Economic Environment: Unemployment and Its Types in India

Unemployment is a critical economic concept with various types like disguised, seasonal, structural, cyclical, technological, and frictional unemployment. In India, these types impact different sectors and segments of the population, highlighting the complexities of the job market. Understanding these nuances is crucial for assessing the health of the economy and formulating targeted policies to address unemployment challenges effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

ECONOMIC ENVIRONMENT B.Com IIIrd Yr. By- Dr. O.P.Singh (Associate Professor) Department of Commerce, HCPG College Varanasi

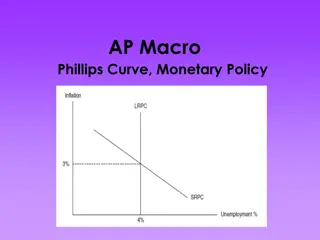

Syllabus Unit-I Economic Trends (overview): Income; Savings and Investments, Industry; Trade and Balance of Payments, Money; Finance; Prices. Unit-II Problems of Growth: Unemployment; Poverty, Regional Imbalances, Social Injustice; Inflation; Parallel economy; Industrial sickness. The Current Five Years plan: Major policies; Resources allocation. Unit-III Role of Government: Monetary and Fiscal Policy; Industrial policy; Industrial licensing. Privatization; Devaluation; Export-Import Policy; Regulation of Foreign Investment; Collaboration in the light of Recent Changes. Unit-IV International Environment: International Trading Environment (overview): Trends in the World Trade and The problems of Developing Countries; Foreign Trade and Economic Growth; International Economic Institutions. GATT, WTO, UNCTAD World Bank, IMF, GSP, GSTP; Counter Trade. Indian Economic Environment: Concept, Components and Importance Groupings; International Economic

Unemployment Unemployment occurs when a person who is actively searching for employment is unable to find work. Unemployment is often used as a measure of the health of the economy. The most frequent measure of unemployment is the unemployment rate, which is the number of unemployed people divided by the number of people in the labor force. Types of Unemployment in India Disguised Unemployment. Seasonal Unemployment. Structural Unemployment. Cyclical Unemployment. Technological Unemployment. Frictional Unemployment.

Disguised Unemployment: It is a phenomenon wherein more people are employed than actually needed. It is primarily traced in the agricultural and the unorganised sectors of India. Seasonal Unemployment: It is an unemployment that occurs during certain seasons of the year. Agricultural labourers in India rarely have work throughout the year. Structural Unemployment: It is a category of unemployment arising from the mismatch between the jobs available in the market and the skills of the available workers in the market. Many people in India do not get job due to lack of requisite skills and due to poor education level, it becomes difficult to train them. Cyclical Unemployment: It is result of the business cycle, where unemployment rises during recessions and declines with economic growth. Cyclical unemployment figures in India are negligible. It is a phenomenon that is mostly found in capitalist economies.

Technological Unemployment: It is loss of jobs due to changes in technology. In 2016, World Bank data predicted that the proportion of jobs threatened by automation in India is 69% year-on-year. Frictional Unemployment: The Frictional Unemployment also called as Search Unemployment, refers to the time lag between the jobs when an individual is searching for a new job or is switching between the jobs. In other words, an employee requires time for searching a new job or shifting from the existing to a new job, this inevitable time delay causes the frictional unemployment. It is often considered as a voluntary unemployment because it is not caused due to the shortage of job, but in fact, the workers themselves quit their jobs in search of better opportunities.

Poverty Poverty : Poverty is that social situation in which a particular segment of the society fail to fulfill his minimum needs. In others words the doesn t get two times meal. According to planning According to planning communism poverty line has been defined on the basis of minimum nutritional requirements 2400 calories per person per day for rural areas and 2100 calories per person per day for urban areas. In calories intake in rural areas there is the importance of food grains. Poverty Line Planning commission has used the nutritional requirement as the basis for computing the poverty line. Accordingly, in terms of calorie requirement per person per day, the commission fixed 2400 calories, for rural area and 2100 calories for urban areas Population below poverty line- 26.1%

Poverty Alleviation Programmes Anti - Poverty programmes have been strengthened over the yrs. to generate additional employment create productive assets impart technical and entrepreneurial skills and raise the income level of the poor : Population control More employment opportunities Public co-operative (Part of Answer of this question is written at the end of this section Increase savings Social welfare Fast eco growth Liberal financing

Inflation Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by the additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. It is not high prices but rising price level that constitute inflation. It constitutes, thus, an overall increase in price level. It can, thus, be viewed as the devaluing of the worth of money. In other words, inflation reduces the purchasing power of money. A unit of money now buys less. Inflation can also be seen as a recurring phenomenon. While measuring inflation, we take into account a large number of goods and services used by the people of a country and then calculate average increase in the prices of those goods and services over a period of time. A small rise in prices or a sudden rise in prices is not inflation since they may reflect the short term workings of the market.

Types of Inflation Currency inflation: This type of inflation is caused by the printing of currency notes. Credit inflation:--Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level. Deficit-induced inflation:--The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may the be called the deficit- induced inflation. Demand-pull inflation:- An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation But why does aggregate demand rise. Classical economists attribute this rise in aggregate demand to money supply. If the supply of money in an economy ex- ceeds the available goods and services.

Industrial Sickness The strength of the industrial sector, by and large, determines the soundness of the economy. A developing economy like India cannot afford the growing sickness in industries as it results in a colossal wastage of physical, financial and human resources. In the presence of the resource crunch, the industrial sickness becomes all the more an alarming problem. Industrial sickness usually refers to a situation when an industrial firm performs poorly, incurs losses for several years and often defaults in its debt repayment obligations. The Reserve Bank of India has defined a sick unit as one which has incurred a cash loss for one year and is likely to continue incurring losses for the current year as well as in the following year and the unit has an imbalance in its financial structure, such as, current ratio is less than 1: 1 and there is worsening trend in debt-equity ratio. The State Bank of India has defined a sick unit as one which fails to generate an internal surplus on a continuous basis and depends for its survival upon frequent infusion of funds.

Nature of Sickness Genuine sickness which is beyond the control of the promoters of the concern despite the sincere efforts by them, Incipient sickness due to basic non-viability of the project. Induced sickness which is due to the managerial incompetence and wrong policies pursued deliberately for want of genuine stake. The FICCI study entitled Industrial Sickness Dimensions and Perspectives says that the causes of sickness are both internal and external, often operating in combination. External factors are government policies on pricing, duties, taxes, high interest rates, taxes on profit, slackness in demand, sluggishness in export markets, high labour cost, inadequate availability of inputs, lack of infrastructure and the like.

Parallel Economy? Parallel economy, based on the black money or unaccounted money, is a big menace to the Indian economy. It is also a cause of big loss in the tax-revenues for the government. As such, it needs to be curbed. Its elimination will benefit the economy in more than one way. In a general way, we can define black economy as the money that is generated by activities that are kept secret, in the sense that these are not reported to the authorities. As such, this money is also not accounted to (he fiscal authorities i.e., taxes are not paid on this money. Parallel economy, is based on the unaccounted money of the people and is also know as the Black Money . An alternative term for it is Black economy . It is a great menace to the Indian economy. Black money is nothing but money generated in transactions which are hidden from Government in order to avoid tax. This is usually done in cash because cash transactions do not reveal the identity of the person carrying out the transaction. It s elimination will help the society in more than one way.

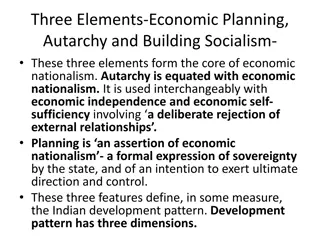

Five Year Plan Planning plays an important role in the smooth functioning of an economy. In 1950, the Government set up the Planning Commission to create, develop, and execute India s five-year plans. In the article, we will look at each five year plan of India and how it helps achieve the basic objectives of growth, employment, self-reliance, and also social justice. Further, it also takes into account the new constraints and possibilities to make the necessary directional changes and emphasis. Objectives of Five Year Plan of India The objectives of these five-year plans were as follows: Economic Growth Economic Equity and Social Justice Full Employment Economic Self-Reliance Modernisation

Major Policies in India by MODI Govt. Pradhan Mantri Jan-Dhan Yojana (PMJDY). Pradhan Mantri Sukanya Samriddhi Yojana (PMSSY). Pradhan Mantri MUDRA Yojana (PMMY) (MUDRA-Micro Units Development and Refinance Agency). Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). Pradhan Mantri Suraksha Bima Yojana (PMSBY). Pradhan Mantri Awas Yojana (PMAY). Pradhan Mantri Fasal Bima Yojana (PMFBY). Pradhan Mantri Kaushal Vikas Yojana (PMKVY).