Energy Efficiency Financing for India's Carbon Neutrality

The drivers and activities of energy efficiency financing towards India's carbon neutrality goals, including key partnerships with multilateral banks and the pathway for future sustainable investments in industrial energy efficiency projects.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

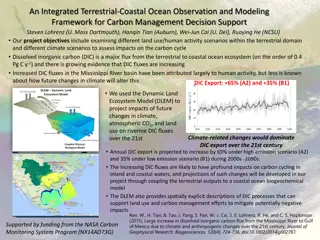

Scaling of Energy Efficiency Financing Step towards Making India Carbon Neutral Workshop - 11thJuly, 2023

Drivers of Green/Energy Efficiency Financing Paris Agreement at COP 21 Limit the increase in the global average temperature to pre-industrial levels: Below 2 C => Goal Below 1.5 C => Effort Non-fossil fuel energy capacity of 500 GW by 2030 Reduce CO2 emissions by 1 Bn tonnes till 2030 50% energy requirement from RE by 2030 Reduce carbon intensity of economy by 45% by 2030 Net Zero by 2070 India s Panchamrit Goals (COP 26)

SBIs activity in the sphere of Energy Efficiency As per IRENA a combination of renewables (both power and end use, electrification and fuels such as hydrogen) and Energy Efficiency, can provide 80% of the CO2 reductions needed to align the world on a 1.5 C pathway SBI has been actively financing Climate Mitigation projects mainly renewable energy projects like Solar (Utility, Rooftop, etc), Wind, Electric Vehicles, etc Projects involving Energy Efficiency are being financed: SME segment: Through SBI s wide branch network - financing energy efficient process/products (Rs. 562.87 crs sanctioned as on 31-3-23) Real Estate segment (Construction financing) both Residential & Commercial buildings (pls refer next slide) Apart from investments, SBI s own operations are also becoming energy efficient IRENA International Renewable Energy Agency

Tie-up with Multilateral and Development Banks Facility 1 Line of credit from KFW for Financing Energy Efficiency (EE) in Residential Buildings: Loan: USD 277 million for providing concessional loans for 25% savings in energy efficiency Investment Grant: EUR 10 million for encouraging energy efficiency savings of above 40% Technical Assistance Grant: EUR 1.5 million Facility 2 Line of Credit from AFD for Climate Finance (including EE in projects/equipment & processes) Loan: EUR 100 million for providing concessional loans Key criteria for EE projects: 20% of EE and GHG emission reduction for industrial process For buildings: Use of low carbon materials and/or certification at gold/silver levels

Way Forward Area to be developed: Lending to large scale industrial energy efficiency projects (e.g. Green Steel) under the Green Finance umbrella To be financed through: Raising dedicated funds for supporting energy efficient industrial processes (both large corporate & MSMEs) Financing Modality: Credit lines from Multilaterals, Green Bonds etc. Newer Energy Efficient avenues to be explored: Energy efficiency in core sectors like Steel, Cement, Oil & Gas etc. To help mitigate stricter trade requirements like CBAM CBAM Carbon Border Adjustment Mechnaism