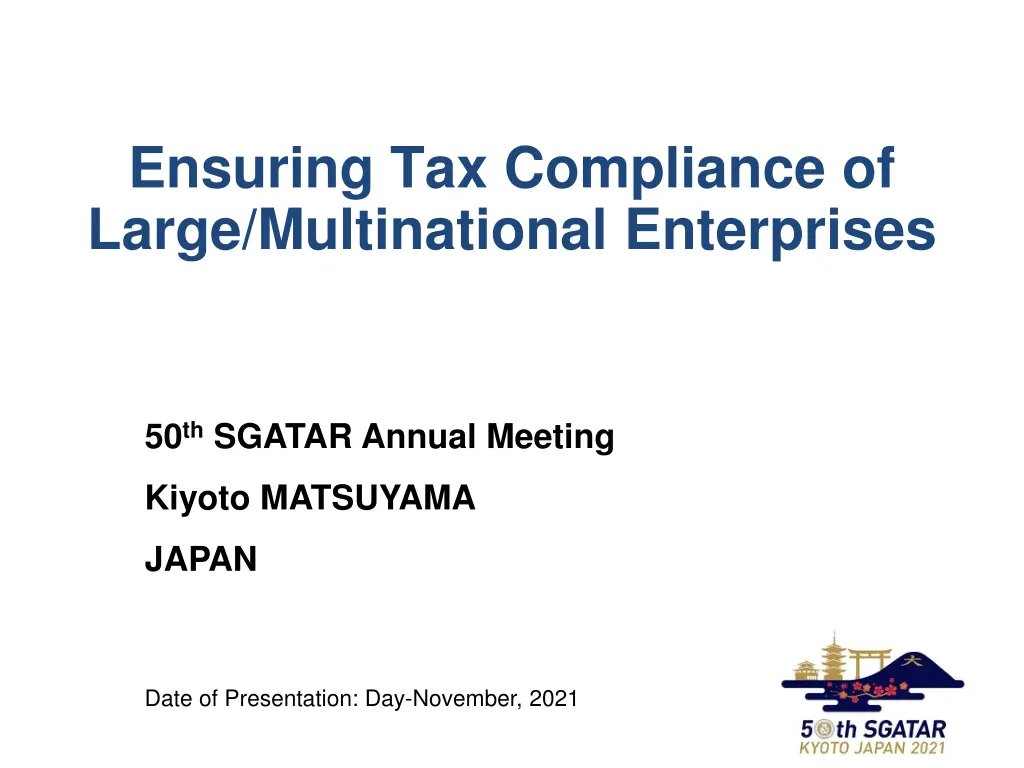

Ensuring Tax Compliance in Large Enterprises

"Explore the strategies and organization to ensure tax compliance in large/multinational enterprises as presented at the 50th SGATAR Annual Meeting. Discover the mission, role, and structure of the Large Enterprise Examination Department in maintaining fair taxation practices. Gain insights into methods and efforts to oversee complex tax cases and improve overall compliance. Learn about the personnel and corporations under the department's jurisdiction."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Ensuring Tax Compliance of Large/Multinational Enterprises 50th SGATAR Annual Meeting Kiyoto MATSUYAMA JAPAN Date of Presentation: Day-November, 2021

Agenda Organization to ensure compliance in large/multinational enterprises Methods to ensure compliance in large/multinational enterprises

Organization to ensure compliance in large/multinational enterprises Organization Diagram (Local Branch Offices) Regional Taxation Bureau (12) Tax Office (524) National Tax Agency Sapporo, Sendai, Kanto Shinetsu, Tokyo, Kanazawa, Nagoya, Osaka, Hiroshima, Takamatsu, Fukuoka, Kumamoto, Okinawa (Internal Departments) Management Division (Large Enterprise Examination) Commissioner's Secretariat Management and Co- ordination Department Special Examiner Taxation Department Chief Examiner Collection Department Taxation Department Co-ordinated Examination and Information Management Division Large Enterprise Examination and Criminal Investigation Department Collection Department Large Enterprise Examination Department Review Division (Councils, etc.) Information Technology Division National Tax Council Criminal Investigation Department (Facilities and Other Institutions) International Management Division National Tax College (Special Organs) Prior Confirmation Screening Division Subdivisions (12) & Branch Offices (7) National Tax Tribunal

Mission and role of the Large Enterprise Examination Department of the Regional Taxation Bureau Mission Enable appropriate and fair taxation in the overall tax administration through efforts to maintain and improve tax compliance of large corporations. Role To oversee cases that are difficult to be handled at the bureau level To oversee cases where the bureau would find it difficult to secure sufficient examination system, such as cases that require continuous appropriation of considerable administrative workload of examination and those that require advanced investigation methods and expert knowledge such as in examination reviews Have a significant ripple effect inside and outside the organization In addition to properly managing large corporations that have strong influence on their business partners and the industry as a whole, and guiding them to play a leading role in enhancing tax compliance, to take back to the rest of the national tax organization the expertise, industry know-how, and information on cutting-edge transactions that have been cultivated through the examinations

Number of personnel and corporations under jurisdiction of the Large Enterprise Examination Department of the Regional Taxation Bureau Number of personnel at the Large Enterprise Examination Department 2,282 (as of July 2021) Corporations under the jurisdiction of the Large Enterprise Examination Department Corporations with total capital or contribution exceeding 100-million yen Foreign corporations Corporations specifically designated by the Commissioner of the National Tax Agency or Regional Commissioner Number of corporations under jurisdiction: 33,992 legal entities (as of July 2021) Number of corporations Item Domestic corporation refers to... Corporations that possess head office or principal office within Japan Number of corporations under jurisdiction Domestic corporations Consolidated corporations Parent corporations Subsidiary corporations Foreign corporations 33,992 28,116 12,795 933 Foreign corporation refers to... Corporations other than domestic corporations (corporations that possess head office or principal office outside of Japan but only branch offices within Japan) 11,862 5,876

Methods to ensure compliance in large/multinational enterprises Basic policy Aim to maintain and improve the tax compliance of large corporations by properly supervising all corporations under its jurisdiction through an effective combination of "focused examination" on areas with high tax administrative risk and "cooperative methods" that lead to voluntary maintenance and improvement of tax compliance. Cooperative Methods Focused Examination Prevention of tax return errors by enhancing tax compliance among taxpayers Initiatives on corporate governance on tax matters Tax return check list, etc. Flexible (focused) appropriation of examination work according to taxpayers' degree of taxation risk Complex and difficult cases Cases of significant ripple effect, etc. Appropriate supervision of corporations under jurisdiction through effective combination Maintenance and enhancement of tax compliance of large corporations

Approach to selection of cases for tax examination Risk-based approach Phased supervision of corporations, based on taxation risk Precise selection of corporations for examination according to their taxation risk and proper allocation of administrative workload Administra- tive workload LARGE Proper allocation of administrative workload of examination - Insufficient internal system - Large discrepancies or fraud in past - High risk transactions Administra- tive workload SMALL Expectation for voluntary proper declaration Taxation risk SMALL Taxation risk LARGE

Undertakings to enhance corporate governance on taxation matters Overview of the undertaking (1) Examination of corporate governance on taxation matters Development of cooperative relationship with corporations Maintenance and enhancement of tax compliance (4) Response to matters requiring improvement (2) Evaluation of corporate governance on taxation matters (3) Interview of senior management (Communication of matters requiring improvement, etc.) Corporation Bureau Reduction in the risk of inappropriate tax treatment and reduction in the burden of coping with tax examinations Increased emphasis on tax examination based on risk-based approach

Undertakings to enhance corporate governance on taxation matters Evaluation result of status of initiatives 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Development and 81% 15% 4% implementation of measures to prevent inappropriate acts Involvement of senior management 73% 25% 2% Development and implementation of structure and function of the accounting 61% 33% 6% department Dissemination of measures to prevent recurrence 45% 40% 15% Development and 29% 44% 27% implementation of manuals, etc. Overall rating 19% 62% 19% Good Normal Requires improvement

Undertakings to enhance corporate governance on taxation matters Process flow X Fiscal Year X +1 Fiscal Year X +2 Fiscal Year X +3 Fiscal Year Determine the timing of examination in accordance with taxation risk of the corporation (risk-based approach) Current Examination Next Examination Determination of taxation risk Field examination Explanation of evaluation results Determination of taxation risk Omission of examination Determination of taxation risk Omission of examination Determination of taxation risk Field examination Explanation of evaluation results corporate governance on taxation corporate governance on taxation Notification of evaluation Notification of evaluation Examination and evaluation of Examination and evaluation of prevent recurrence and hearing Response to matters requiring Response to matters requiring and exchange of opinions and exchange of opinions status of measures to prevent Formulation of measures to Hearing on implementation on implementation status results results improvement improvement recurrence matters matters Corporation under examination confirms its standing Corporation under examination confirms its standing Execute the next examination based on the status of formulation and implementation of documented measures to prevent recurrence The number of corporations by assessment category for each fiscal year is published on the National Tax Agency's website

Application of digital technology in tax examinations (DX of tax examination) Utilization of web conferencing systems [Assumptions for implementation] Internet Officer in charge of the examination (conference room of corporation under examination) - The corporation under examination requests the use of a web conferencing system with the understanding that highly confidential information will be exchanged during tax examinations and that there is a risk of information leakage due to system vulnerabilities. Interview counterpart (Employee of head office, business premise, etc.) PC on loan from the corporation under examination etc. (web conference) - The corporation under examination is utilizing the web conferencing system in the course of its normal business, including exchange of highly confidential information - Use of equipment and connection provided for use by the counter party at a location managed or controlled by the corporation under examination to the extent consistent with the security policy of the opposite party Officer in charge of the examination Interview counterpart * Although the security level of the web conferencing system in use by the corporation under examination is considered to be high, the risk of information leakage cannot be completely mitigated. As such, points on the right should be paid proper attention before execution. - Recordings of audio and images should not be kept Example of remote examination Corporation under examination Officer in charge of the examination (bureau conference room, etc.) Authenticate connection of only designated terminals to the network (Enhanced security) Network connection of the corporation under examination Print-out of data Work PC Sharing of data Wi-Fi network Communication PC Web conference and data server Wi-Fi network