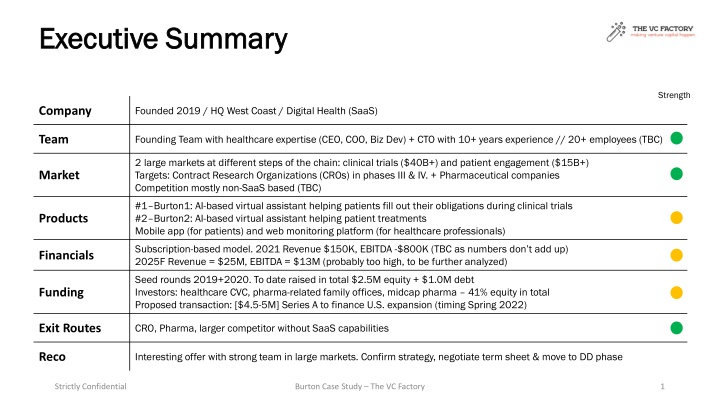

Executive Summary

Founded in 2019, this West Coast-based Digital Health SaaS company targets large markets in clinical trials and patient engagement. With a strong founding team possessing healthcare expertise and over 20 employees, the company leverages a subscription-based model. Their innovative solutions address critical issues in clinical trial compliance, enhancing results and retention. Proposed Series A funding aims to facilitate expansion in the U.S. market, aiming for significant revenue growth by 2025.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Executive Summary Executive Summary Strength Founded 2019 / HQ West Coast / Digital Health (SaaS) Company Founding Team with healthcare expertise (CEO, COO, Biz Dev) + CTO with 10+ years experience // 20+ employees (TBC) Team 2 large markets at different steps of the chain: clinical trials ($40B+) and patient engagement ($15B+) Targets: Contract Research Organizations (CROs) in phases III & IV. + Pharmaceutical companies Competition mostly non-SaaS based (TBC) Market #1 Burton1: AI-based virtual assistant helping patients fill out their obligations during clinical trials #2 Burton2: AI-based virtual assistant helping patient treatments Mobile app (for patients) and web monitoring platform (for healthcare professionals) Products Subscription-based model. 2021 Revenue $150K, EBITDA -$800K (TBC as numbers don t add up) 2025F Revenue = $25M, EBITDA = $13M (probably too high, to be further analyzed) Financials Seed rounds 2019+2020. To date raised in total $2.5M equity + $1.0M debt Investors: healthcare CVC, pharma-related family offices, midcap pharma 41% equity in total Proposed transaction: [$4.5-5M] Series A to finance U.S. expansion (timing Spring 2022) Funding CRO, Pharma, larger competitor without SaaS capabilities Exit Routes Interesting offer with strong team in large markets. Confirm strategy, negotiate term sheet & move to DD phase Reco Strictly Confidential Burton Case Study The VC Factory 1

What I like What I like Patients not complying with clinical trial protocols is a critical issue. Burton s solutions seem to significantly improve results. Given the cost of clinical trials, paying a moderate subscription to get them right will not be a roadblock The team has a proven expertise in healthcare, seems to have wide recognition (cf. published papers) and is surrounded by pharma/healthcare investors UX/UI seem elegant and intuitive both for patients and healthcare professionals, which should drive usage and retention. Demo needed + check the on-boarding process to ensure the solution is easy to use Scalable business model and large potential for repeat revenue Visible exit routes especially given the current environment Strictly Confidential Burton Case Study The VC Factory 2

Further DD Needed Further DD Needed Why have they developed two products already? Does one help to sell the other? MyReco seems to have a huge potential that is largely untapped so far. It is very difficult to put one product on the market, let alone two Dig on the market positioning: what are the envisaged advantages of moving along the value chain? How much funding is related to it? Competition: who else is using their approach? How big are incumbent players? Financials: need to understand how they were built and sensitize their numbers, not enough info at this stage + get the usual SaaS metrics (CAC, LTV, churn, MRR growth etc.) Equity: check the usual clauses preventing cheap buyout by pharma-related parties (preemption, ROFO, etc.) and potential conflicts of interest at the Board level Founders are already quite diluted. Check the point with them + their equity story may not hold and/or existing investors able to bridge to break-even Strictly Confidential Burton Case Study The VC Factory 3

Proposed Transaction + Next Steps Proposed Transaction + Next Steps Based on their financials and adding some buffer, they would need an additional $4.5-5M by end of year to get to break-even (assuming cash flows and EBITDA are not too far apart) Deal terms as follow (to be negotiated once we know more about last funding info + metrics): $4.0M equity investment in 1x non-participating preferred led by us ($2.5M) with existing parties taking their pro-rata (TBD) + debt complement up to $1M Investment 15-20% FD equity stake (post-money valuation c.$20-25M) Valuation Board composition: Us 1, Founders 2, Existing Investors 1, Independent 1 Usual clauses on Founder Obligations, Governance & Liquidity SHA Agreement on growth strategy + financials projections Satisfactory audits + IC [Limited no-shop TBD as they have cash in the bank] Conditions precedent Strictly Confidential Burton Case Study The VC Factory 4