Exchange Rate Volatility and Capital Flow Dynamics

Explore the impact of capital flow volatility on exchange rate fluctuations, with a focus on mitigating factors and resilience measures. Discover how countries with variable capital flows experience more volatile exchange rates and the role of portfolio balance effects in shaping FX market dynamics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The impact of capital flow volatility on exchange rate volatility: from mitigating factors to the FX resilience measures. Louisa Chen, Estelle Xue Liu and Zijun Liu By David Cook

Summary Countries with more (HF & ST) variable capital flows have more volatile exchange rates portfolio balance effects(?). Measures P.B. effects w/ version of Amihud (2001) illiquidity measure. How much do exchange rates change in response to an adjustment of balances of institutional portfolio investors? If markets are sufficiently deep, exogenous sales from one class of investors will have little effect on prices.

Evidences of Portfolio Balance Explanation.S-T S-T Liquidity Effect Greater immediate bounce of f/x vol on increase in flow volume in shallower emerging markets. M-T Mitigation Effect Indicators of relatively thick FX markets (trade, size of final market, etc.) reduce the correlation of f/x vol with cap flow vol. Case-Studies Calculate resilience index (weighted indicator of mitigating factors) . Resilience negatively associated with f/x vol during crisis.

Strength: Empirical Analysis Combines analysis of finl market data with macro variables. Bond & equity fund flows Implementation of current econometric techniques. Cluster analysis rationalizes division of countries into groups with stable markets and those without. Use panel structural VAR to decompose innovations into common and idiosyncratic & timing restrictions.

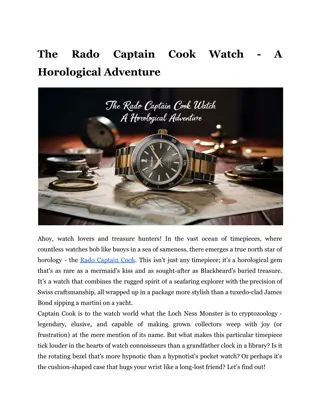

Emerging markets rely more on bank borrowing for short-term funding. This may reduce ability to adjust. Short-term Bank Borrowing/Short-term Debt 100.00% 80.00% 60.00% 40.00% 20.00% 0.00% UK Romania Poland Czechoslovakia Peru Australia Uruguay Paraguay Iceland Mexico Sweden Brazil Canada Philippines Korea Israael Chile Norway Hungary Thailand Indonesia New Zealand Turkey Colombia

Challenge: Endogeneity Consistent with portfolio balance effects. Does economic information manifested in f/x rates lead to more financial reallocation in less established markets. Or specifically more reallocation by institutional fund investors. Example: International fin l analysts believe (relative) emerging market risks have increased, sell portfolio and currency to home investors at lower prices, depreciated exchange rates. Less resilient markets may have more cyclical risks with stronger exchange rate effects relative to capital flows. Hard to think of instruments that affect flows without affecting underlying joint risk return properties of assets.

Contribution: Resilience Index From a monitoring perspective, resilience measures likely to be useful predictors of potential exchange rate instability regardless of underlying theory. Would be useful to know more about the time series properties of the resilience measures. Treatment is largely based on mean values, but these are presumably constructed with variables that have considerable time series variation.

Cross-Validation Country sample limited by access to capital flow figures. But the resilience measures could be validated with broad sample of countries using parameter estimates and macro data with sample figures. This would also offer additional information on liquidity in other countries or times.