Efficient Monte Carlo Simulation of Security Prices Explained

Delve into the world of Brownian Motion, Wiener Process, Stochastic Calculus, and Security Price Models as outlined in the 1995 paper by Darrell Duffie and Peter Glynn from Stanford University. Understand the background, motivation, assumptions, and theorems behind efficient Monte Carlo simulation techniques for security prices.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Efficient Monte Carlo Simulation of Security Prices By Darrell Duffie and Peter Glynn, Stanford University, 1995 Paper Review by: Niv Nayman Technion- Israel Institute of Technology July 2015

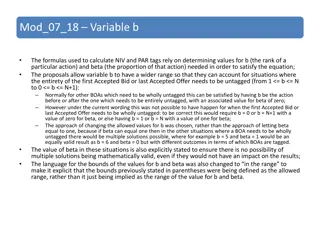

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

Brownian Motion Definition. We say that a random process, , is a Brownian motion t : 0 t X with parameters ( , ) if 1. For 0 < t1 < t2< < tn-1 < tn ) ( , ) ( ) ( , ... , X X X X X X t t t t t t 2 1 3 2 1 n n are mutually independent. ( ) ( ) 2. For s>0, + 2 , X X N s s s t t 3. Xt is a continuous function of t. We say that Xt is a B( , ) Brownian motion with drift and volatility Remark. Bachelier (1900) Modeling in Finance Einstein (1905) Modeling in Physics Wiener (1920 s) Mathematical formulation

Wiener Process When =0 and =1 we have a Wiener Process or a standard Brownian motion (SBM) . We will use Btto denote a SBM and we always assume that B0=0 Then, ( ) ( ) = 0, B B B N t 0 t t Note that if Xt ~B( , ) and X0=x then we can write = + + X x t B t t Where Bt is an SBM. Therefore see that ( ) + 2 , t X N x t t Since, E B ( ) ( ) = + + = + = = 2 2 E X x t x t Var X Var B t t t t t

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

ItIntegral Definition. A partition of an interval [0,T] is a finite sequence of numbers T of the form 1 2 1 : , , , , 0 [( ) | T n n t t t t = = = ] t t t t T 1 2 1 n n Definition. The norm or mesh of a partition T is the length of the longest of it s subintervals, that is 1,...,n i = = = : max h t t 1 T i i Recall the Riemann integral of a real function n t ( ) ( )( ) = , lim h , s X ds t X t t 1 1 1 s i i i i 0 0 = 1 i And the Riemann-Stieltjes integral of a real function w.r.t a real function gt=g(t) n )( ) t ( ) ( = , lim h , s X dg t X g g 1 1 s s i i t t 0 1 i i 0 = 1 i Then the It integral of a random process w.r.t a SBM Bt n )( ) t ( ) ( = , lim h , s X dB t X B B 1 1 s s i i t t 0 1 i i 0 = 1 i It can be shown that this limit converges in probability.

Stochastic Differential Equation A stochastic differential equation (SDE) is of the form ( ) ( ) = + , , dX t X dt t X dB t t t t Which is a short-hand of the integral equation t t ( ) ( ) = + + , , X X s X ds s X dB 0 t s s s 0 0 Where Bt is a Wiener Process (SBM). t is a Riemann integral. ( ) 0 , s X ds s is an It integral. ( ) 0 t , s X dB s s

It Process An It process in n-dimensional Euclidean space t X n is a process defined on a probability space and : 0,T X ( ) , ,P n satisfying a stochastic differential equation of the form ( t dX = ) ( ) + , , t X dt t X dB t t t Where T > 0 Bt is a m-dimensional SBM : 0,T n n satisfies the Lipschitz continuity and polynomial growth conditions. : 0,T Existence and Uniqueness Conditions n m n satisfies the Lipschitz continuity and polynomial growth conditions. Such that t y + C D n , : 0,T ; , t x y ( ) ( ) ( ) ( ) ( ) ( ) ( ) + + , , , , ; , , 1 t x t x t y C x y t x t x D x = 2 = 2 2 2 Where and . : i i : ij , i j These conditions ensure the existence of a unique strong solution Xt to the SDE ( ksendal 2003)

Diffusion Process A time-homogeneous It Diffusion in n-dimensional Euclidean space X n t ( ) is a process defined on a probability space : X , ,P n and satisfying a stochastic differential equation of the form ( ) t t dX X dt = ( ) + X dB t t Where Bt is a m-dimensional SBM is Lipschitz continuous. : n n n m n is Lipschitz continuous. : Existence and Uniqueness Conditions Meaning ( ) x ( ) y ( ) x ( ) y + n . . , C st x y C x y = 2 = 2 2 2 Where and . i : : ij i , i j This condition ensures the existence of a unique strong solution Xt to the SDE ( ksendal 2003).

It'sLemma ( ) ( ) Suppose Xt is an It process satisfying the SDE = + , , dX t X dt t X dB t t t t And f(t,x) is a twice- differentiable scalar function. Then 2 2 f t f x f f x = + + + df dt dB t 2 2 x In more detail 2 1 2 f t f x f f x ( ) ( ) ( ) ( ) ( ) ( ) ( ) ( ) 2 = + + + , , , , , , , , df t X t X t X t X t X t X dt t X t X dB t t t t t t t t t 2 x Sketch of proof 2 1 2 f t f x f The Taylor series expansion of f(t,x) is = ) + + + 2 ... df dt dx dx 2 x ( ( ) ( ) Recall that ~ 0, dB B B N dt O dt t dt + t t Substituting and gives t x X Sketch of Proof + dx dt dB t 2 1 2 ( f t f x f ( ) ( ) = + + + + + + 2 2 2 2 2 ... df dt dt dB dt dtdB dB t t t 2 x ) dt As the terms and tend to zero faster. Setting and we are done. t dB dt 1.5 0 dtdB O dt 2 dt t 2

Geometric Brownian Motion dX ( ) ( ) = + , , t X dt t X dB Suppose Xt satisfies following SDE t t t t With and ( , t t X ) ( ) = = , X t X X t t t = X dt + X dB Thus the SDE turns into ( , f t X dX t t t t Since is a twice- differentiable scalar function in (0, ) ) ( ) log t t X = By It Lemma we have 2 2 f t f x f f x = + + + df dt dB t 2 2 x Then 2 2 2 1 X 1 1 X X ( ) = + + + = + log 0 t d X X dt X dB dt dB t t t t t 2 2 2 X t t t 2 2 t t ( ) ( ) ( ) The integral equation = + + = + + log log log X X ds dB X t B 0 0 t s t 2 2 0 0 2 + t B Finally t 2 = t X X e If X0 >0 then Xt > 0 for all t> 0 0

Geometric Brownian Motion t Definition. We say that a random process, , is a geometric : 0 t X Brownian motion(GBM) if for all t 0 2 + t B t 2 = t X X e 0 Where Bt is an SBM. We say that Xt ~GBM( , ) with drift and volatility Note that 2 ( ) t s + + B t s + 2 = X X e t s + 0 2 2 ( ) + + + t B s B B s t + t t 2 2 = X e 0 2 ( ) + s B B s t + t 2 = X e t -a representation which we will later see that is useful for simulating security prices.

Expected Growth Rate of GBM Define , where denotes the information available at time t. : | t t t E E = t ( ) N Recall the moment generating function of 2 , Y 1 2 2 2 s + s ( ) s E e = = sY M e Y Suppose Xt ~GBM( , ) , then 2 ( ) + s B B s t + t 2 = E X E X e t s + t t t ( ) 2 ~ 0, N s s ( ) 2 B B = X e E e s t + t t t 2 2 + s s 2 2 = = X e t s X e t - So the expected growth rate of Xt is

Properties of GBM Note that, 2 ( ) 2 + X X s B B t s + ( ) t 2 = = + + + log t s X t s X e s B B t s + t 2 t t Thus 1. Fix t1 < t2< < tn-1 < tn . Then X X X X X X t t t , ,..., 3 n 2 t t t 1 2 1 n are mutually independent. 2. Paths of Xt are continuous as a function of t, i.e. they do not jump. 3. For s>0, 2 X 2 + log ~ N , t s X s s 2 t

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

The Black-Scholes Model The Black-Scholes equation is a partial differential equation (PDE) satisfied by a derivative (financial) of a stock price process that follows a deterministic volatility GBM, under the no-arbitrage condition and risk neutrality settings. Starting with a stock price process that follows GBM t : 0 tS 2 + t B t 2 = S dt + S dB = dS S S e 0 t t t t t ( ) ( ) + We represent the price of the derivative of the stock price process as Where a twice- differentiable scalar function at St>K. : f = rt , f t S e S K t t 2 r interest rate K- strick price We apply the It lemma 2 2 2 S f t f s f f s = + + + t df S dt S dB t t t 2 2 s The arbitrage-free condition serves to eliminate the stochastic BM component, leaving only a deterministic PDE. = + + 2 2 2 S f t f s f t df S dt t 2 2 s 2 2 2 S f t f s f Risk neutrality is achieved by setting = r + + = t rS rf t df 2 2 s With we have the celebrated BS PDE: rf dt=

The Heston Model A more elaborated model, dealing with a stochastic volatility stock price process that follows a GBM = S dt + S t dS v S dB t t t t tv Where , the instantaneous variance, is a Cox Ingersoll Ross (CIR) process ( ) t t dv v dt = + v t v S dB t t S v and are SBM with correlation , or equivalently, with covariance dt. , t t B B is the rate of return of the asset. is the long variance, or long run average price variance: as t tends to infinity, the expected value of ttends to . is the rate at which treverts to . is the volatility of the volatility.

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

Monte Carlo Evaluation t X n Suppose is an It process satisfying the SDE ( ) ( ) = + , , dX t X dt t X dB t t t t and one is interested in computing ( ) E f X l T Sometimes it is hard to analytically solve the SDE or to determine its distribution. Although numerical computations methods are usually available (i.e. the Kolmogorov backward equation (KBE) via some finite-difference algorithm), in some cases it is convenient to obtain a Monte Carlo approximation ( ) 1 N N = ( ) i l f X T 1 i This requires simulation of the system.

The Monte Carlo realizations are done by simulating a discrete-time approximation of Discrete-time Simulation the continuous-time SDE. The time interval [0,T] is sampled at periods of length h>0. h k X Th X Denote as Xt evaluated at t=kh. h Thus is the discrete evaluation of XT. ( ) ( ) E f X E f X Denote the approximation of by . h l hl T Th e l l And the approximation error by . h h e = lim h 0 It can be shown, under some technical conditions, that . h 0 Definition. A sequence has order-k convergence if is bounded in h. he h k he

The Euler Approximation The integral equation form of the SDE t h + t h + ( ) ( ) += + + , , X X s X ds s X dB t h t s s s t t The Euler method approximates the integrals using the left point rule. t h + t h + ( ) ( ( ( ) )( ) t h + t h + ( ) ( ) , , s X dB t X dB , , s X ds t X ds s s t s s t t t t t ) ( ) = , t X B B = , t X h + t t h t t = , t X h With ~N(0,1). t h X Thus, one can evaluate XT with by starting at and proceeding by Th X ( 1 , k k k X X kh X h = x h 0 ) ( ) = + + h h h h k , kh X h + + 1 k For k=0, , T/h-1. Where 1, 2, are N(0,1) i.i.d. h X Note. The processes Xt and are not necessarily defined on the same probability space ( , , ). Th

The Euler Approximation Error Is said to be a first-order discretizaion scheme ( ) ( ) = + + h k h k h k h k , , X X kh X h kh X h + + 1 1 k In which eh has order-1 convergence. There is an error coefficient s.t. has a order-2 convergence. h + e h h h The error coefficient gives a notion of bias in the approximation. Although usually unknown it can be approximated to first order by ( ) 2 l l = 2 h h h h Under the polynomial growth condition of f (Talay and Tubaro, 1990).

The Milshtein Scheme X t h + t h + ( ) ( ) += + + , , X s X ds s X dB The integral equation form of the SDE t h t s s s t t ( ( ) ) ( ( ) ) = = = = , : t X X t t t The Milshtein method apply the It s lemma on . , : t X X t t t 2 2 1 2 = + + + + + 2 ' '' ' t t t t t d dt dB dt dB t t t t t t t t t t t 2 2 t x x x 2 2 1 2 = + + + + + 2 ' '' ' t t t t t d dt dB dt dB t t t t t t t t t t t 2 2 t x x x The integral form 1 2 1 2 s s = + + + 2 ' '' ' du dB s t u u u u u u u t t s s = + + + 2 ' '' ' du dB s t u u u u u u u t t Then the original SDE turns into 1 2 t h + s s = + + + + 2 ' '' ' X X du dB ds t h + t t u u u u u u u t t t 1 2 t h + s s + + + + 2 ' '' ' du dB dB t u u u u u u u s t t t

The Milshtein Scheme As the terms and are ignored. 0 h ( ) dsdu O h ( ) 1.5 2 dsdB O h u Thus t h + t h + t h + s += + + + ' X X ds dB dB dB t h t t t s u u u s Applying the Euler approximation to the last term we obtain t t t t t h + t h + t h + s s ( ) ) = ' ' ' dB dB dB dB B B dB u u u s t t u s t t s t s t t t t t ) ( ( t h + t h + ( ) = = + 2 ' ' B dB B B B B dB B B B t h + t h + t t s s t t t t s s t t t t 1 2 ( ) ( ) ( ) = 2 Y B t = + = , , dY a t Y dt b t Y dB BdB Define and suggest a solution . Indeed, Y dY a t 2 B B B t t t t t t t t t t 2 2 1 2 1 2 Y b Y Y = + + + = + + 1 1 + = 0 1 t t t t t dt b dB dt BdB BdB t t t t t t t t 2 Thus, 1 2 1 2 ( ) t h + t h + = = = = 2 2 B dB dY Y Y Y B B h t h + t h + s s s t t t t t and 1 2 1 2 1 2 1 2 ( ) ( ) t h + s ( ) 2 + = = 2 2 2 2 ' ' ' ' 1 dB dB B B h B B B B B h h t h + t h + t h + u u u s t t t t t t t t t t t t

The Milshtein Scheme Thus 1 2 1 2 1 2 ( ) t h + s ( ) 2 + = 2 2 2 ' ' ' dB dB B B h B B B B B h t h + t h + t h + u u u s t t t t t t t t t t Then t h + t h + t h + s += + + + ' X X ds dB dB dB t h t t t s u u u s t t t t Turns into the Milshtein discretization 1 2 ( ) += + + + 2 ' 1 X X h h h t h t t t t t With ~N(0,1). h X Thus, one can evaluate XT with by starting at and proceeding by Th X = x h 0 ( ) ( ) ( ) ( ) ( h 1 2 ) = + + + 2 h k h k h k h k h k h k ' 1 X X X h X h X X + + + 1 1 1 k k For k=0, , T/h-1. Where 1, 2, are N(0,1) i.i.d.

The Milshtein Scheme ( u dsdB O h ) If the terms and are to be visible. ( ) dsdu O h 32 2 We have Where And Remark. Euler and Milshtein deal with first and second-order discretization schemes respectively for 1-D SDE with . t X as Talay (1984,1986) provides second-order discretization schemes for multidimensional SDE with . : n 1 t X n

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

Discrete-time Monte Carlo Simulations The Monte Carlo realizations are done by simulating a discrete-time approximation of the continuous-time SDE. Denote, as the i th discrete-time simulation output. Th X ( ) h i iY 1 N = as a discrete-time crude monte carlo approximation of . ( ) ( ) 1 i N ( ) E f X l , l h N f Y T i as the approximation error . ( ) ( ) , , e h N l h N l N h The time required to compute is roughly proportional to . ( ) , l h N 2 n T Where n and T are fixed for a given problem. This paper pursues the optimal tradeoff between N and h given limited computation time.

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

Abstract This paper provides an asymptotically efficient algorithm for the allocation of computing resources to the problem of Monte Carlo integration of continuous-time security prices. The tradeoff between increasing the number of time intervals per unit of time and increasing the number of simulations, given a limited budget of computer time, is resolved for first-order discretization schemes (such as Euler) as well as second- and higher order schemes (such as those of Milshtein or Talay).

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

Assumptions C f is and satisfies the polynomial growth condition. ( T f X f X h ) ( ) h 0 as . i. Th ( ) ( ) 2 2 as (i.e. is uniformly integrable ). ( ) T E f X E f X ( l h O h = + + 0 h h h 0 2 f X h 0 h ii. Th Th ) p p hl iii. as , where 0 and p>0. ( ) h f X iv. The (computer) time required to generate is given the deterministic Th ( ) = + q q as , where >0 and q>0. h h O h h 0 Theorem Given t units of computer time. 1 1 If or as then ( ) ( ) 0 t tht tht + + 2 2 q p q p i. p )( e h N ) ( , as . t t + 2 q p t t 1 If , where 0<c< , as then c ( 1 ( ) t tht + 2 q p ( ) 0 tht + 2 q p ii. ) 12 p as , where is N(0,1) and ) , q t t t e h N c )( ( ) t = Var f X + 2 p ( c + 2 q p T

The Asymptotically Optimal Allocation ( ) Assuming the discritization error alone has order-p convergence with h = + p p hl l O h h t As the computation budget t gets large the period ht should have order-1/(q+2p) convergence with t. 1 ( ) tht c + 2 q p Then the estimation error has order-p/(q+2p) convergence in probability with t. ( ) 12 p )( e h N ) + p ( , t c + 2 q p q c t t 1 ( ) If it the above does not hold, the estimation error does not converge in distribution to zero as quickly (i.e. not at this order ). 0/ tht + 2 q p p )( e h N ) ( , t + 2 q p t t It follows that this rule is Asymptotically Optimal .

Interpertation ( ) ( ) h 1 + Informally, if then , where c t 2 q p = + th c ( ) q q . tht t N N h O h + 2 q p t t t 2p h N Const Thus, t t T Let be the number of time intervals, as ht is the period. t t h n : 2 = = : 4 = For the Euler scheme (p=1) : For the Milshtein or Talay schemes (p=2): : n n h h N N 12 t t t t t t : 2 = = : 16 = : n n h h N N 12 t t t t t t ( ) 1 12 ( ) tht c p )( e h N ) + 2 q p For the asymptotically optimal allocation, if then Thus ) ( , t t t t t e h N h ht e h N = + p ( , t c + 2 q p q c t t ( ) ) ) ( ( 12 p p p )( ) ( ) ( ) 1 1 + p p p p p ( ( ) ( ) , , , h ht e h N h c e h N c + + + 2 2 2 q p q p q p q c t t t t t t t t t Thus, ( ) + p , e h N h + 2 q p t t t c As the root-mean-squared estimation error is and the error bias is . p e h + 2 q p t c For the Euler scheme (p=1) : For the Milshtein or Talay schemes (p=2): : 2 = = = : : n n h h e e 1 1 2 2 t t t t : 2 = = = : : n n h h e e 1 1 2 4 t t t t

Experiments - Settings ( ( ) ) ( ( ) ) = = , t X X rX t t t Consider the SDE with . ( ) ( ) , , t t t t dX t X dt t X dB = + = = , 0 t X X X X t t t t The diffusion process Xt>0 which satisfies the constant-elasticity-of-variance model (Cox,1975) = + X dB dX rX dt t t t t with , can be simulated by the Euler or Milshtein Schemes. 0.5,1 A European call option on the asset with strike price K and expiration date T is , has we would try to estimate its initial price by . ( ) T Y e X K = ( ) ( ) ( ) + + E f X = = rT rT f X e Y X K T T T For =1 we obtain the Black-Scholes model. Technical Details. For which f is and satisfies the polynomial growth conditions everywhere but at x=K. C ( ) 2 + + x K x K ( ) x ( ) Then it can be uniformly well approximated for above by . TechnicalDetails = 0,1 f 2 If we take to be of order-2p convergence we preserve the quality of aproximation. For we have as (Yamada, 1796 and dominated convergence). ( T f X f X ) ( ) ) h 0 h 0.5,1 Th

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

Experiments - Results For the particular case: We take The following results are obtained, Comments For the Euler scheme (p=1) : For the Milshtein scheme (p=2): : 2 = = : 4 = = = , : n n N N e e 12 = : 2 : 16 , : n n N N e e 14 The assumption hold with other but normal i.i.d increments with zero mean and unit variance uder technical conditions (Talay, 1984,1986).

What are we going to speak about ? Background The Paper - Brownian Motion - Wiener Process (SBM) - Introduction - Discretization Schemes - Euler - Milshtein (1978) - Talay (1984, 1986) - Motivation - Abstract - Assumptions - Theorem - Proof - Interpretation - Experiments - More to go - Stochastic Calculus (It s Calculus) - Stochastic Integral (It s Integral) - Stochastic Differential Equation (SDE) - It Process - Diffusion Process - It s Lemma - Example : Geometric Brownian Motion (GBM) - Security Price Models - The Black-Scholes Model (1973) - The Heston Model (1993)

More to go More monte carlo methods for asset pricing problems: Boyle (1977,1988,1990) Jones and Jacobs (1986) Boyle, Evnine and Gibbs (1989) An Alternative large deviation method for the optimal tradeoff : chapter 10 of Duffie (1992). Extensions ) ( + T X X dt Path dependent security payoffs T t 0 ( ) = Stochastic short-term interest rates (Duffie,1992) r R X t t A path dependent lookback payoff inf X X T t t Extension of the general theory of weak convergence for more general path-dependent functionals More discretization schemes: Slominski (1993,1994), Liu (1993) Adding a memory constraint