Financial Planning for Your Special Child's Future

Begin early financial planning for your special child's future to secure their care in case something happens to you. Understand the key questions, legal terms, documents, and roles of individuals involved in securing your child's financial well-being. Follow an 8-point plan to ensure your child's financial security.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

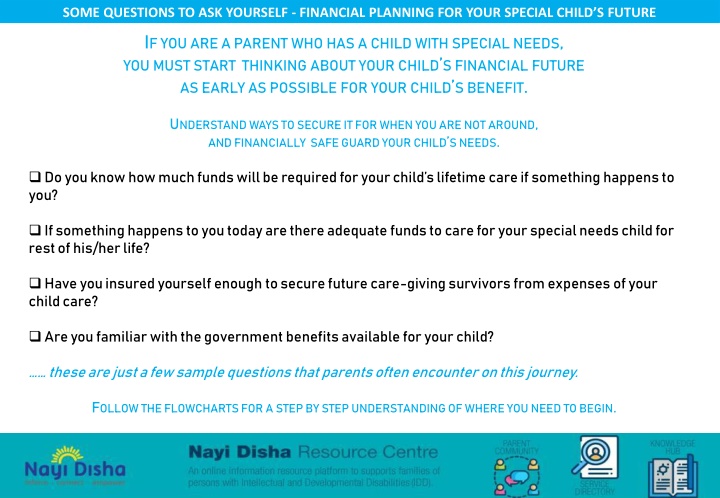

SOME QUESTIONS TO ASK YOURSELF - FINANCIAL PLANNING FOR YOUR SPECIAL CHILDS FUTURE EARLY AS POSSIBLE FOR YOUR CHILD S BENEFIT IFYOUAREAPARENTWHOHASACHILDWITHSPECIALNEEDS, YOUMUSTSTARTTHINKINGABOUTYOURCHILD SFINANCIALFUTURE ASEARLYASPOSSIBLEFORYOURCHILD SBENEFIT. UNDERSTANDWAYSTOSECUREITFORWHENYOUARENOTAROUND, ANDFINANCIALLYSAFEGUARDYOURCHILD SNEEDS. Do you know how much funds will be required for your child s lifetime care if something happens to you? If something happens to you today are there adequate funds to care for your special needs child for rest of his/her life? Have you insured yourself enough to secure future care-giving survivors from expenses of your child care? Are you familiar with the government benefits available for your child? these are just a few sample questions that parents often encounter on this journey. FOLLOWTHEFLOWCHARTSFORASTEPBYSTEPUNDERSTANDINGOFWHEREYOUNEEDTOBEGIN.

UNDERSTAND THE YOUR LEGAL TERMS & DOCUMENTS EARLY AS POSSIBLE FOR YOUR CHILD S BENEFIT A will is a legal document through which an individual expresses his/her desire on how assets are to be distributed to their near and dear after his/her demise. WILL A trust is legal agreement for management, preservation and upkeep of the child who is the benefactor of the Trust. The Trust deed defines the objective, power of trustees (people managing the trust), management, preservation and distribution of income to the child. TRUST The legal procedure to appoint a person to oversee an individual s life decisions. The appointed Guardian will look after the personal needs of the individual under their care, while overseeing any legal duties that need to be undertaken on behalf of the ward (the person being cared for by the Guardian). GUARDIANSHIP A LOI is not a legal document per se but a description about your child s life and vision. This one document passes on vital information about your child to the future caretaker(s) LETTER OF INTENT(LOI)

UNDERSTAND THE ROLES OF INDIVIDUALS IN YOUR LEGAL DOCUMENTS EARLY AS POSSIBLE FOR YOUR CHILD S BENEFIT Initiates proceedings of Will execution Can be a friend, family or an appointed professional WILL EXECUTOR/ ALTERNATE WILL EXECUTOR For special needs child this person needs to be a blood- related family member. Initiates process for the formation of the Trust SETTLOR Can be a friend, family or an appointed professional Organizes and handles financial affairs for your special child FINANCIAL CARETAKER Can be a friend, family or an appointed professional TRUSTEES MANAGE the Trust Organizes and handles personal affairs for your special child Has to be a blood related family member GUARDIAN

8 POINT PLAN TO SECURE YOUR CHILDS FINANCES EARLY AS POSSIBLE FOR YOUR CHILD S BENEFIT ASSETS LOI 1. REVIEWYOURPERSONALASSETS 2.DRAFTALETTEROFINTENT (LOI) LIABILITIES EARNINGS DEBTS PARENTSOFACHILD WITHSPECIALNEEDS 3.FINDA FINANCIAL ADVISOR Think about & pick out an individual(s) to fill the role of WILL EXECUTOR and ALTERNATE EXECUTOR SETTLOR & TRUSTEES FOR THE TRUST GUARDIAN FOR YOUR CHILD 4.ASSIGNLEGALROLESTOINDIVIDUALS INYOURCHILD SLIFE Who can be your financial advisor? FINANCIAL PLANNER ESTATE PLANNER CHARTERED ACCOUNTANT 5.WRITE AWILL LOI WILL WILL 6.SETTLORFORMSTHETRUST 7.APPLYFORGUARDIANSHIP GIVETHELOITO THEGUARDIAN 8.INFORMNEARANDDEARABOUT WILL, LOI, TRUST & GUARDIANSHIP NEARANDDEAR TRUST

SORTING FINANCES FOR YOUR SPECIAL CHILD THROUGH A WILL & A TRUST Alternate Executor will act in the absence/demise of the Will Executor Initiates proceedings of Will execution WILL EXECUTOR ALTERNATE WILL EXECUTOR PARENT WRITE THE WILL DISTRIBUTION OF ASSETS FORMS the Trust TRUST IS FORMED Optionally, inheritance can be passed on to rest of the family through the Trust (instead of Will) SETTLOR OTHER FAMILY MEMBERS & other causes MANAGE the Trust TRUSTEES Organizes and handles finances for your special child Organizes and handles personal affairs for your special child YOUR CHILD WITH SPECIAL NEEDS Trust Beneficiary GUARDIAN FINANCIAL CARETAKER

DISTRIBUTING PESONAL & FINANCIAL AFFAIRS FOR YOUR CHILDS CARE - WHAT ARE YOUR OPTIONS? EARLY AS POSSIBLE FOR YOUR CHILD S BENEFIT YOUR CHILD WITH SPECIAL NEEDS OPTION 1 OPTION 2 OPTION 3 GUARDIAN GUARDIAN FINANCIAL CARETAKER GUARDIAN TRUST Manages financial matters only Manages both personal & financial matters Manages personal matters only Manages financial matters only Manages personal matters only Note : A Guardian can be part of a Trust, but recommended to keep personal & financial care taking duties separate. FINANCIAL CARETAKER

THE WILL AND PROBATE PROCEEDINGS WHAT YOU NEED TO KNOW Is Probate proceedings mandatory all over the country? What is a Probate process in legal proceedings? How long does a Probate process take? Probate is a legal procedure wherein the executor is given legal rights for ensuring the Will is rightfully executed In general it can take a minimum of 6months & maximum can be any amount of time governed by the case. No. It is mandatory in three states in India Maharashtra, Chennai & West Bengal. In what other situations is a probate proceeding mandated by Court? If executor or legatee has to establish any legal right over the assets of the deceased. If there is no executor in the Will The deceased has multiple assets and some may falling the above mentioned states.

THE WILL AND PROBATE PROCEEDINGS WHAT YOU NEED TO KNOW Initiates proceedings of Will execution. Court invites objections from the public and legal heirs with regard to the inheritance that is stipulated in the Will Parents appoint a Will executor Files for Probate proceedings in the Court of Law WILL EXECUTOR PARENT WRITE THE WILL Probate is a situational process, and cannot be avoided or skipped. Advertise the Will Invite legal heirs of the deceased It is important to mention why the special child receives a designated amount in comparison to others, in order to make the probate process less tedious. WILL EXECUTED Also, it is good practice to register the Will to reduce chances of disputes within the family. NO OBJECTION FILLED The executor received a certificate to execute the Will OBJECTION RAISED The court proceedings address the objections before Will execution is granted.

CREATE A TRUST AS EARLY AS POSSIBLE FOR YOUR CHILDS BENEFIT Initiates proceedings of Will execution. Parents appoint a Will executor PROBATE PROCEDINGS WILL AFFECT TWO ASPECTS OF YOUR WILL Files for Probate proceedings in the Court of Law WILL EXECUTOR PARENT WRITE THE WILL Assets set aside for the Trust If parents transfer assets to the Trust in their living, then the TRUST IS NOT IMPACTED IF WILL ENTERS PROBATE PROCEEDINGS. Assets specified in the Will for rest of the family (spouse, other children etc.), charities It is advisable to form the Trust as early as possible. ONCE THE PROBATE PROCEDINGS ARE COMPLETE, THE ASSETS MAY BE LEGALLY CLAIMED BY THE CONCERNED INDIVIDUALS OR TRUST.