Financial Inclusion: Ensuring Access and Equality

Financial inclusion aims to provide universal access to a variety of financial services, including banking, insurance, and credit, for vulnerable and low-income groups. By broadening the resource base and protecting financial wealth, it plays a crucial role in economic development and mitigating exploitation. The significance lies in ensuring last-mile delivery of services like bank accounts, low-cost credit, asset creation, insurance products, and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

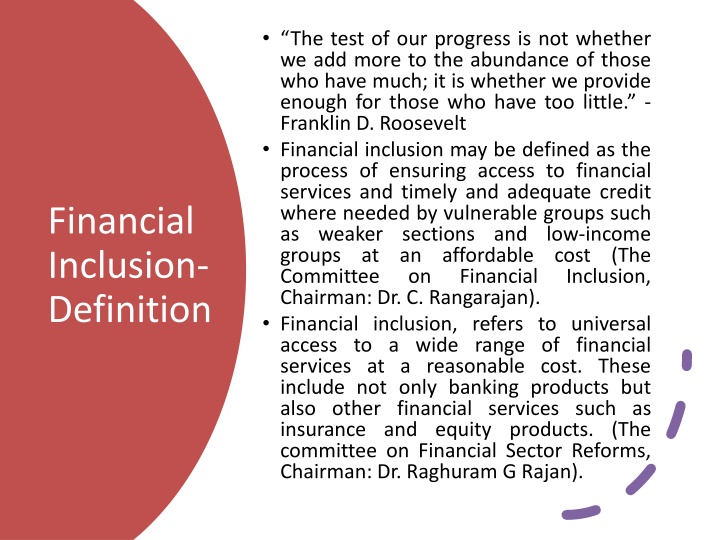

The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little. - Franklin D. Roosevelt Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low-income groups at an affordable Committee on Chairman: Dr. C. Rangarajan). Financial inclusion, refers to universal access to a wide range of financial services at a reasonable cost. These include not only banking products but also other financial services such as insurance and equity products. (The committee on Financial Sector Reforms, Chairman: Dr. Raghuram G Rajan). Financial Inclusion- Definition cost Inclusion, (The Financial

According to a world bank report, around 2 billion people don t use formal financial services and more than 50% of adults in the poorest households are UNBANKED. Financial inclusion broadens the resource base of the financial system by developing a culture of savings among a large segment of the rural population and plays its own role in the process of economic development. Further, by bringing low-income groups within the perimeter of the formal banking sector; financial inclusion protects their financial wealth and other resources in exigent circumstances. Financial inclusion exploitation of vulnerable usurious money lenders by facilitating easy access to formal credit. Why Financial Inclusion also mitigates sections the by

Significance of Financial Inclusion Ensuring last-mile delivery of financial services like: Bank accounts for savings and transactional purposes Low-cost credit generation, asset creation, and personal uses. Financial advisory Insurance (life, non-life) products Remittance and payment services (UPI, AEPS, IMPS) Mortgage for income

Household Access to Financial Services Access Contingency Planning Credit Wealth Creation Savings & Investments based on household s level of financial literacy and risk perception Retirement Savings Buffer Savings Insurable Contingencies Business Livelihood Emergency Loans Housing Loans Consumption Loans Source: A Hundred Small Steps - Report of the Committee on Financial Sector Reforms (Chairman : Dr. Raghuram Rajan)

Financial Inclusion Index Significance The Reserve Bank of India has released the Composite Financial Inclusion Index (FI-Index) for the year ending 31stMarch 2022. India s Financial Inclusion Index has improved to 56.4 from 53.9 in the previous year 2021. The improvement has been seen across all its sub-indices (Access, Usage, and Equality). About It is a comprehensive index incorporating details of banking, investments, insurance, postal as well as the pension sector in consultation with the government and respective sectoral regulators. It was developed by the RBI in 2021,without any base year', and is published in July every year. Aim To capture the extent of Financial Inclusion across the country. The FI-Index is responsive to ease of access, availability, and usage of services, and quality of services, consisting of 97 indicators.

Financial Inclusion Index Parameters It captures information on various aspects of financial inclusion in a single value ranging between 0 and 100, where 0 represents complete financial exclusion and 100 indicates full financial inclusion. It comprises three broad parameters (weights indicated in brackets) viz., Access (35%), Usage (45%), and Quality (20%) with each of these consisting of various dimensions, which are computed based on a number of indicators. The index is responsive to ease of access, availability and usage of services, and quality of services for all 97 indicators. What is the Significance of The FI Index? Measures Level of Inclusion: It provides information on the level of financial inclusion and measures financial services for use in internal policy making. Development Indicators: It can be used directly as a composite measure in development indicators. Fulfil the G20 Indicators: It enables fulfillment of G20 Financial Inclusion Indicators requirements. The G20 indicators assess the state of financial inclusion and digital financial services, nationally and globally. Facilitate Researchers: It also facilitates researchers to study the impact of financial inclusion and other macroeconomic variables.

Pradhan Mantri Jan Dhan Yojana Initiatives to Increase FI index in India Digital Identity (Aadhaar) National Centre for Financial Education (NCFE) Centre for Financial Literacy (CFL) Project Expansion of financial services in Rural and Semi-Urban Areas Promotion of Digital Payments

Pradhan Mantri Jan Dhan Yojana Initiatives to Increase FI index in India Digital Identity (Aadhaar) National Centre for Financial Education (NCFE) Centre for Financial Literacy (CFL) Project Expansion of financial services in Rural and Semi-Urban Areas Promotion of Digital Payments

51.4% of farmer households are financially excluded from both formal/ informal sources. Of the total farmer households, only 27% access formal sources of credit; one-third of this group also borrowed from non-formal sources. Overall, 73% of farmer households have no access to formal sources of credit. 64% of the farmer households in the northeastern states were unable to access any finance whereas below 20% received formal credit. NSSO 59th Round Survey, 2003

Government of India Population Census 2011 Only 35.5% of households availed banking services as per the census of 2001. As per census 2011, only 58.7% of households are availing banking services in the country. This increase may be attributed to increase in banking services in rural areas. Availing of Banking Services Census 2001 Census 2011 80 70 60 50 40 30 20 10 0 67.8 58.7 54.4 49.5 35.5 30.1 Rural Urban Total Source: Department of Financial Services, GoI

RBI Working Paper Study Sadhan Kumar (2011) worked out an Index on financial inclusion (IFI) based on three variables namely penetration (number of adults having bank account), availability of banking services (number of bank branches per 1000 population) and usage (measured as outstanding credit and deposit). The results indicate that Kerala, Maharashtra and Karnataka has achieved high financial inclusion (IFI >0.5), while TamilNadu, Punjab, A.P, H.P, Sikkim, and Haryana identified as a group of medium financial inclusion (0.3<IFI<0.5) and the remaining states have very low financial inclusion.

World Bank Financial Access Survey Results Number of Bank Branches Number Number of ATMs Bank Deposits Bank Credit of Bank Branches Number of ATMs Per 1000 KM Per 0.1 million 10.64 23.81 46.15 8.52 18.8 21.29 14.86 8.07 10.71 16.73 11.29 10.49 24.87 35.43 50.97 41.58 as % to GDP S. No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Country India China Brazil Indonesia Korea Mauritius Mexico Philippines South Africa Sri Lanka Thailand Malaysia UK USA Switzerland France 30.43 1428.98 7.93 8.23 79.07 104.93 6.15 16.29 3.08 41.81 12.14 6.32 52.87 9.58 84.53 40.22 25.43 2975.05 20.55 15.91 ... 210.84 18.94 35.75 17.26 35.72 83.8 33.98 260.97 ... 166.48 106.22 8.9 49.56 119.63 16.47 ... 42.78 45.77 17.7 60.01 14.29 77.95 56.43 122.77 ... 100.39 109.8 68.43 433.96 53.26 43.36 80.82 170.7 22.65 41.93 45.86 45.72 78.79 130.82 406.54 57.78 151.82 34.77 51.75 287.89 40.28 34.25 90.65 77.82 18.81 21.39 74.45 42.64 95.37 104.23 445.86 46.83 173.26 42.85 Source: Financial Access Survey, IMF; Figures in respect of UK are as of 2010

Constraints to Financial Inclusion The three big challenges are- high cost, lack of robust technology, and lack of awareness. The banks are faced with high operating cost in extending the financial services to the remote areas. High maintenance cost of these accounts as well as small ticket size of the transactions is also adding to the problem.

Extent of Financial Exclusion in India According to the World Bank Financial Access Survey Results, in our country, financial exclusion measured in terms of bank branch density, ATM density, bank credit to GDP and bank deposits to GDP is quite low as compared with most of developing countries in the world. The Economic Census 2005 revealed that the massive Small and Medium Enterprises (SME) sector, which provides 90 per cent of non-farming employment, could access only 4 per cent of institutionalized finance, leaving the rest to usurious money lenders. Banks in India almost monopolize national cash savings. The significance of this sector lies in the fact that about two-third unit in SME sector are owned and operated by the disadvantaged section of the population, like SCs, STs, and OBCs. Agriculture not only plays the central role for achieving high growth but also inclusive growth for the economy as a whole (generates about 20 per cent of India s GDP and provides employment to nearly two-third of its population). However, a very large segment of agricultural sector is starved of formal credit, forcing the farmers to borrow from the informal moneylenders at usurious interest rates. This sets a cycle of indebtedness. At present, only about 5% of India's 6 lakh villages have bank branches. There are 296 under-banked districts in states with below-par banking services.

Financial Inclusion RBI Policy Initiatives Basic Saving Bank Deposit (BSBD) Relaxed and simplified KYC norms Simplified Branch Authorization Policy Compulsory Requirement of Opening Branches in Un-banked Villages Opening of intermediate brick and mortar structure FIPs should be disaggregated and percolated down up to the branch level Kisan Credit Card (KCC) Issued General Credit Card (GCC) Issued Licensing of New Banks Financial Literacy Initiatives Growth in SHG-Bank Linkage Growth of MFIs Bank Credit to MSME Insurance penetration in the country Equity penetration in the country

In operational terms, microcredit or microfinance involves small loans, up to Rs. 25000, extended to the poor collateral for undertaking self- employment projects (RBI, 2007- 08). The Gramin developed Bangladesh, is one of the most popular models of microfinance institutions and replicated in various parts of the world. Under this model, non- government (NGOs) form and develop self- help groups (SHGs). without any Bank originally model, Microfinance in has been organizations

Gramin Bank has reversed conventional banking practice by obviating the need for collateral. It has created the need for a banking system based on mutual trust, accountability, participation, creativity. The formal/institutional banking sector has not lived responsibility of meeting the financial needs of the poor due to various reasons such as lack of branch network in the rural area, lack of collateral security of farmers and poor people, and lack of education, awareness among the poor. Apart from conventional FinTechs have started digital lending to the urban poor applications, marketing channels. and up to its social Microfinance channels, through e-mail/SMS/direct mobile

Hundreds of millions of low- income people have benefited from microfinance inception, with million borrowers served by the industry worldwide annually. It enables people to expand their present income. It provides easier access to formal credit. It makes future possible. It serves the under-financed and underprivileged society. since about its 140 Benefits of Microfinance investments sections of

It helps in the generation of employment opportunities It inculcates the discipline of saving. It brings about economic gains. It results in management practices. It results in better education. Benefits of Microfinance significant better credit

Business Models Used SELF-HELP GROUP JOINT LIABILITY GROUP GRAMEEN BANK MODEL RURAL COOPERATIVES

A self-help group (SHG) is a small and formal association of poor, preferably having similar backgrounds who have come together to realize some common goals based on the principle of self-help and collective responsibility. The promotion of self-help groups in India began more formally in 1992 with the launch of the Programme by the National Bank for Agriculture and Rural Development. Usually, the self-help groups comprise 10- 20 women belonging to a homogenous group who come together with a common objective of becoming self-employed. socio-economic Self Help Groups (SHGs) SHG-Bank Linkage

More than 84% of the groups being exclusively women groups, the program provided the much-needed push for the empowerment of women in the country The program aimed at improving the rural poor s access to formal credit systems in a cost-effective and sustainable manner by making use of SHGs. The invention of the Self-Help Group is a boon for the small farmer in general and village women in particular. It has been responsible for bringing a qualitative change in the lives of thousands of people. Under Self-Help expected to provide credit to the SHGs against group guarantee and members of the group stand as collective guarantors. Banks allow the members of the SHGs to decide on which members of the group shall borrow and how much, and the methodology of repayment. Self Help Groups (SHGs) Group, banks are

A Joint Liability Group (JLG) is an informal group comprising of 4-10 individuals coming together for the purpose of availing bank loans on an individual basis or through a group mechanism against the mutual guarantee. Generally, the members of a JLG would engage in a similar type of economic activity. In certain groups, members may prefer to undertake different types of economic activities as well. The members would undertaking to the bank to enable them to avail of loans. JLG members are expected to provide support to each other in carrying out occupational and social activities. Joint Liability Group (JLG) offer a joint

Members should belong to similar socio- economic status, environments carrying out farming and Allied activities and who agree to function as a joint liability group. This way the groups would be homogeneous and organized by like-minded farmers/Individuals and develop mutual trust and respect. The members should be residing in the same village/ area/neighborhood and should know and trust each other well enough to take up joint liability for group/individual Loans. Members who have defaulted to any other formal financial Institution, in the past, are debarred from the Group Membership. More than one person from the same family should not be included in the same JLG. background, and Criteria of Membership in JLG

Model A Financing Individuals in the JLG. Each member of the JLG should be provided an individual KCC / GCC or term loan for undertaking agriculture and allied activities. The members stand as mutual guarantors to each other s debt liability created out of individual KCC/GCC. Any member opting out of the group or joining the group will necessitate a new loan agreement, to be kept on record in the bank branch. JLG Model B Financing the JLG as a Group. The JLG functions, operationally as one borrowing unit in this model. The group would be eligible for accessing one loan, which could be a combined credit requirement for all its members. All members would jointly execute the document and own the debt liability jointly and severally. The mutual agreement needs to ensure consensus among all members about the amount of individual debt liability that will be created. Any change in the composition of the group will lead to a new document being registered by the bank branch. Lending Models

SHG Vs. JLG Parameters Financial focus SHG Model Based on savings JLG Model Based on credit With the promoting microfinance institution Control and ownership With members Builds internal capacity Depends on external capacity Capacity targets Functional focus Decentralisation Cost Flexibility Poverty High Low High Finance Low High Low

The Grameen Model was the brainchild of Nobel Laureate Prof. Muhammad Bangladesh in the 1970s. It has inspired the creation of Regional Rural Banks (RRBs) in India. The primary motive of this system is the development economy. However, in India, SHGs have been more successful as MFIs when compared to Grameen Banks. Yunus in Grameen Bank Model end-to-end the of rural

Rural established in India at the time of Indian independence. The resources of poor people were pooled, and financial services were provided from this fund. However, this system had complex monitoring structures and was beneficial only to the creditworthy borrowers in rural India. Hence, this system did not find the success that it sought initially. Cooperatives were Rural Cooperatives

Member and customer deposits This is applicable to MFIs that are organized as mutual funds, cooperatives, and microfinance banks offering savings products. Subsidies and grants Grants are more prominent when the MFI is just being set up. Own capital The microfinance institution s own finance/capital accounts for a part of the funding extended to borrowers. Loans from partner banks This is the primary source of funding for an MFI. Funding received from public investors Bilateral or multilateral organizations offer funds to MFIs. This is a source of long-term funding for the MFI. Funding received from private investors These funds are supplied directly to the MFI or through investment funds that specialize in microfinance. This is also a source of long-term funding for the MFI. Source of Finance of MFIs