Financial Information and Analysis for School District 2023-24

This report presents detailed financial information and analysis for a school district for the fiscal year 2023-24. It covers valuation, tax revenue, levy comparisons, per pupil cost, special building fund status, lease purchase implications, and bond issues. The data provides insights into the district's financial health and funding strategies.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

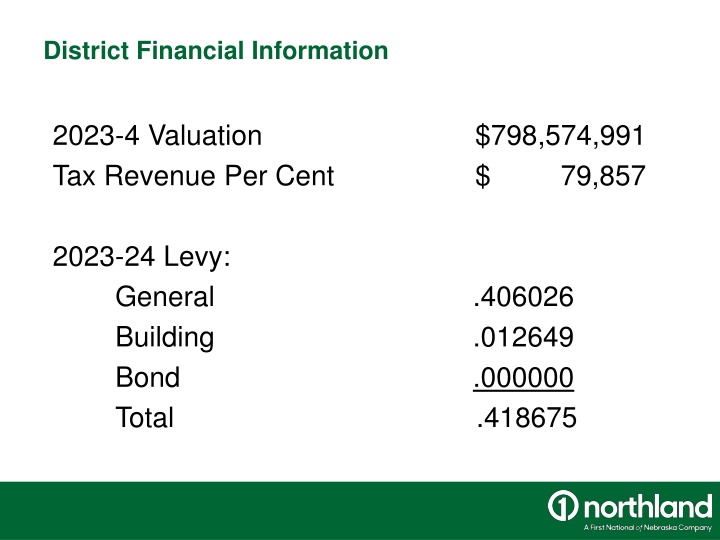

District Financial Information 2023-4 Valuation Tax Revenue Per Cent $798,574,991 $ 79,857 2023-24 Levy: General Building Bond Total .406026 .012649 .000000 .418675

Area Levy Comparison-2023/24 Fiscal Year Wayne Community Schools Winside Public Schools Wausa Public Schools Pierce Public Schools LCC Public Schools Osmond Public Schools Allen Consolidated Schools Hartington Newcastle PS Randolph Public Schools 1.019535 0.860691 0.850940 0.823448 0.792679 0.733131 0.647255 0.495307 0.418675

Area Per Pupil Cost -2023/24 Fiscal Year Allen Consolidated Schools LCC Public Schools Osmond Public Schools Wausa Public Schools Winside Public Schools Randolph Public Schools Hartington Newcastle PS Pierce Public Schools Wayne Community Schools $30,394 $26,719 $25,728 $21,931 $21,900 $21,661 $20,936 $15,526 $14,005 *State Average -$16,213

Special Building Fund End of fiscal year SBF Balance $1,100,000 Annual SBF Revenues LB 243 Revenue Growth $ 101,000 $ 155,700 (3%) $ 464,290 (BOE) SBF can only grow if additional revenues aren t needed for General Fund due to LB 243.

Lease Purchase: Financial Implications Maturity Length Current interest rates Levy Impact per/million 7 years 4.75% 2.0 cents An estimated lease purchase project would probably be maxed out at around $1,000,000 due to debt service limitations and need for General Fund flexibility.

Bond Issue Levy outside the 1.05 statutory limit/LB 243 limit Monetizes all funds for immediate construction Levy impact would be for longer and total P & I higher with bond issue than other options Annual levy/tax impact lower with bond issue Ag land at 50% of market value for bond issue Requires a majority approval of registered voters residing in District.

Bond Issue (Preliminary) $1,000,000 Bond Issue @ 20 years LB2 Valuation Bond Yield Levy Impact $626,868,490 4.30%-4.50% 1.2 cents $100,000 of property Irrigated Acre Irrigated Quarter $12/per year $0.49/per year $80/per year