Economic Impact of COVID-19 on Job Market in New York

Discover the early signs of trouble in the job market in New York, with insights on job loss percentages, spending drops, and unemployment rates. Explore research findings on the effects of COVID-19 on employment statistics and potential biases in data collection methods, highlighting significant challenges faced during the pandemic.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

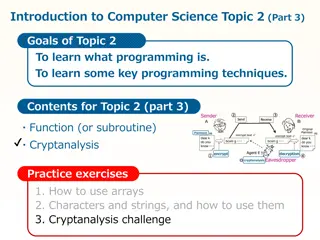

Early signs of trouble Arie Kapteyn Francisco Perez-Arce

We see about 20% job loss between March and Early April

Opportunity Insights shows sharp drop in spending in early April (-30%) SLIDE 12

And a 60% drop in hours worked in small businesses SLIDE 13

BLS May 8: Unemployment rate=14.7% If we take with a job not at work as misclassification of unemployed or temporary lay-off then total employment loss is 21,841+ (roughly) 7.5mln~ 29.3 mln. That is approximately 18.9% of March employment. Alternatively: classify out of the labor force, but not looking as unemployed and the unemployment rate jumps to 19.8%

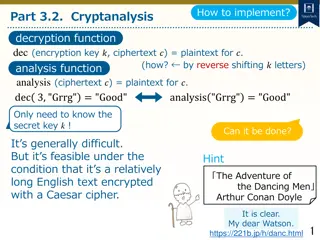

There is more Ward and Edwards (Sept. 2020): Statistics in the Time of Coronavirus: COVID-19-related Nonresponse in the CPS Household Survey (RAND working paper) Heffetz, Reeves (Dec. 2020), Measuring Unemployment in Crisis: Effect of COVID-19 on Potential Biases in the CPS, (NBER Working Paper 28310): Move from in-person to telephone interviewing led to under-representation of groups with weaker attachment to the labor market (and generally to fewer respondents who belong to minority groups). CPS is a rotating panel: during the pandemic there were fewer fresh respondents (who tend to be employed less)

Comparing Jobs in UAS and BLS Employment March-May 2020 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 March April May BLS UAS BLS corrected

Comparing Jobs in UAS and BLS Employment March-May 2020 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 March April May BLS UAS BLS corrected

Job Loss Compared to March Implied Job Loss 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 April May BLS UAS BLS corrected

New York Times, February 23 (Testimony by Jerome Powell)

There is nothing unusual about sampling and non-sampling errors The main point is to argue that the BLS numbers are likely consistent with results of early indicators of job loss. How close is the comparison in later months?

Employment Rates since March Employment to Population Ratio 65.0 63.0 61.0 59.0 57.0 55.0 53.0 51.0 49.0 47.0 45.0 BLS UAS BLS corrected

A stable difference Since July, both UAS and BLS job numbers show little movement, but the BLS employment rate is about 2.2% higher. The BLS definition may be more generous (worked at least one hour in the reference week) than what UAS respondents understand ( have a job ) The movements are still highly correlated (.88) during this period. Without expecting perfection, it appears that probability-based internet panels certainly can provide early warnings of changes ahead.