Employment Trends in the Lithium-Ion Battery Industry

The lithium-ion battery industry is set to undergo significant growth, impacting employment with a focus on job types, industrial policies, and structuring trends. Explore insights on job evolution, industry value chain, and global policies shaping workforce dynamics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Work and employment in the lithium-ion battery industry for electric vehicles: a preliminary overview Tommaso Pardi Int. J. Automotive Technology and Management, Vol. 23, No. 4, 2023

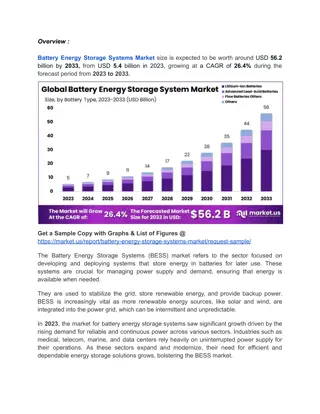

Introduction The lithium-ion battery industry will capture between 25% and 40% of the value and employ by 2031 at least 780,000 direct workers, twelve times more than today. What type of jobs? Social downgrading low road/upgrading high road? Which type of employment relationship? A review of existing literature and a preliminary data collection on wages (in Europe) and labour contracts (in France) Combining global value chain literature (and the productive models literature

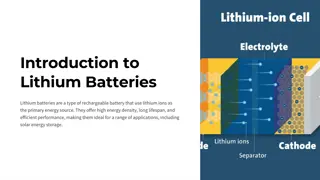

The lithium-on battery industry value chain Developed from pre-existing production of batteries for portable electronics 1 extraction of raw material 2 raw material refining 3 cell components production (cathodes, anodes, separators, etc.) 4 cells manufacturing 5 assembly of cells in modules 6 assembly of modules in packs 7 recycling of batteries2. In 2018 the Nevada Tesla gigafactory (20 Gwh) was considered the biggest. Today (40-60 Gwh) 1Gwh = 80 direct jobs 40%-50% of the total value

Structuring trends The return of industrial policies Green finance, venture capital and start-ups The shift in lobbying power from anti to pro- electric

The return of industrial policies NEV policies in China: half of the total stock of Evs; 75% of all cell manufacturing capacity; 90% of anode and electrolyte production; 70% of the refined minerals production (Bridge and Faiden 2022) In Europe: NextGen funds ( 800 billion 2021-2027); European Battery Alliance ( 6 billion); Important Projects of Common European Interest 120 billion invested in electro-mobility in Europe 30 gigafactories in the ten years pipeline, 40% owned or co-owned by OEMs In the US: Infrastructure Bill, Infrastructure and Investment Jobs Act, Inflation Reduction Act: $45 per KWh installed (up to $15 billion per giga-factory Vallejo & Mordue 2024) 24 gigafactories in the ten years pipeline, 80% owned or co- owned by OEMs

The return of industrial policies Re-industrialisation of high-wage countries: 80% of the new capacity installed in Europe is in Western countries Only 1 giga-factory is in Mexico Risk of downgrading / but automotive jobs Evidence from Hungary and Poland: bad jobs labour intensive low value added production (Szabo et al 2022) Other factors such as high skilled workforce availability, advanced industry and innovation infrastructure, low energy cost, high share of renewable energy in energy production, access to raw materials and proximity to OEMs core assembly factories appear to be at least equally or more important (Duffner et al., 2020).

The return of industrial policies Shortened supply chains and circular economy regulations: In Europe: the IPCEI European Battery Innovation / mandatory carbon footprint declaration for batteries sold in Europe; local content rules In the US: the US Defence Production Act; the American Battery Initiative (local sourcing) Trade and fiscal regulations with labour clauses: in IRA provision of apprenticeship and prevailing wages

Green Finance, venture capital and start-ups In 2021 Tesla reached a capital evaluation of 1,000 billions The IEA Battery Index increased by 315% between 2018 and 2021 Little is known about job quality (with the partial exception of Tesla)

The shift in lobbying power from anti to pro-electric Post-dieselgate convergence towards BEVS Battery production as a strategic battlefield for controlling the BEV industry

The current landscape East Asian battery makers: In 2020, six East-Asian companies (CATL, LG, Panasonic, Samsung, BYD and SKI) controlled 89% of the total battery capacity for EVs, with most of their capacity localised in China. Developed from battery production for electronic consumers (L thje et al. 2013) China Labour Watch enquiry in BYD (2011): 94% migrant workers; hourly wage 1$; 144 hours per month of compulsory overtime; 14 days of continuous working; 30 sec. working cycle; high workforce turnover L thje 2022: upgraded for BEVs but similar foxconnization of the auto-sector Similar evidences from Hungary (Szabo et al. 2022, Czirfusz 2023): migrant workers on six month temporary contracts

The current landscape Start-ups in battery manufacturing Northvolt, Verkor, InoBat, QuantumScape, Ilika Plc., etc. Mostly in high-wage countries Northvolt and Sweden: High human capital rate to recruit high profile managers Clean and cheap energy circular economy business model Proximity to premium OEMs Relative high wages / but 24% less than Volvo (see also Tesla in Nevada and Berlin) High workforce turnover (12% in 2021) (high performance regime?) In Northvolt Poland wages are 27% Less than Toyota Poland

The current landscape OEMs joint ventures and direct battery production Make or buy? Long term contracts with East-Asian battery makers Joint-ventures for battery productions Few attempts at fully making (VW, Stellantis, Daimler, Toyota (?)) + acquisition or participation in start-ups New gigafactories as separate companies with new labour contracts, lower wages and more flexible hours Envision (since 2016) / Nissan Sunderland : 18% lower wages In ACC 400 workers on the 1500 employed by the powertrain factory of Douvrin will keep their wages, but not new hires Still good jobs, with permanent contracts, negotiated with trade unions

Conclusions Dominant East-Asian companies relying on and exporting low road employment relationship Industrial policies and shortening supplying chains priorities bring battery production in Western-high wage countries Which role (and jobs) for semi-peripheral / integrated periphery countries? Battery start-ups: new productive models + high performance regime in manufacturing unionization? OEMs as possible future main employers: partial downgrading / but still automotive jobs vs portable electronic jobs Central role of industrial policies in promoting just transitions to good jobs