Financial Analysis Problems: NPV, Payback Period, Profitability Index

Explore various financial analysis problems including Net Present Value (NPV), Payback Period, and Profitability Index calculations for different cash flows and investment scenarios. Understand how different discount rates and required returns impact project decisions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

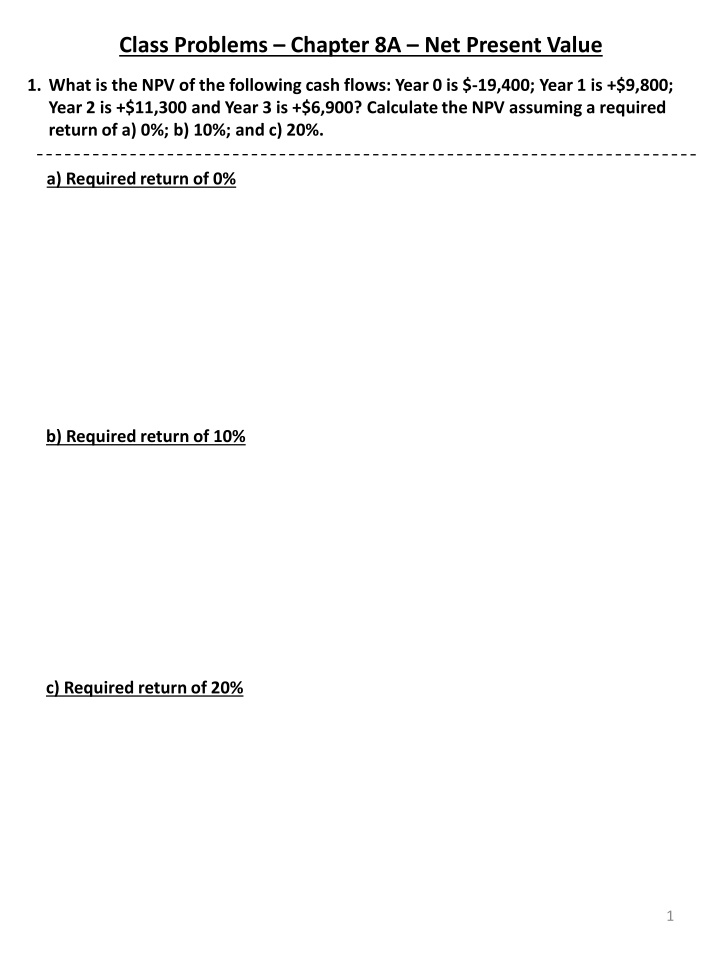

Class Problems Chapter 8A Net Present Value 1. What is the NPV of the following cash flows: Year 0 is $-19,400; Year 1 is +$9,800; Year 2 is +$11,300 and Year 3 is +$6,900? Calculate the NPV assuming a required return of a) 0%; b) 10%; and c) 20%. a) Required return of 0% b) Required return of 10% c) Required return of 20% 1

2. The Blue Hen Brewery, Inc. is considering an investment of $168,500 to create more brewing capacity to meet the increasing demand for their craft beer. They expect to generate the following net cash flows from this investment: year 1 of $86,000; year 2 of $91,000; and year 3 of $53,000, They use the NPV decision rule and want to know if this project would add value to the shareholders assuming a required return of 9%. Should this project be approved? What if the required return was 21%? a) Required return of 9% b) Required return of 21% 2

Class Problems Chapter 8B Payback Period and Profitability Index 1. Compute the payback period for cash flows A and B below. If the required payback period is 3 years, do you accept or reject the project? Payback period for Cash Flow A Payback period for Cash Flow B 3

2. Compute the profitability index for the cash flows noted below assuming a discount rate of 15% and 22%. Profitability Index at a Discount Rate of 15% Profitability Index at a Discount Rate of 22% 4

3. The Matterhorn Corporation is trying to choose between the following mutually exclusive design projects. a) If the required return is 11% and the company applies the profitability index decision rule, which project should the firm accept? Cash Flow (I) Cash Flow (II) 5

b) If the company applies the NPV decision rule, which project should it accept? c) Explain why your answers in parts (a) and (b) are different. 6

Class Problems Chapter 8C NPV and IRR 1. What is the NPV of the following cash flows: Year 0 is $-19,400; Year 1 is +$9,800; Year 2 is +$11,300 and Year 3 is +$6,900? Calculate the NPV assuming a required return of a) 10%; and b) 20%. a) Required return of 10% b) Required return of 20% 2. For problem #1 above, what would you expect the approximate IRR to be? Compute the NPV at a required return of 22%. 7

3. Assume the following cash flows: Year 0 is -$50,000; Year 1 is +$25,000 and Year 2 is +$30,000. The IRR for this series of cash flows is in which range below: A. B. C. Between 0 to 5% Between 5% to 10% Greater than 10% 8

Class Problems Chapter 8D Net Present Value Hardwell Co. is evaluating three projects (Mike s Project, Emily s Project and Robert s Project) to invest in and can only choose one of the projects. The firm uses the NPV decision rule as their investment criteria, but is uncertain as to the appropriate required return to use in the analysis. Senior management has asked you to evaluate these three projects assuming the required return is a) 5%; b) 10%; and c) 12%. After you have completed your analysis, complete the following summary chart to be used for your presentation to senior management. Cash Flows Cum Total Project Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Mike Emily Robert Summary Calculations Project Cum Cash Flow NPV at 5% NPV at 10% NPV at 12% Mike Emily Robert 9

1. Mike s Project involves an investment of $1 million upon project launch and an additional investment of $1 million in each of the next two years. This investment will then generate net cash of $2 million in year 3 and $2 million in year 4. What is the NPV if the required return is a) 5%; b) 10%; and c) 12%? a) Required return of 5% b) Required return of 10% c) Required return of 12% 10

2. Emily s Project involves an investment of $3 million upon project launch and then there are no cash flows until year 5 when this project will generate $5 million in cash. What is the NPV if the required return is a) 5%; b) 10%; and c) 12%? a) Required return of 5% b) Required return of 10% c) Required return of 12% 11

3. Robert s Project involves an investment of $3 million upon project launch and then there will be one cash flow in year 1 of $3.4 million. What is the NPV if the required return is a) 5%; b) 10%; and 3) 12%? a) Required return of 5% b) Required return of 10% c) Required return of 12% 12