Financial Management Seminar: Risk & Return Analysis

Understand risk and return analysis in financial management with a focus on single stock performance, diversification benefits, calculating average return, sample variance, and standard deviation using real data from Intel and Nike. Learn key concepts and formulas to assess and manage risks effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT AY2019/2020 Seminar 4 Risk and return Dr. Giota Papadimitri Senior lecturer in Accounting and Financial Management

RECAP RISK & RETURN Single stock Average return Calculate mean Risk Calculate variance & St. Dev *** ST. DEV (VOLATILITY) IS THE SQ ROOT OF THE VARIANCE U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

RECAP RISK & RETURN Diversification Lack of relationship between Std. dev and avg returns of individual stocks Investors prefer to diversify their portfolios Types of risks: systematic & non-systematic risks A measure for assessing the incremental risk of adding a risky asset to a portfolio we look at the portfolio s variance formula n n N is the number of assets in the portfolio and wi is the weight of the ith asset. = i 1 = 2 cov( , ) w w r r Cov(ri,rj) is the covariance between the return on asset i and asset j. This is a measure of the tendency of the returns of two assets to move together. It is related to correlation, which you may have seen before, as follows: Corr(ri,rj)=cov(ri,rj)/(si*sj) p i j i j = 1 j U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

QUESTION 1 Using the data below for Intel and Nike, calculate the average return for each for the period in question: INTC 2010 0.0626 0.3122 2011 0.1933 0.1115 2012 -0.1203 0.1191 2013 0.3088 0.5450 2014 0.4430 0.2376 2015 -0.0221 0.3139 2016 0.0878 -0.1771 2017 0.3084 0.2470 2018 0.0421 0.1986 2019 0.3070 0.3810 NKE U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 1 We sum the annual returns and then divide by 10, the number of periods in this sample, to find the sample average return for each stock: INTC 0.0626 0.3122 0.1933 0.1115 2012 -0.1203 0.1191 2013 0.3088 0.5450 2014 0.4430 0.2376 2015 -0.0221 0.3139 2016 0.0878 -0.1771 2017 0.3084 0.2470 2018 0.0421 0.1986 2019 0.3070 0.3810 NKE 2010 2011 GENERAL FORMULA 100.0626+0.1933 0.1203+ +0.3070 RETURNINTC= ?=1 = 0.1611 10 100.3122+0.1115+0.1115 +0.3810 RETURNNIKE= ?=1 = 0.2289 10 U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

QUESTION 2 Using the same return series, calculate the sample variance and standard deviation for INTC and NKE returns INTC 0.0626 0.3122 0.1933 0.1115 2012 -0.1203 0.1191 2013 0.3088 0.5450 2014 0.4430 0.2376 2015 -0.0221 0.3139 2016 0.0878 -0.1771 2017 0.3084 0.2470 2018 0.0421 0.1986 2019 0.3070 0.3810 NKE 2010 2011 U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 2 We find the deviation each year s return from the mean for each firm and square them, sum over the entire period and divide by sample size minus one (10-1 in this case) to find sample variance. Then take square root to find standard deviation VARIANCE FORMULA *ST. DEV (VOLATILITY) IS THE SQ ROOT OF THE VARIANCE Sum of squared deviations INTC 0.0626 0.1611= -0.0985 Deviation from mean Deviation squared INTC NIKE -0.0985 0.0833 0.0322 -0.1174 -0.2814 -0.1098 0.1477 0.3161 0.2819 0.0087 -0.1832 0.085 -0.0733 -0.406 0.1473 0.0181 -0.119 -0.0303 0.1459 0.1521 Variance INTC St Dev INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC 0.009702 0.006939 0.287288 0.329214 0.031921 0.036579 0.178664 0.191257 0.001037 0.013783 0.079186 0.012056 0.021815 0.099919 0.079468 7.57E-05 0.033562 0.007225 0.005373 0.164836 0.021697 0.000328 0.014161 0.000918 0.021287 0.023134 NIKE NIKE NIKE INTC NIKE MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 2 We find the deviation each year s return from the mean for each firm and square them, sum over the entire period and divide by sample size minus one (10-1 in this case) to find sample variance. Then take square root to find standard deviation VARIANCE FORMULA *ST. DEV (VOLATILITY) IS THE SQ ROOT OF THE VARIANCE Sum of squared deviations INTC Deviation from mean Deviation squared INTC NIKE -0.0985 0.0833 0.0322 -0.1174 -0.2814 -0.1098 0.1477 0.3161 0.2819 0.0087 -0.1832 0.085 -0.0733 -0.406 0.1473 0.0181 -0.119 -0.0303 0.1459 0.1521 Variance INTC (-0.0985)2=0.009702 St Dev INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC 0.009702 0.006939 0.287288 0.329214 0.031921 0.036579 0.178664 0.191257 0.001037 0.013783 0.079186 0.012056 0.021815 0.099919 0.079468 7.57E-05 0.033562 0.007225 0.005373 0.164836 0.021697 0.000328 0.014161 0.000918 0.021287 0.023134 NIKE NIKE NIKE INTC NIKE MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 2 We find the deviation each year s return from the mean for each firm and square them, sum over the entire period and divide by sample size minus one (10-1 in this case) to find sample variance. Then take square root to find standard deviation VARIANCE FORMULA *ST. DEV (VOLATILITY) IS THE SQ ROOT OF THE VARIANCE Sum of squared deviations INTC Deviation from mean Deviation squared INTC NIKE -0.0985 0.0833 0.0322 -0.1174 -0.2814 -0.1098 0.1477 0.3161 0.2819 0.0087 -0.1832 0.085 -0.0733 -0.406 0.1473 0.0181 -0.119 -0.0303 0.1459 0.1521 Variance INTC St Dev INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC 0.009702 0.006939 0.287288 0.329214 0.031921 0.036579 0.178664 0.191257 0.001037 0.013783 0.079186 0.012056 0.021815 0.099919 0.079468 7.57E-05 0.033562 0.007225 0.005373 0.164836 0.021697 0.000328 0.014161 0.000918 0.021287 0.023134 NIKE NIKE NIKE INTC NIKE 0.009702+0.001037+0.079186 +0.021287=0.287288 MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 2 We find the deviation each year s return from the mean for each firm and square them, sum over the entire period and divide by sample size minus one (10-1 in this case) to find sample variance. Then take square root to find standard deviation VARIANCE FORMULA *ST. DEV (VOLATILITY) IS THE SQ ROOT OF THE VARIANCE Sum of squared deviations INTC Deviation from mean Deviation squared INTC NIKE -0.0985 0.0833 0.0322 -0.1174 -0.2814 -0.1098 0.1477 0.3161 0.2819 0.0087 -0.1832 0.085 -0.0733 -0.406 0.1473 0.0181 -0.119 -0.0303 0.1459 0.1521 Variance INTC St Dev INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC 0.009702 0.006939 0.287288 0.329214 0.031921 0.036579 0.178664 0.191257 0.001037 0.013783 0.079186 0.012056 0.021815 0.099919 0.079468 7.57E-05 0.033562 0.007225 0.005373 0.164836 0.021697 0.000328 0.014161 0.000918 0.021287 0.023134 NIKE NIKE NIKE INTC NIKE 0.287288/9=0.031921 MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 2 We find the deviation each year s return from the mean for each firm and square them, sum over the entire period and divide by sample size minus one (10-1 in this case) to find sample variance. Then take square root to find standard deviation VARIANCE FORMULA *ST. DEV (VOLATILITY) IS THE SQ ROOT OF THE VARIANCE Sum of squared deviations INTC Deviation from mean Deviation squared INTC NIKE -0.0985 0.0833 0.0322 -0.1174 -0.2814 -0.1098 0.1477 0.3161 0.2819 0.0087 -0.1832 0.085 -0.0733 -0.406 0.1473 0.0181 -0.119 -0.0303 0.1459 0.1521 Variance INTC St Dev INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC 0.009702 0.006939 0.287288 0.329214 0.031921 0.036579 0.178664 0.191257 0.001037 0.013783 0.079186 0.012056 0.021815 0.099919 0.079468 7.57E-05 0.033562 0.007225 0.005373 0.164836 0.021697 0.000328 0.014161 0.000918 0.021287 0.023134 NIKE NIKE NIKE INTC NIKE 0.031921 = 0.178664 MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

QUESTION 3 This time, find the covariance estimate for the two return series. Then calculate the correlation coefficient and comment on its magnitude. Have NKE and INTC stocks tended to hedge each other s risk in this period? INTC 0.0626 0.3122 0.1933 0.1115 2012 -0.1203 0.1191 2013 0.3088 0.5450 2014 0.4430 0.2376 2015 -0.0221 0.3139 2016 0.0878 -0.1771 2017 0.3084 0.2470 2018 0.0421 0.1986 2019 0.3070 0.3810 NKE 2010 2011 U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 CO-VARIANCE FORMULA ??? ???? while the correlation coefficient r is given by: ? = where sA and sB are the standard deviations of the two stocks. Deviation from mean INTC -0.0985 0.0322 -0.2814 0.1477 0.2819 -0.1832 -0.0733 0.1473 -0.119 0.1459 Returns Covariance Correlation INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 NIKE 0.0833 -0.1174 -0.1098 0.3161 0.0087 0.085 -0.406 0.0181 -0.0303 0.1521 -0.008205 0.012300434 -0.00378 0.030898 0.046688 0.002453 -0.015572 0.02976 0.002666 0.003606 0.022191 0.0626-0.1611=-0.0985 MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 CO-VARIANCE FORMULA ??? ???? while the correlation coefficient r is given by: ? = where sA and sB are the standard deviations of the two stocks. DevINTC *DevNIK E Deviation from mean Returns INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC -0.0985 0.0322 -0.2814 0.1477 0.2819 -0.1832 -0.0733 0.1473 -0.119 0.1459 NIKE 0.0833 -0.1174 -0.1098 0.3161 0.0087 0.085 -0.406 0.0181 -0.0303 0.1521 -0.0985 * 0.0833= -0.00925 -0.008205 -0.00378 0.030898 0.046688 0.002453 -0.015572 0.02976 0.002666 0.003606 0.022191 MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 CO-VARIANCE FORMULA ??? ???? while the correlation coefficient r is given by: ? = where sA and sB are the standard deviations of the two stocks. DevINTC *DevNIK E Deviation from mean Returns Covariance Correlation INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC -0.0985 0.0322 -0.2814 0.1477 0.2819 -0.1832 -0.0733 0.1473 -0.119 0.1459 NIKE 0.0833 -0.1174 -0.1098 0.3161 0.0087 0.085 -0.406 0.0181 -0.0303 0.1521 -0.008205 0.012300434 -0.00378 0.030898 0.046688 0.002453 -0.015572 0.02976 0.002666 0.003606 0.022191 0.36 0.00825 0.00378 + + 0.022191 10 1 MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 CO-VARIANCE FORMULA ??? ???? while the correlation coefficient r is given by: ? = [Note: correlation can also be expressed as instead of r] where sA and sB are the standard deviations of the two stocks. DevINTC *DevNIK E Deviation from mean Returns Covariance Correlation INTC 0.0626 0.1933 -0.1203 0.3088 0.443 -0.0221 0.0878 0.3084 0.0421 0.307 0.1611 NIKE 0.3122 0.1115 0.1191 0.545 0.2376 0.3139 -0.1771 0.247 0.1986 0.381 0.2289 INTC -0.0985 0.0322 -0.2814 0.1477 0.2819 -0.1832 -0.0733 0.1473 -0.119 0.1459 NIKE 0.0833 -0.1174 -0.1098 0.3161 0.0087 0.085 -0.406 0.0181 -0.0303 0.1521 -0.008205 0.012300434 -0.00378 0.030898 0.046688 0.002453 -0.015572 0.02976 0.002666 0.003606 0.022191 0.36 0.012300434 0.178664 0.191257 = MEAN U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 There is, as one might expect, a mildly positive correlation between the returns of these stocks in this period. This makes sense, they are both large US firms, both are parts of the DJIA and S&P500, so those links indicate they should be positively correlated, but they are in quite different industries, so their correlation should not be that high. Their risk reduction effects against each other in a portfolio would be moderate. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

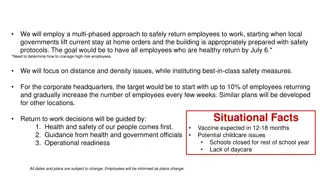

QUESTION 4 Using your answers to Q1-Q3, find the average return and standard deviation of a portfolio consisting of 20% INTC and 80% NKE. Plot this portfolio sstandard deviation and average return along with the two stocks standard deviation and average return numbers on a graph. Comment on your graph. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 A portfolio s average return is a weighted average of its components average returns Therefore, for the 80-20 portfolio, we have avg ret = 0.8*0.2289 + 0.2*0.1611=0.2153 U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 A portfolio s average return is a weighted average of its components average returns Therefore, for the 80-20 portfolio, we have avg ret = 0.8*0.2289 + 0.2*0.1611=0.2153 For the standard deviation of this portfolio, we start with the portfolio variance formula n n = i 1 = 2 cov( , ) w w r r p i j i j = 1 j In this case n=2, so the expression becomes: 2?? 2+?? 2?? 2+2?? ?? ????,? 2= ?? ?? By substituting the figures calculated thus far: 0.82*0.03658 + 0.22*0.03192 + 2 * 0.0123 * 0.8 * 0.2 = 0.02862 The standard deviation is the square root of this, which gives us sP=0.1692. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 3 0.25 Portfolio NIKE 0.2 AVERAGE RETURN 0.15 INTC 0.1 0.05 0 0.165 0.17 0.175 0.18 0.185 0.19 0.195 AVERAGE ST. DEVIATION U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

QUESTION 5 Explain the concepts of non-systematic risk and systematic risk. Give examples for each type of risk. Which one of these risks can an investor drive down to zero using diversification? Critically discuss why the other type of risk cannot be driven down to zero. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 5 Non-systematic risk comprises the types of events that pertain to an individual asset or at most an industry only. These could be both good or bad. Examples: CEO unexpectedly departing, a company product bringing in more revenues than anticipated, a significant product failure, losses due to fraud would all be examples of events that affect a specific stock s return. Key point: The return movements that these types of events lead to are uncorrelated across stocks . Systematic risk events are across the board. They affect more or less all risky stocks, to varying degrees. Examples: Sudden interest rate changes, surprises in GDP growth, inflation and energy prices, changes in investor sentiment and consumption and investment behaviours of consumers and firms would affect the universe of risky assets across the board. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 5 o Since non-systematic risks are largely unrelated across stocks, they can be driven down to insignificance in a well-diversified portfolio, without giving up average return. o Good surprises in your stocks on average cancel bad surprises in this risk category. o Systematic risk, however, affects all risky assets in varying degrees in the same direction, so one cannot drive systematic risk down without giving up average return. Investors are paid in excess returns over the risk-free rate to bear systematic risks. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

QUESTION 7 Describe how Markowitz portfolio optimization is done. State whether or not you agree with the following statement: Given the same set of expected return and variance-covariance matrix estimates, investors doing Markowitz optimization would arrive at the same efficient frontier regardless of their risk preferences . U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 7 Markowitz portfolio optimisation involves using average return and covariance estimates for a set of risky assets to determine their best combinations in portfolios. Best in this context means yielding the highest average return for a given level of standard deviation. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 7 Markowitz portfolio optimisation involves using average return and covariance estimates for a set of risky assets to determine their best combinations in portfolios. Best in this context means yielding the highest average return for a given level of standard deviation. The end result is known as the efficient frontier This is the set of all portfolios which generate the highest return for a given level of risk These portfolios dominate all other portfolios as well as any and all individual risky assets in the investment universe Given the same set of inputs, all investors, regardless of their risk preferences, would come up with the same efficient frontier. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

QUESTION 8 One of the most popular investment performance metrics is the Sharpe ratio. It is calculated as: where ? is average return of a risky asset/portfolio, ?? is the risk-free rate and ? is the portfolio s standard deviation. Calculate the Sharpe ratio for the 20-80 INTC-NKE portfolio in Q4 using a risk-free rate of 1.5% per year. Compare this ratio against INTC and NKE s Sharpe ratios for the same period and comment. U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT

ANSWER TO QUESTION 8 These are this period s Sharpe ratios for these assets NIKE SR= 0.2289 0.015 0.1912 =1.118 INTEL SR= 0.1611 0.015 0.1786 =0.8180 80/20 Portfolio SR= 0.2153 0.015 0.1692 =1.183 U20437 MACROECONOMICS - AY2018/2019 P30265 ADVANCED GLOBAL FINANCIAL MANAGEMENT