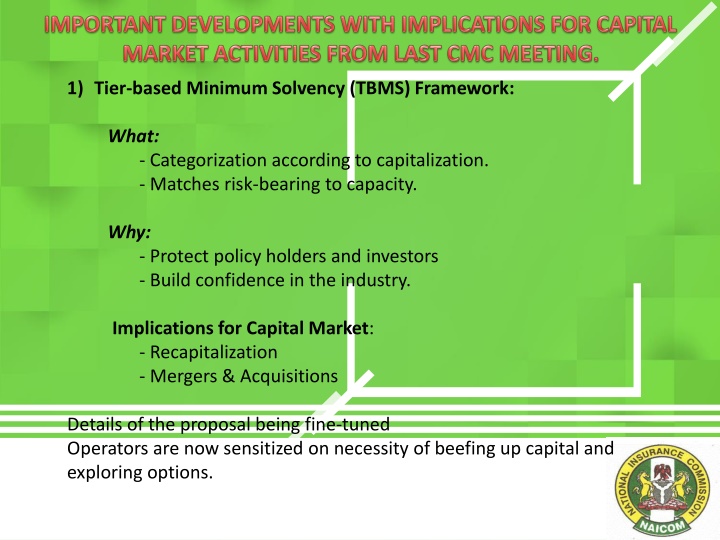

Enhancing Insurance Industry Stability through Tier-based Minimum Solvency Framework

Explore the Tier-based Minimum Solvency (TBMS) framework, which categorizes insurers based on capitalization to match risk capacity. Learn how this framework aims to protect policyholders, investors, and industry confidence through capital market implications like recapitalization and M&A activities.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

1) Tier-based Minimum Solvency (TBMS) Framework: What: - Categorization according to capitalization. - Matches risk-bearing to capacity. Why: - Protect policy holders and investors - Build confidence in the industry. Implications for Capital Market: - Recapitalization - Mergers & Acquisitions Details of the proposal being fine-tuned Operators are now sensitized on necessity of beefing up capital and exploring options.

Tier Level Life Non-Life Tier 3 Individual life, Health Insurance and Miscellaneous Insurance Fire, Motor, General Accident, Agricultural and Miscellaneous Tier 2 All Tier 3 plus group life All Tier 3 risks plus engineering, Marine, Bonds Credit guarantee and Suretyship insurances Tier 1 All Tier 2 plus Annuity All Tier 2 plus Oil and Gas (oil related projects, exploration) and aviation insurances.

Tier Level Tier-based Minimum capital (Nbillion) Life Companies Tier 3 2.0 Tier 2 3.0 Tier 1 6.0 Non-Life Companies Tier 3 3.0 Tier 2 4.5 Tier 1 9.0 Composite Companies Tier 3 5.0 Tier 2 7.5 Tier 1 15.0

The overriding consideration is to ensure safety and soundness of Insurance institutions, by: Checking unhealthy risk-to-capital ratios due to prevalent high risk appetite Reducing, and ultimately eradicating, the incidences of default in claims payment Preventing further reputational damage Guarding against erosion of shareholders investments

- Stiff opposition from operators. -Inhibiting Legal Framework: Weak laws unduly hamper the regulator Overhaul of legal framework slow and laborious. - Interference in regulatory policy issues a hindrance. - Tweaks to TBMS framework ongoing (to be re-introduced on completion of review) - Ongoing consultation with stakeholders. - Amendment of insurance laws pending with NASS