Effective Financial Management for Centre Treasurers

Learn about the key responsibilities and best practices for Centre Treasurers, including maintaining financial records, following national finance policies, and managing fixed assets and GST. Explore detailed information on setting up fixed assets registers, Centre processes, and financial policies. Gain insights into budgeting, reporting, bank account management, and more essential tasks for successful financial management within a Centre setting.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Treasurer Office Holder Zoom

Karakia Timatanga May peace be widespread May the seas be like greenstone A pathway for us all this day Let us show respect for each other Kia hora te marino Kia whakapapa pounamu te moana Hei huarahi m t tou i te rangi nei Aroha atu Aroha mai T tou i tatou katoa Hui ! T iki ! For one another Bind us all together!

Overview Purpose of the role: To keep full, accurate and up to date financial records for the Centre. To communicate these records to the Centre members. Overview: National finance policy Centre processes Fixed assets GST Other information

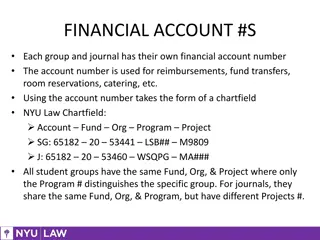

Finance Policy Key Points for Centre Treasurers: An annual budget must be set with input from all Centre members Monthly reports are presented to the Centre Bank accounts are linked to Xero and reconciled monthly Bank accounts have at least two authorisers and signatories payments must be reviewed before approving Recommended that credit/debit cards be phased out as these do not meet dual signatory rules All records are kept for seven years

Centre Processes $200

Fixed Assets Fixed Assets Register Set-up: Equipment purchased for long-term use, costing more than $2,500 All Centres should have had the registers set-up using the following codes: 2790 Depreciation 9200 Computer Equipment 9201 Less Accumulated Depreciation on Computer Equipment 9210 Furniture & Fittings 9211 Less Accumulated Depreciation on Furniture & Fittings Purchasing New Assets (see Fixed Asset Guide pg. 8-10): Code all new fixed assets purchased to 9200 or 9210 Register assets Run depreciation monthly or annually

GST *If Centre is Registered for GST Filing: Check the filing dates (will be two-monthly or six-monthly) Ensure all GST returns are filed on time can be done through Xero but user needs MyIR login with authorisation Before submitting check through GST Audit Report to ensure transactions are categorised correctly Reconcile GST return after filing (see webinar from 8:40) Remember to pay, if GST owing Fundraising: Information on IRD website showing what has GST https://www.ird.govt.nz/roles/not-for-profits-and-charities/running-your- nfp/gst

Other information Bank accounts: Signatories and online banking administrators/authorises should be updated each year Check whether there is anyone that needs to be removed Charities website: Recommended all Centres have their own Charities number (if applying for grants, this will be necessary) If you Centre is part of the group someone in the Centre just needs to update the Officer Details annually If not, you will need to upload a Tier 4 Performance Report (or join the group) before February Need Help? Email AskFinance

Other information To consider: Finance policy states: When Centres opt for a fees model the Centre will endeavour to keep fees low to allow high participation of Playcentre Aotearoa wh nauand reduce cost barriers to entry Does your Centre take this into consideration when setting fees? Are wh nau eligible for the WINZ subsidy supported to apply? Adequate reserves should be held by Playcentres this is deemed to be four months operating costs to ensure these could be met between bulk funding rounds How much does your Centre have in the bank? If there are significant savings/term deposits, are these being saved for a specific project; are there any health & safety concerns that need to be addressed?

Karakia Whakamutunga Our work is finished For the moment Blessing upon us all Our friends Our families Peace to the Universe Kua mutu m tou mahi M t neiw Manaakitia mai m katoa O m tou hoa O m touwh nau Aio ki te Aorangi