Elements of Cost and Classification in Business

Learn about the essential elements of cost in business, including material, labor, and expenses. Explore the classification of costs such as direct, indirect, and overheads. Understand how costs are categorized and the components of total cost in production.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

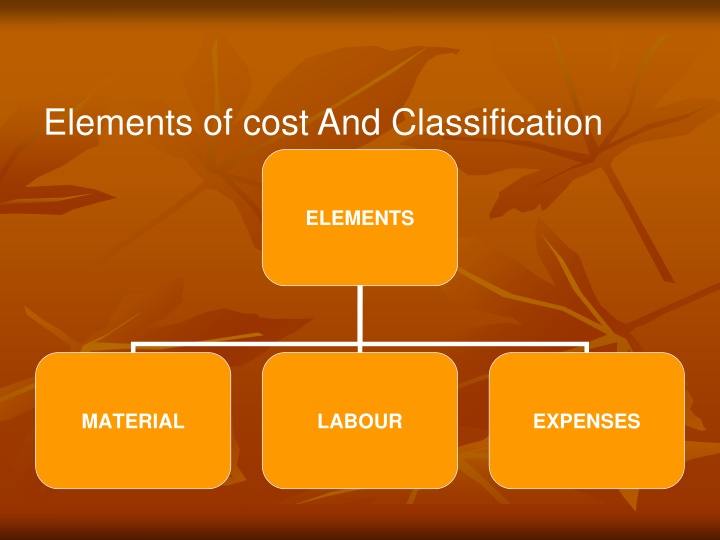

Elements of cost And Classification ELEMENTS MATERIAL LABOUR EXPENSES

MATERIAL---DIRECT INDIRECT OVERHEADS LABOUR-----DIRECT INDIRECT--OVERHEADS EXPENSES DIRECT INDIRECT OVERHEADS

OVERHEADS SELLING& DISTRIBUTION OVERHEADS FACTORY OVERHEADS OFFICE OVERHEADS

MATERIAL DIRECT-SPECIALLY PURCHASED VISIBLE IN FINAL PRODUCT PRIMARY PACKING MATERIAL PARTS PURCHASED FOR PRODUCTS EXAMPLES WOOD IN FURNITURE CLOTH IN GARMENTS INDIRECT-NOT VISIBLE EXAMPLES ADHESIVE IN FURNITURE GLUE IN BOOK BINDING

LABOUR DIRECT-DIRECTLY INVOLVED IN PRODUCTION LABOUR ENGAGED IN PRODUCTION LABOUR IN TOOL SETTING OR REPAIRS INDIRECT NOT DIRECTLY INVOLVED PROVIDING SERVICE TO LABOUR EXAMPLES WATCHMAN,ELECTRICIAN,SWEEPERS.

EXPENSES DIRECT EXPENSES DIRECTLY RELATED TO A PRODUCT INDIRECT COMMEN EXPENSES NOT RELATED TO A PARTICULAR JOB AND CAN BE APPORTIONED TO VARIOUS JOBS.

COMPONENTS OF TOTAL COST PRIME COST=DIRECT MATERIAL+DIRECT LABOUR+DIRECT EXPENSES FACTORY COST=PRIME COST+FACTORY OVERHEADS. OFFICE COST OR TOTAL COST OF PRODUCTION=FACTOR Y COST+OFFICE OVERHEADS. TOTAL COST OR COST OF SALES=OFFICE COST+SELLING& DISTRIBUTION OVERHEADS

Factory overheads Rent,rates,taxes of factory building Factory telephone charges Factory repairs and maintenance Heating and lighting expenses in factory. Salary to factory manager,foreman,supervisor etc. Power and fuel. Insurance of factory building,machinery,workers Bonus,overtime&leave wages Salary and fees to factory directors. Drawing office salary. Salary to storekeeper. Factory printing & stationery Gas,steam,coal charges.cleaning & haulage charges. Indirect material,nut,bolts,screws,nails etc .

Office overheads Office salaries,rent,rates,taxes,lighting etc. Director fees Office insurance(building,staff,appliances) Printing,stationery,postage and stamp charges. Office telephone,telegrams,fax charges. Legal charges andpublic relation expenses. Office lighting,heating,repairs. Depreciation(building,furniture& appliances. Audit fees &counting house salary. General expenses. Hire charges of office machinery.

Selling & distribution overheads Salesman salary,commision,travelling expenses. Trade & cash discount allowed,brokerage etc. Branch expenses,sample expenses. Expenses for cataloques and price lists. Printing,stationery,postage of selling deptt. Packing material& delivery van expenses. Rent,taxes on godown & warehouse. Advertisement exps. &bad debts. Salary of sales manager&other sales staff. After sales service charges. Free gifts &collection charges.

Components of total cost Direct material+ Prime cost+ Direct wages+ Factory overheads= Direct expenses= Factory cost --------------- Prime cost - --------------- - Works cost+ Office Office cost &adm.overh eads= Office cost+ Selling & Total cost --------------- - distribution overheads= Profit= Cost of sales+ Selling price --------------- -

Classification of cost According to elements-material,labour &expenses. According to functions- manufacturing,administrative,selling &distribution, & research &devlpt. According to controllability-controllable,& uncontrollable. According to normality- normal & abnormal.

According to behaviour or variability Semi-variable cost Fixed cost Variable cost

According to behaviour or variability Fixed cost----------costs which remain same at every level of output.these cost are related to time and not to production. Variable cost-------costs which increase in volume with increase in volume of production.the per unit cost remains constant at every level of output. Semi variable cost these are fixed as well as variable. Upto a particular level these costs are fixed but once the level is crossed even slightly these costs shift to the next higher level and so on.

Cost center & profit center Cost center-a smallest segment of activity or area or responsibility for which costs are accumulated. Profit center-a center whose performance is measured both in terms of expenses incurred and revenues earned by it. ----------------//////////////////////---------------------