Financial Intelligence Processing Unit Report 2018-2020 Insights

Explore the activities of the Financial Intelligence Processing Unit (FIPU) from 2018 to 2020, including the analysis of Suspicious Transaction Reports (STRs), evolution of reporting entities, confidential reports received, and more. Gain valuable insights into the financial intelligence processes and trends over the years.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

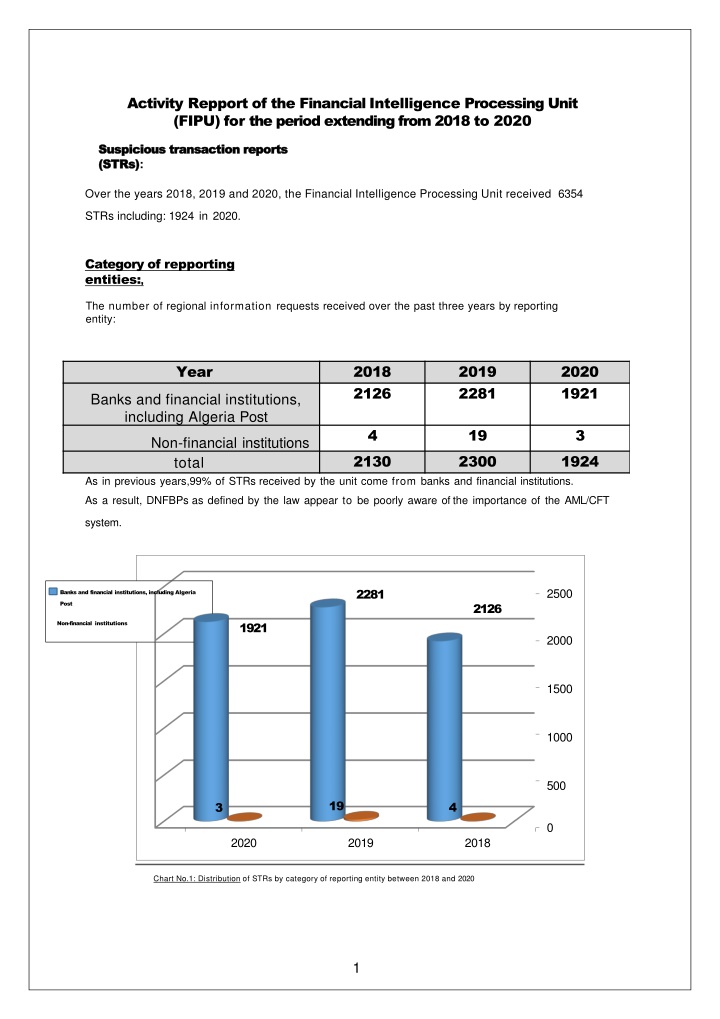

Activity Repport of the Financial Intelligence Processing Unit (FIPU) for the period extending from 2018 to 2020 Suspicious Suspicious transaction reports transaction reports ( (STRs STRs) ): Over the years 2018, 2019 and 2020, the Financial Intelligence Processing Unit received 6354 STRs including: 1924 in 2020. Category of repporting entities:, The number of regional information requests received over the past three years by reporting entity: Year 2018 2126 2019 2281 2020 1921 Banks and financial institutions, including Algeria Post 4 19 2300 3 Non-financial institutions total As in previous years,99% of STRs received by the unit come from banks and financial institutions. 2130 1924 As a result, DNFBPs as defined by the law appear to be poorly aware of the importance of the AML/CFT system. 2281 2500 Banks and financial institutions, including Algeria Post 2126 1921 Non-financial institutions 2000 1500 1000 500 19 4 3 0 2020 2019 2018 Chart No.1: Distribution of STRs by category of reporting entity between 2018 and 2020 1

The number of STRs has evolved.2015- 2020): Year 2015 Number 2016 2017 2018 2019 2020 Of STRs 1290 1240 1239 2130 2300 1924 As shown in the chart below, the number of STRs received from reporting entities from 1290 in 2015 to 2300 in 2019, an increase of 78%, to decrease slightly to 1924 in 2020. 2500 2000 1500 1000 500 0 2020 2019 2018 2017 2016 2015 Chart No.02: Annual change in the number of STRs between 2015 and 2020. The number of STRs has been steadily increasing since 2015 to reach 2,300 STRs in 2019. The decrease in the number of reports recorded in 2020 compared to 2018 and 2019 to slow down In activities due to the "Covid" pandemic19" in Algeria and around the world that has severely affected the overall economic situation, 2) Confidential reports: During the period under review, the Financial Intelligence Processing Unit received a total of 411 confidential reports (From the Customs Administration and the Bank of Algeria (the Tax Administration and the General Inspectorate of Finance did not send any confidential reports), including RC74 reports in 2020: 2

Year 2018 218 3 0 221 2019 119 4 0 123 2020 60 7 7 74 Customs Bank of Algeria others total 250 218 200 Customs Bank of Algeria 150 119 100 60 50 7 4 0 3 2018 2019 2020 Chart No.03: Distribution of confidential reports by reporting institution between 2018 and 2020. The number of confidential reports issued by the customs services and the Bank of Algeria has increased from2015 to 2020: Year 2015 2016 2017 2018 2019 2020 159 168 184 221 123 74 Number of confiden tial reports 3

Number of confidential reports received 250 221 184 200 168 159 150 123 100 74 50 0 2020 2019 2018 2017 2016 2015 Chart No.04: Evolution of the number of confidential reports received by the Financial Intelligence Processing Unit between 2015 and 2020. 3) Regarding files sent to the public prosecutor: In 2020, the Financial Intelligence Processing Unit referred eleven (11) files to the Public Prosecutor at the Court of Algiers, resulting from analyses carried out on STRs, confidential reports and spontaneous information from foreign counterpart units, including (07) Files subject to administrative freezing For funds followed by a judicial freezing. 2018 2019 the total Type of crimes conviction Cases Convictions Cases Acquittal /discharg discharg discha rge cases convi ction s e e 20 57 51 59 25 20 79 82 71 Money laundering 37 64 60 39 80 40 76 144 100 Terrorist financing 1 0 3 0 0 0 1 0 3 Money laundering and financing terrorism 4) Freezing orders: In the year2020 In accordance with the provisions of Articles 17 and 18 of Law No. 05-01 as amended and supplemented, the Cell was notified Financial inquiry processing seven (07) Freezing decisions related to suspicious transactions, regarding which it received Suspicious statements. 4

In fact, the Financial Intelligence Processing Unit can oppose the execution of any transaction that has not yet been executed and that is the subject of An STR. The execution of the transaction is postponed for a period not exceeding72 hours from the date of receipt of the STR by the unit. This decision is taken in cases where there is an immediate risk of disappearance of the identified suspicious funds (cash withdrawal, transfer to foreign countries, etc.). 5) National cooperation: The FIPU automatically and upon request communicates information and the results of its analyses to the relevant competent authorities. Spontaneous Reporting: The FIPU transmits information and the results of its analyses to the competent authorities whenever there are grounds to suspect money laundering, terrorist financing or predicate offences. Reporting upon request: The FIPU responds to requests for information from the competent authorities. Requests for assistance received by the Financial Intelligence Processing Unit at the national level:, In the exercise of its missions, the FIPU receives information requests from several national bodies, in particular , authorities responsible for law enforcement (Directorate General of National Security, National Gendarmerie, judicial bodies, Central Office for the Repression of Corruption OCRC) to obtain information relating to natural and legal persons. Requests received between 2 years2018 and 2020 within the framework of national cooperation:, The number of information requests received during the past three years amounted to 267, as shown in the table below: Year 2018 2019 2020 13 25 21 General Directorate of National Security requests 33 72 33 National Gendarmerie Command Requests 3 8 49 Counterpartsunits requests 5

0 5 5 Central Office of Corruption repression requests 49 110 108 the total: The graphs below show the distribution of requests received by the unit from relevant national bodies in:2018, 2019 and 2020 within the framework of national cooperation: Requests received in 2018 FIU OCRC 6% 0% DGSN 27% GN 67% Requests received in 2019 OCRC 7% CRF 5% DGSN 23% GN 65% 6

Requests received in 2020 OCRC 5% DGSN 19% FIU 45% GN 31% Charts No.06,05 and 07: Details of requests received in 2018, 2019 and 2020 within the framework of national cooperation. Requests for information received by the Financial Intelligence Processing Unit to support the cases handled by the judicial authorities have increased significantly during the year.2020. In addition, the FIPU may, in application of Article15 of the Law 05-01 ,amended and supplemented, sending information to specific categories of persons subject to professional confidentiality. These are security and judicial bodies specialized in combating money laundering and terrorist financing. However, the information provided must relate to facts that justify suspicion of money laundering. Requests for assistance issued by the Financial Intelligence Processing Unit at the national level:, In 2020, the Financial Intelligence Processing Unit reported four (04) suspected cases to the competent national authorities within the framework of national coordination and information exchange. It also requested several organizations for additional information, in particular banks, which remain the main source of information for the Financial Intelligence Processing Unit: 7

Year 2016 2017 2020/2018 Requests for additional information issued by FIPU 721 50 2303 Number of requests issued by the unit 2500 2303 2000 1500 1000 721 500 50 0 2016 2017 2018/2020 Chart No.08: Evolution of the number of requests for additional information issued by the Financial Intelligence Processing Unit between 2016 and 2020. 6) International cooperation: Cooperation with foreign financial intelligence units (:)FIUs Recommendation 40 of the Financial Action Task Force (FATF) calls for the widest possible international cooperation in matters of money laundering, related predicate offences and terrorist financing. Countries should cooperate spontaneously and upon request and should do so on a lawful basis. Based on the legislative and regulatory provisions, especially Articles25 and 26 of Law No. 05-01 of 6 February2005 Amended and Supplemented on the Prevention and Combating of Money Laundering and the Financing of Terrorism, the Financial Intelligence processing unit can exchange financial information directly with foreign counterparts, subject to reciprocity and respect for confidentiality. Thus it has a larger network of operating partners. Any inquiries or anyAnd Spontaneous information provided by foreign financial intelligence units is considered by the financial intelligence processing unit a suspicious transaction report STR. It is important to note that the exchange of information between the Financial Intelligence Processing Unit and its foreign counterparts is in accordance with the recommendations of the Financial Action Task Force.(Egmont) and best practices issued by the FATF Group, And the bilateral agreements signed between the Financial Intelligence Processing Unit and its counterparts. 8

Requests issued or received by the Financial Intelligence Processing Unit: During the period from 2016 to the end of 2020, the FIPU received a total of 218 international requests, and issued 466 requests, as shown in the following table: Year 2016 2017 2018 2019 2020 79 101 11 11 16 Requests received 129 37 25 201 74 Submitted requests 100% 90% 37 80% 70% 129 25 60% 74 201 50% 40% 101 30% 20% 79 11 10% 16 11 2019 0% 2020 2016 2017 2018 Requests received Submitted requests Chart No.09: Evolution of the number of requests issued or received by the FIPU internationally, between 2016 and 2020. Cooperation agreements: Since its establishment until the end of the year2020, the Financial Intelligence Processing Unit signed twenty-one (21) memoranda o f Understanding and exchanging information with counterpart units from Africa, Asia and Europe: Counterpart unit s name Date of Signature number. 1 2 3 4 5 6 7 8 State 04/12/2007 Senegal National Financial Information Processing Unit (CENTIF) 27/04/2010 Financial Information Processing Unit (CTIF-CFI) Kingdom of Belgium 19/05/2010 United Arab Emirates Anti-Money Laundering and Suspected Cases Unit (UAE-FIU) 2010 Mauritania Financial Intelligence Analysis Authority (CANIF) 05/05/2011 Anti-Money Laundering and Terrorist Financing Unit Hashemite Kingdom of Jordan 28/11/2011 Tunisian Financial Analysis Authority (CTAF) Tunisia 29/11/2011 Bahrain Anti-Money Laundering and Terrorist Financing Unit 29/11/2011 Sudan Sudan Financial Investigation Unit 9

9 10 11 12 13 14 15 16 17 18 19 20 21 29/11/2011 Financial Information Collection Unit Yemen 30/11/2011 Unit of Financial Processing (UTRF) Kingdom of Morocco 26/05/2011 Poland General Inspector of Financial Information of the Republic of Poland 28/03/2012 Intelligence and Action against Covert Financial Circuits (TRACFIN) Unit France 29/04/2012 Egyptian Money Laundering Unit (EMLCU) Egypt 30/04/2012 Financial Intelligence Unit of the Royal Oman Police Sultanate of Oman 12/09/2012 Special Investigation Commission (SIC) Lebanon Saudi Arabia 07/04/2012 Saudi Arabian Financial Intelligence Unit 07/05/2012 Burkina Faso Financial Information Processing Unit (CENTIF-BF) 02/05/2014 Japan Chad Japan Intelligence Center (JAVC) 03/12/2015 National Financial Investigation Agency (ANIF du TCHAD) 25/06/2015 Russian Federation UK Federal Financial Supervision Service 26/09/2016 National Crime Agency In addition, the Financial Intelligence Processing Unit intends to sign memoranda of understanding and exchange information with relevant authorities, in particular with the Chinese Financial Intelligence Unit (CAMLMAC) and the South African Financial Intelligence Unit (FIC). Participation in the activities of international bodies: In 2020, the Financial Intelligence Processing Unit participated in meetings of international bodies i n v o l v e d i n combating Money laundering and terrorist financing as well as in many events organized in this context. FATF The Financial Intelligence Processing Unit participated in the 29th Plenary Session of the Financial Action Task Force (FATF).)GAFI held in February2020 in Paris, France, as well as the last two plenary sessions in October 2020 and February 2021, via video conference. MENAFATF The Financial Intelligence Processing Unit participated in the general session.33 for Which was held in a hybrid capacity in the Arab Republic of Egypt in November MENAFATF 2021. 10