Financial Capability and Asset Building Curriculum Overview

This presentation provides an overview of the Financial Capability and Asset Building (FCAB) Curriculum, discussing key components, the rationale behind the project, partnership details, historical context, and curriculum points. It delves into why social workers engage in FCAB work and the fundamental components of the curriculum, emphasizing the importance of addressing the financial needs of vulnerable populations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

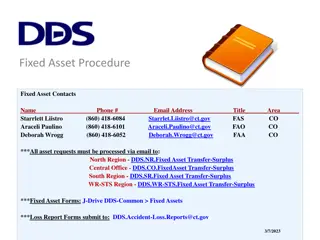

Financial Capability and Asset Building (FCAB) Curriculum: Key Components Council on Social Work Education APM, November 3, 2013 Julie Birkenmaier, Ph.D. Saint Louis University

Presentation Overview FCAB project, Center for Social Development (CSD) Rationale Fundamental components Example Fit with EPAS Instructor resources

FCAB Project (2012-2015), CSD Washington University in St. Louis Michael Sherraden, Principle Investigator (CSD) FCAB Curriculum development Margaret Sherraden, (UMSL and CSD) Julie Birkenmaier (SLU) Lissa Johnson (CSD) Tiffany Trautwein (CSD) FCAB partnership and demonstration Mike Rochelle (CSD) Gena McClendon (CSD) Funding Wells Fargo Advisors Arthur Vining Davis Foundation

FCAB and Social Work Why? History of FCAB work Person-in-environment perspective Serve financially vulnerable people Student demand How? Use PIE and strengths-based perspective Engage in micro, mezzo and macro FCAB practice

Key FCAB Curriculum Points Social workers have a history of performing FCAB work. FCAB history influences the current financial situation. Current FCAB policy and practice contexts shape options and behaviors.

Key FCAB Curriculum Points (cont.) Income statements differ from balance sheets. Household financial content must relate directly to financially vulnerable people and asset development. Social workers engage in micro, mezzo, and macro FCAB work.

Fundamental Components of the FCAB Curriculum: Part I Introduction to FCAB Context Financial services Policy Household finances Earnings and income Spending and budgeting

Fundamental Components of the FCAB Curriculum: Part II Household finances Saving, investing, asset building Credit, debt, and building assets Protecting assets Asset preservation, de-accumulation, and legacy Micro, mezzo, and macro social work practice

Example of FCAB Modules in an Elective Course Introduction to FCAB Earnings and income Context: Financial products and services Spending and budgeting Saving and investing Credit, debt, and assets Protecting assets Asset preservation Mezzo and macro social work practice

FCAB Curriculum Fit with EPAS: Example EPAS Competency 2.1.10(a) (d) Engage, assess, intervene, and evaluate with individuals, families, groups, organizations, and communities. Practice Behaviors Modules Skills Assessment (a) Substantively and effectively prepare for action with individuals, families, groups, organizations, and communities. (b) Collect, organize, and interpret client data. (b) Assess client strengths and limitations. (c) Help clients resolve problems. Compare advantages and disadvantages of various institutions (e.g., banks, community banks, savings and loans, and various types of credit unions). Compare advantages and disadvantages of various financial products and services. Community assessment B.1 J.1 J.2

Instructor Resources for FCAB Syllabi on ACOSA website FCAB initiative, CSD Other CSD publications Birkenmaier, Sherraden, & Curley (2013) Scholarly FCAB literature in journals University of Maryland, School of Social Work Financial Social Work Initiative (FSWI) Scholar Network

Additional Information Julie Birkenmaier, Saint Louis University Birkenjm@slu.edu (314) 977-3323 Mike Rochelle, CSD Mrochelle@brownschool.wustl.edu