Financial Literacy Curriculum Importance and Cost of Living Crisis

Financial literacy is crucial for understanding the current cost of living crisis caused by inflation and global economic factors. Rising prices impact individuals and businesses, leading to tough financial choices and adjustments in spending habits.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Financial Literacy Curriculum Financial Literacy Curriculum City of London Academy Trust | Year 9 Assembly

2 What is FLIC? What is FLIC? The Financial Times news group has set up a charity, Financial Literacy and Inclusion Campaign focused on building up the financial knowledge and skills of everyone in the UK, especially the people that don t usually come across this information. Flic have been working with Shoreditch Park to plan lessons that will improve your financial literacy.

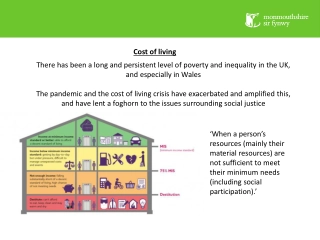

Why is financial literacy important? Why is financial literacy important? What is the COST OF LIVING Crisis? | Newsround #Newsround #CostOfLiving #Explainer #martinlewis We got the money saving expert Martin Lewis @moneysavingexpert to help us explain this! You've probably heard people talking about a 'cost of living' crisis and the problems it is causing recently. But what does it actually mean? Well, it's basically about the price of things around the world and how much money people have to spend on the things that they need - like food, fuel and family life. For a variety of reasons prices are going up and, although governments say they are trying to take action to make things easier, for many people it means that tough choices are having to be made about how to spend their money. Why are prices going up? The rising cost of things is known as inflation. That's when, over time, prices rise and how much you can buy with your money falls, so people demand to be paid more in wages, which means it costs companies more to pay people to make things, which then pushes up how much they cost to make and the prices rise... and so on. The effects can be seen in lots of things including rising energy prices, rising food prices, strikes by train staff, fuel protests by drivers and even problems at airports. It's not just happening in the UK, it's happening all around the world. Energy prices are a good example of this. Energy prices have an impact on pretty much everything - from heating homes, to transporting goods and keeping factories in production. When they rise, the costs of everything rises and those costs have been passed down to ordinary people's bills. The Resolution Foundation - an organisation which provides advice and ideas on improving living standards - is warning that the Ukraine conflict is making the situation even worse. "The crisis in Ukraine has increased both the scale of price rises, but also the degree of uncertainty about their levels and duration," the Foundation's report says. There have also been other shortages of goods like building materials and computer chips, which has created problems. Businesses are are passing on these extra costs - higher energy, petrol and transport bills - to customers. Since the coronavirus pandemic and the UK leaving the European Union, some companies have struggled to recruit people for certain jobs and they have offered higher wages to attract them - however, the cost of these increased wages has been passed down to the customer too. All of these factors play into the same result - prices going up. 'Struggles' People struggling with the soaring cost of living are cutting back on food and car journeys to save money, according to a BBC-commissioned survey in June 2022. More than half (56%) of the 4,011 people asked had bought fewer groceries, and the same proportion had skipped meals. Many people have cut spending on clothes and socialising too. So what's the problem? Well, as prices go up, not everyone's pay or benefits are going up at the same time or by the same amount. If someone's pay or benefits aren't going up at the same time as prices, then the money in their pocket doesn't go as far and buying things gets harder. The same also goes for places like schools who find the money they have to spend doesn't buy them as much stuff as it used to. The worry for governments and charities is that it means more people not being able to turn the heating on as much as they'd like, eat as healthily as they might, and having to go to charities or foodbanks for help. The UK's Office for National Statistics found that half of adults it surveyed said they had bought less food in the last fortnight due to higher prices. Asda and Tesco have also reported customers cutting back on how much they buy. What is being done to help? The UK government has made various announcements about the help it is offering but many charities say what's being done isn't enough to help those that need it most and there have been warnings that prices could keep rising. Welcome to the official BBC Newsround YouTube channel. Subscribe here . https://bit.ly/3bYidJ3 Please visit www.bbc.co.uk/newsround/13865002 for tips about what to do if you are feeling sad about what you've seen, heard or read. At Newsround we bring you news stories which are affecting you and hear your opinion, the latest trends, movie reviews and what you re doing to help each other and the environment. Want top tips on the latest video games? Want to know more about what s going on in the world of sport and music? Then you re in the right place. To watch the daily bulletins head to the BBC iPlayer and to get involved with votes and have your say on a news story head over to the Newsround website https://www.bbc.co.uk/newsround For daily news bulletins visit the BBC iPlayer https://www.bbc.co.uk/iplayer/episodes/b006mdbc/newsround

4 Why is financial literacy important? Why is financial literacy important? We have been hearing about the cost of living in the news. Due to national and international changes, many families are experiencing difficulties with their finances. We want to make sure that you are equipped with the knowledge and skills that can help you to prepare and protect yourself financially in the future.

Having a respectful learning environment 5 Money is a very personal topic. People have different values about money and this might be influenced by their circumstances. During your financial literacy lessons, there are some important expectations for keeping our learning environment safe and respectful. In every lesson; We will listen to each other respectfully We will avoid making judgements or assumptions about others We will comment on what has been said, not the person who has said it We won t put anyone on the spot and we have the right to pass We will not share personal stories or ask personal questions

Have you heard of cryptocurrency? Have you heard of cryptocurrency? Cryptocurrencies are digital currencies. There are tens of thousands of different cryptocurrencies. Bitcoin is one of the most well-known. 5 Facts about crypto from Ishaan @Revishaan Here are 5 facts about crypto currencies -made in collaboration with Ishaan Bhimjiyani

How has the value of bitcoin changed? Crypto: higher or lower? 7 Jan 2009 Dec 2013 Jan 2015 Dec 2017 May 2010 < 0.01 950 240 15,000 0 Jan 2022 Nov 2021 Dec 2020 4,500 Dec 2019 25,000 22,000 60,000 *Note that the numbers shown have been rounded, so are approximate.

What will you be learning? 8 You will have six lessons on how to make financial decisions. How to manage financial risk Session 1 Session 2 Session 3 Session 4 Session 5 Session 6 Decision- making Pocket money debate Mobile phone products Financial exploitation Cryptocurrency Online gaming Online safety Don t forget your calculator!