Essential Information on W-4 and Direct Deposit Forms

Understand the critical details for W-4 and Direct Deposit forms to ensure accuracy and compliance. Learn about the importance of correct details, common mistakes, and guidelines for employees, including students and international students. Get insights on Direct Deposit authorization, W-4 personal and withholding information, and the significance of accurate information for tax purposes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Human Resources Presents What you need to know for W-4 and Direct Deposit Forms Wednesday, March 14, 2017 12:00 A.M. to 12:30 P.M. 12:30 P.M. to 1:00 P.M. 1:00 P.M. to 1:30 P.M. Presenter: Jill Jarapko

Why Payroll Forms? Employees can make changes to Direct Deposit and W-4 forms as frequently as needed. *You don t have to write the Government a check every tax season. You ve let us know that employees have many questions about these forms. Student employees may need extra assistance with these forms. International Students have different rules. *Always consult your tax preparer before making changes.

Direct Deposit Authorization Account Type must be correct, otherwise direct deposit record is inactivated Routing Numbers are always 9 digits. Forms without a signature are not valid and an entirely new form must be submitted. Check with Payroll before closing bank account

W-4 Form - Personal Information If Social Security Number, Citizenship or Marital Status is missing, the form is NOT valid. An entirely new form must be submitted. Marital status is a factor in determining how much money will come out of each check. Less money is taken out of each pay check if Married is selected. Address must be the employees permanent address, not their campus housing.

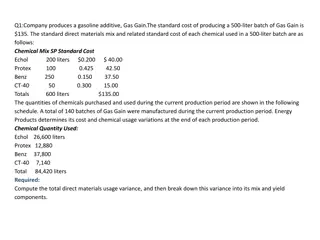

W-4 Form - Withholding Information Exempt Wisconsin Resident Exempt from taxes means the employee did not have a tax liability in the previous year and does not have a tax liability in the current year. No taxes come out of their pay checks Students often file this category. Exempt from Federal/State Taxes? Yes = Exempt Allowances must be LEFT BLANK when claiming EXEMPT. Additional Withholding must also be left blank. If allowances are provided along with the YES box checked, the form is NOT valid. An entirely new form would need to be submitted.

W-4 Form - Withholding Information Non-Exempt Wisconsin Resident Exempt from taxes means the employee did not have a tax liability in the previous year and does not have a tax liability in the current year. Non-Exempt Employee owes taxes and funds will come out of their pay checks 0 0 Exempt from Federal/State Taxes? No = Non-Exempt Allowances must be FILLED IN when claiming NON-EXEMPT. Number of Allowancesis determined by each individual s situation (e.g., number of dependents). The higher the number of allowances, the less amount of money will come out of each pay check If NO allowances are provided and the No box is checked, the form is NOT valid. An entirely new form would need to be submitted. Additional Withholding is not required. This is if the individual would like to have a specific dollar amount taken out of their pay checks towards their taxes.

W-4 Form - Withholding Information Non-Exempt Illinois Resident wanting Reciprocity Federal information filled out as usual. See previous slides. Declaring Reciprocity means that NO State taxes will come out of the employee s pay checks. The employee would be responsible for their own state tax payments. 0 Employees residing outside Wisconsin are not required to declare reciprocity. To Declare Reciprocity: Chose YES for Exempt from WI State Taxes and check the box of the State in which the employee resides. Leave Above Fields BLANK for all other states outside of Wisconsin. If you have checked one of these boxes, do NOT enter any amounts in the Wisconsin State Tax blocks. If these are NOT left BLANK, the form is NOT valid. An entirely new form would need to be submitted.

W-4 Form - International Visitors and Signature International employees must complete the International Visitors section, i.e., anyone who selects Neither for their Citizenship election. Forms without a signature are not valid and an entirely new form must be submitted.

Resources Jill Jarapko ext. 2204 Jarapko@upw.edu Amy Bobylak - ext. 2253 - rank@uwp.edu https://www.uwp.edu/explore/offices/humanresources/ Important Forms Academic Faculty & Staff University Staff Student Employment W-4 https://uwservice.wisconsin.edu/docs/forms/pay-employee-withholding.pdf (Page 5 only) Direct Deposit (ACH) Authorization https://www.uwp.edu/explore/offices/humanresources/upload/pay-direct-deposit.pdf