Enhancing Communication in the Finance Sector: Overcoming Regulatory Barriers and Improving Engagement

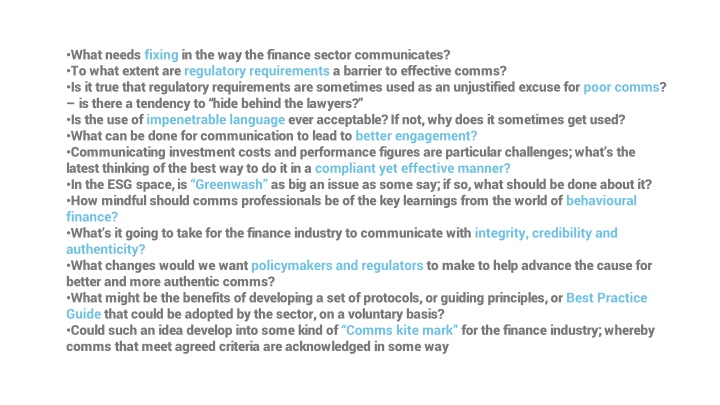

The finance sector faces challenges in communicating effectively, with regulatory requirements often serving as barriers. There is a tendency to use legal language as an excuse for poor communication, leading to a lack of engagement. Addressing impenetrable language, improving transparency in investment cost and performance reporting, combating greenwashing in ESG, and incorporating insights from behavioral finance are crucial steps towards fostering integrity, credibility, and authenticity in financial communications. Policymakers and regulators can support this goal by advocating for clearer communication standards and encouraging voluntary adoption of best practices. Establishing a communication "kite mark" could recognize firms adhering to agreed-upon criteria, promoting industry-wide transparency and accountability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

What needs fixing in the way the finance sector communicates? To what extent are regulatory requirements a barrier to effective comms? Is it true that regulatory requirements are sometimes used as an unjustified excuse for poor comms? is there a tendency to hide behind the lawyers? Is the use of impenetrable language ever acceptable? If not, why does it sometimes get used? What can be done for communication to lead to better engagement? Communicating investment costs and performance figures are particular challenges; what s the latest thinking of the best way to do it in a compliant yet effective manner? In the ESG space, is Greenwash as big an issue as some say; if so, what should be done about it? How mindful should comms professionals be of the key learnings from the world of behavioural finance? What s it going to take for the finance industry to communicate with integrity, credibility and authenticity? What changes would we want policymakers and regulators to make to help advance the cause for better and more authentic comms? What might be the benefits of developing a set of protocols, or guiding principles, or Best Practice Guide that could be adopted by the sector, on a voluntary basis? Could such an idea develop into some kind of Comms kite mark for the finance industry; whereby comms that meet agreed criteria are acknowledged in some way

When assessing whether a promotion is fair, clear and not misleading, a firm may need to consider (among other things): The authenticity of the proposition described in the relevant promotion. This may mean undertaking background checks on directors, controllers or other key individuals associated with the product provider. The commercial viability of the proposition described in the promotion. Has the promotion adequately disclosed any significant factors that could threaten the product s viability? Could potential investors make an informed decision about investment? Whether advertised or headline rates of return are reasonably capable of being achieved. This may mean reviewing materials such as the product provider s financial statements and/or management accounts, business plan, financial projections and capital position. Whether there are any fees, commissions or other charges within the investment s structure or elsewhere that could materially affect the ability of the product provider to deliver advertised or headline rates of return. If the product is advertised as being eligible for a particular tax treatment (eg, for inclusion within an Innovative Finance ISA), does the product actually meet the requirements for this treatment? (For tax treatment, see also COBS 4.5.7 R; COBS 4.5A.8 UK)

In assessing whether a financial promotion is fair, clear and not misleading, a firm should consider the guidance in COBS 4. In particular, firms are reminded that COBS 4.2.5 G states that a financial promotion should not describe a feature of a product or service as guaranteed , protected or secure , or use a similar term unless: that term is capable of being a fair, clear and not misleading description of it, and the firm communicates all of the information necessary, and presents that information with sufficient clarity and prominence, to make the use of that term fair, clear and not misleading. This means that where an investment is described in a promotion as secured or asset- backed (or equivalent), you should consider whether the promotion contains the information necessary to enable investors to: understand how such protection operates, and assess any potential weaknesses or deficiencies in it MECHANISMS PROTECTIONS RISKS

The road to hell is paved with good intentions... Continuous loop of communication Listen Ownership mistakes happen, admit them, own Adjust Improve Rinse repeat .