Eligibility for 24-Month STEM OPT Extension

The Office of International Affairs provides guidance on eligibility criteria and application process for the 24-month STEM OPT extension for F-1 students. Students must meet specific requirements to qualify for this extension, including having prior approval for 12 months of post-completion OPT and holding a bachelor's or higher degree in a STEM field. Learn more about eligibility, E-Verify, and reporting requirements.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Dynamic Scoring: A Progress Report on Why, When, and How Presented at the Harvard Macroeconomic Policy Seminar September 24, 2024 Doug Elmendorf, Glenn Hubbard, and Heidi Williams

A very brief introduction to budget estimates The Congressional Budget Office (CBO) and the staff of the Joint Committee on Taxation (JCT) provide official budget estimates used by Congress in considering potential policy changes The estimating process is often called scoring In a typical year, CBO publishes roughly 700 public estimates, and it and JCT provide thousands of private estimates Dynamic Scoring: Elmendorf, Hubbard, and Williams 2 09/24/2024

A very brief introduction to budget estimates Budget estimates by CBO and JCT take account of expected behavioral responses by households, businesses, executive branch agencies, and state and local governments Except by longstanding convention any responses that would change nominal GDP (e.g., changes in labor supply or productivity) Including such responses would be dynamic scoring Dynamic Scoring: Elmendorf, Hubbard, and Williams 3 09/24/2024

An important question is whether this longstanding convention is the best way for CBO and JCT to serve Congress and the public

Our paper does not try to answer that question, but instead to analyze the economic and institutional issues presented by the choice between conventional and dynamic scoring

Note: Budget estimates are not the only information provided by CBO and JCT, but the estimates are often consequential in the budget process and so warrant attention Other aspects of the estimating process also deserve scrutiny, but that requires other papers

The structure of the paper How do we think about dynamic scoring: Why? When? How? Illustrative examples: Potential changes in immigration policies and in federal investment and permitting Dynamic Scoring: Elmendorf, Hubbard, and Williams 7 09/24/2024

Why? What are the advantages and disadvantages of dynamic scoring relative to conventional scoring?

A simple argument in favor: If estimates include some foreseeable behavioral responses, why not all of them? A change in a benefit program might induce an individual to stop or start taking up those benefits and to change their work effort There is no economic reason to view those responses differently; indeed, they may be closely connected Both responses matter for budgetary impact Dynamic Scoring: Elmendorf, Hubbard, and Williams 9 09/24/2024

Another argument in favor: Policymakers care about the impact of policies on labor, capital, and productivity How would changing this tax or that benefit program affect people s decisions about work? How could federal policy encourage business investment? How can the federal government support innovation and productivity growth? Dynamic Scoring: Elmendorf, Hubbard, and Williams 10 09/24/2024

Concern #1: Is it feasible to produce dynamic estimates given time and resource constraints? Dynamic scoring requires additional calculations and review by analysts Therefore, one approach is to focus on major legislation 09/24/2024 Dynamic Scoring: Elmendorf, Hubbard, and Williams 11

Concern #1: Is it feasible to produce dynamic estimates given time and resource constraints? Another approach would be to do dynamic scoring more regularly by using standardized and simplified processes How much could investments by CBO and JCT in models and experience reduce the incremental time needed? Would Congress accept longer cycle times? Dynamic Scoring: Elmendorf, Hubbard, and Williams 12 09/24/2024

Concern #2: Are the excluded effects especially uncertain? Uncertainty of labor and saving responses is no greater than uncertainty of many other responses that are included today Relevant evidence base continues to expand CBO (2015): Including additional effects improves accuracy if their mean is notably different from zero, if the sign of the mean is known, and if the variance of the estimate is held down Dynamic Scoring: Elmendorf, Hubbard, and Williams 13 09/24/2024

Concern #3: Are the excluded effects usually small? Yes, relative to the size of the economy in many cases. But: 1: Even so, their budgetary effect can be large relative to other budgetary effects of a proposal and thus can significantly affect the overall estimate 2: It is valuable for policymakers to get objective estimates of whether those economic effects are large or small Dynamic Scoring: Elmendorf, Hubbard, and Williams 14 09/24/2024

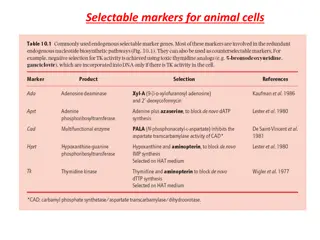

Example: Conventional & dynamic estimates for tax bills Conventional Increase in deficit Dynamic (C-D)/C Tax Relief Extension Act of 2015 $97 b $87 b 10% Modify and Make Permanent Bonus Depreciation from 2015 $281 b $267 b 5% Tax Cut and Jobs Act of 2017 $1456 b $1071b 26% Protecting Tax Cuts Act of 2018 $631 b $545 b 14% Dynamic Scoring: Elmendorf, Hubbard, and Williams 15 09/24/2024

Concern #4: Would changing methodology and making estimates more complex reduce credibility? Credibility is crucial All else equal, credibility is fostered by consistency over time in methodology and by simplicity of methodology But all else is not generally equal: Bias in estimates and excluding behavioral responses that people expect to occur can reduce credibility Dynamic Scoring: Elmendorf, Hubbard, and Williams 16 09/24/2024

Concern #4: Would changing methodology and making estimates more complex reduce credibility? The history of CBO s and JCT s analysis is not one of stasis in methodology or particular focus on simplicity Instead, the agencies have made ongoing advances in methodology, usually involving greater complexity, to improve the accuracy of estimates and expand the information presented Importantly, the agencies have explained their methodologies Dynamic Scoring: Elmendorf, Hubbard, and Williams 17 09/24/2024

When? When might dynamic scoring (or intermediate alternatives to conventional scoring) be deployed?

What are some advantages of various alternatives for specifying the deployment of dynamic scoring? Major legislation: Focus on proposals with largest economic impact Threshold could be chosen to get more or fewer estimates Selected policy areas: Consistency across proposals being compared by Congress Agencies could focus capacity-building investments Dynamic Scoring: Elmendorf, Hubbard, and Williams 19 09/24/2024

What are some advantages of various alternatives for specifying the deployment of dynamic scoring? Intermediate alternatives: Capture some important additional effects without adding full macroeconomic complexity Example: population-change approach Example: add (say) labor supply responses Dynamic Scoring: Elmendorf, Hubbard, and Williams 20 09/24/2024

What issues arise with appropriation bills? Budget estimates for such bills focus on how quickly available funding would be spent and do not include behavioral responses Adjust so-called scorekeeping guidelines ? Provide dynamic estimates as additional information? Dynamic Scoring: Elmendorf, Hubbard, and Williams 21 09/24/2024

What factors increase the value of investments in dynamic scoring capacity for a policy area? Topics of broad and enduring interest from policymakers Substantial research base about the economic effects of policies Straightforwardness of modeling policy alternatives: standardized units (dollars, numbers of people, tax rates) versus structural changes to programs or the tax code Dynamic Scoring: Elmendorf, Hubbard, and Williams 22 09/24/2024

How? How have CBO s past dynamic analyses illustrated the process of dynamic scoring? (JCT s process is somewhat different)

What are the key steps in producing a dynamic estimate? CBO s 2021 analysis of infrastructure spending is a clear model 1: Estimating direct effects of a proposed policy on labor, capital, and productivity Types of labor and capital Time pattern Dynamic Scoring: Elmendorf, Hubbard, and Williams 24 09/24/2024

What are the key steps in producing a dynamic estimate? 2: Estimating changes in output and other economic factors Potential output and actual output Effects of financing Challenge of aggregating elements of a legislative proposal 3: Estimating changes in the budget Budgetary feedback model and rules of thumb Dynamic Scoring: Elmendorf, Hubbard, and Williams 25 09/24/2024

Illustrative example: Potential increase in green cards for people with advanced STEM degrees

Conventional approach Additional immigrants are not modeled as earning income, so there is no additional income or payroll tax revenue Additional immigrants are modeled as receiving federal benefits for which they are eligible, so there is additional spending The required modeling is complex and cuts across the budget, but has been standardized to be feasible on short timeframes Dynamic Scoring: Elmendorf, Hubbard, and Williams 27 09/24/2024

Population-change approach Incorporates the direct budgetary effects of changing the number of people in the country in particular, the effects on taxable compensation and thus income and payroll tax revenue Dynamic Scoring: Elmendorf, Hubbard, and Williams 28 09/24/2024

Example: Conventional & population-change approaches Dynamic Scoring: Elmendorf, Hubbard, and Williams 29 09/24/2024

Dynamic approach Incorporates many additional effects For example: immigration of high-skilled workers raises overall productivity In this year s baseline update by CBO, the population change reduced the projected deficit by roughly $600b, and the additional dynamic effects by a further roughly $300b Dynamic Scoring: Elmendorf, Hubbard, and Williams 30 09/24/2024

Illustrative examples: Potential changes in federal investment and federal permitting of investment

CBOs 2021 report on physical infrastructure spending Flexible modeling organized around five key factors: How state and local governments respond to additional federal funding How quickly funding leads to outlays How quickly outlays increase productivity How much outlays increase productivity How outlays are financed Dynamic Scoring: Elmendorf, Hubbard, and Williams 32 09/24/2024

Application to federal funding for R&D Recent research seems to provide the evidence needed for the five key factors from CBO s physical infrastructure analysis Many potential policy changes are denominated in standardized units of dollars Dynamic Scoring: Elmendorf, Hubbard, and Williams 33 09/24/2024

Application to federal permitting The evidence currently available is too limited for credible dynamic analysis and not sufficient even to capture all the effects one would want in a conventional estimate Thus, CBO (2023): CBO has insufficient information to determine the number of projects or level of additional royalties that could be generated Dynamic Scoring: Elmendorf, Hubbard, and Williams 34 09/24/2024

Over time, Congress has asked CBO and JCT to provide more information about how potential policy changes would affect labor supply, investment, productivity and the federal budget The agencies have drawn on expanding research bases, built new tools, gained experience, and done innovative analyses Decisions by Congress about the extent to which such analyses should be included in budget estimates involve tradeoffs regarding time, resources, accuracy, and comparability