compared to a range of 12.0% to 12.5% previously. This compares to operating margin of 4.8% in the prior year period and 10.3% in Fiscal 2020. Gross margin is expected to increase 70 to 90 basis points to last year, up from 50 to 70 basis points previously, with stronger AUR growth and favorable product mix more than offsetting increased freight headwinds. Great!

3rd quarter revenues For third quarter Fiscal 2022, revenues are expected to increase approximately 14% to 16% in constant currency to last year. Foreign currency is expected to negatively impact revenue growth by approximately 140 basis points. Net Revenue. In the third quarter of Fiscal 2022, revenue increased by 27% to $1.8 billion on a reported basis and was up 28% in constant currency. Foreign currency negatively impacted revenue growth by approximately 150 basis points in the third quarter. Great!

3rd quarter operating margins Operating margin for the third quarter is expected in the range of 13.0% to 13.5%, roughly in-line with last year, with modest gross margin expansion partly offset by a shift in the timing of investments from the second quarter, increased freight expenses, normalizing channel mix shift compared to the prior year s COVID disruptions and about 30 basis points of negative impact from foreign currency. Operating income for the third quarter of Fiscal 2022 was $289 million and operating margin was 15.9% on both a reported basis and an adjusted basis. Great!

Tax Rate The full year Fiscal 2022 tax rate is now expected to be approximately 21% to 22%, assuming a continuation of current tax laws. Fourth quarter and full year Fiscal 2022 tax rates are expected to be approximately 21% to 22% Third quarter Fiscal 2022 tax rate is expected to be approximately 22% to 23%. In the third quarter of Fiscal 2022, the Company had an effective tax rate of approximately 21% on both a reported basis and an adjusted basis 3rdquarter improved, but doesn t seem to have changed full year

Polling Question #3: Based on the previous information, how did Ralph Loren s stock change when earnings were released A. Increase more than 5% B. Increase less than 5% C. About flat D. Decrease less than 5% E. Decrease more than 5%

3rd quarter release on Feb 3, 2022 7% increase!

Zoom What they said after Q1 ended April 30, 2020. Financial Outlook: Financial Outlook: Zoom is providing the following guidance for its second quarter fiscal year 2021 and its full fiscal year 2021. Second Quarter Fiscal Year 2021: Total revenue is expected to be between $495.0 million million and and $500.0 $500.0 million and non-GAAP income from operations is expected to be between $130.0 million and $135.0 million. Non between between $0.44 $0.44 and and $0.46 $0.46 with approximately 299 million non-GAAP weighted average shares outstanding. Full Fiscal Year 2021: Total revenue is expected to be between $1.775 billion and $1.800 billion. This revenue outlook takes into consideration the demand for remote work solutions for businesses. It also assumed increased churn in the second half of the fiscal year when compared to historic churn levels due to a higher percentage of customers who purchased monthly subscriptions in the first quarter. Non-GAAP income from operations is expected to be between $355.0 million and $380.0 million. Non-GAAP diluted EPS is expected to be between $1.21 and $1.29 with approximately 300 million non-GAAP weighted average shares outstanding $495.0 Non- -GAAP diluted EPS is expected to be GAAP diluted EPS is expected to be

Zoom Actual results for Q2 Ended July 31, 2020 (released afternoon of 8/31/20) Revenue: Revenue: Total revenue for the quarter was Total revenue for the quarter was $663.5 million Income from Operations and Operating Margin: Income from Operations and Operating Margin: GAAP income from operations for the quarter was $188.1 million, compared to $2.3 million in the second quarter of fiscal year 2020. After adjusting for stock-based compensation expense and related payroll taxes, expenses related to charitable donation of common stock, and acquisition-related expenses, non-GAAP income from operations for the second quarter was $277.0 million, up from $20.7 million in the second quarter of fiscal year 2020. For the second quarter, GAAP operating margin was 28.3% and non-GAAP operating margin was 41.7%. Net Income and Net Income Per Share: Net Income and Net Income Per Share: GAAP net income attributable to common stockholders for the quarter was $185.7 million, or $0.63 per share, compared to GAAP net income attributable to common stockholders of $5.5 million, or $0.02 per share in the second quarter of fiscal year 2020. Non-GAAP net income for the quarter was $274.8 million, after adjusting for stock-based compensation expense and related payroll taxes, expenses related to charitable donation of common stock, acquisition-related expenses, and undistributed earnings attributable to participating securities. Non Non- -GAAP net income per share was GAAP net income per share was $0.92 $663.5 million, up 355% year-over-year. $0.92.

Zoom What they said after Q1 ended April 30, 2020. Financial Outlook: Financial Outlook: Zoom is providing the following guidance for its second quarter fiscal year 2021 and its full fiscal year 2021. Second Quarter Fiscal Year 2021: Total revenue is expected to be between $495.0 million and $500.0 million and non-GAAP income from operations is expected to be between $130.0 million and $135.0 million. Non-GAAP diluted EPS is expected to be between $0.44 and $0.46 with approximately 299 million non-GAAP weighted average shares outstanding. Full Fiscal Year 2021: Total revenue is expected to be between Total revenue is expected to be between $1.775 billion billion and and $1.800 billion $1.800 billion. This revenue outlook takes into consideration the demand for remote work solutions for businesses. It also assumed increased churn in the second half of the fiscal year when compared to historic churn levels due to a higher percentage of customers who purchased monthly subscriptions in the first quarter. Non-GAAP income from operations is expected to be between $355.0 million and $380.0 million. Non Non- -GAAP diluted EPS is expected to be GAAP diluted EPS is expected to be between between $1.21 $1.21 and and $1.2 $1.29 with approximately 300 million non-GAAP weighted average shares outstanding $1.775

Zoom Updated outlook included in Q2 earnings release Financial Outlook: Financial Outlook: Zoom is providing the following guidance for its third quarter fiscal year 2021 and its full fiscal year 2021. Third Quarter Fiscal Year 2021: Total revenue is expected to be between $685.0 million and $690.0 million and non-GAAP income from operations is expected to be between $225.0 million and $230.0 million. Non-GAAP diluted EPS is expected to be between $0.73 and $0.74 with approximately 300 million non-GAAP weighted average shares outstanding. Full Fiscal Year 2021: Total revenue is expected to be between Total revenue is expected to be between $2.37 billion billion and and $2.39 billion $2.39 billion. This revenue outlook takes into consideration the demand for remote work solutions for businesses. It also assumed increased churn in the second half of the fiscal year when compared to historic churn levels due to a higher percentage of customers who purchased monthly subscriptions in the first quarter. Non-GAAP income from operations is expected to be between $730.0 million and $750.0 million. Non Non- -GAAP diluted EPS is expected to be GAAP diluted EPS is expected to be between between $2.40 $2.40 and and $2.47 $2.47 with approximately 300 million non-GAAP weighted average shares outstanding. $2.37

What happens when the news is bad?

Polling Question #4: What impact did the release have on Dave and Buster s stock price? A. Increased B. Decreased C. Not sure

Dave and Busters 17% increase!

Apple Guidance provided when Apple released 4th quarter earnings for 2018: revenue between $89 billion and $93 billion for the first quarter of 2019 Actual results for the first quarter of 2019: $84.3 billion of revenues How did the market react? Stock price opened up about 8%! Why? On January 2, 2019, Apple CEO Tim Cook warned that revenue would only be about $84 billion. Stock dropped by 10%!

The impact of analysts Facebooks 2021 4th quarter release Analysts expected EPS of $3.84. Actual was $3.67 Analysts expected first quarter estimated revenues of $30B. Actual was $27 - $29B Flattening of Daily Active Users (no longer a growth stock?) Stock price fell 25%

Adjusted earnings Many companies report adjusted EBITDA, adjusted net income, and adjusted EPS to report what they feel is a more normalized income from their operations If adjustments are not easily manipulated (e.g., adding back amortization), they can be useful for comparability If easily manipulated (e.g., one-time restructuring), exercise caution!

Example: American Well S-1 (Prospectus) What is one positive and one negative? Focus on 6-month results

Example: American Well S-1 (Prospectus) Now how do things look?

3M 2019 4th quarter release. Recurring non-recurring items?