Financial Statement Analysis

This course covers various aspects of financial statement analysis including common size analysis, vertical analysis, horizontal analysis, trend analysis, liquidity of short-term assets, debt-paying ability, and operating cycle. Learn about current assets, cash management, marketable securities, and more to enhance your skills in analyzing financial statements effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

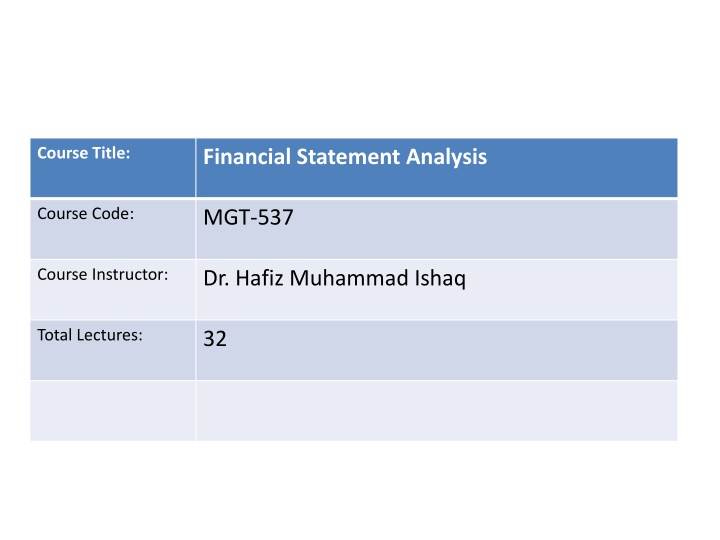

Course Title: Financial Statement Analysis Course Code: MGT-537 Course Instructor: Dr. Hafiz Muhammad Ishaq Total Lectures: 32

Previous Lecture Summary Practical Problems Related to: Common Size Analysis, Vertical Analysis, Horizontal Analysis Trend Analysis,

Today's Lecture Topics Liquidity of Short-Term Assets Related Debt Paying Ability Current Assets Current Liabilities Operating Cycle Cash, Marketable Securities, Receivable, Inventories, Prepayments, Other Current Assets,

Current Assets Current assets In the form of cash orwill be realized in cash or conserve the use of cash within the operating cycle, or one year, whichever is longer Typical examples Cash Marketable securities Receivables Inventories Prepayments

Operating Cycle The time period between the acquisition of goods and the final cash realization from sales Retail and Wholesale Manufacturing Purchase inventory Purchase material Cash sale to customer Produce finished product Sell to customer on credit Collect amount due from customer

Current Assets: Cash (contd) Compensating balance A portion of loan proceeds required to be retained on deposit Increases effective interest rate Against current liability Part of current assets; disclosure Against noncurrent liability Reported as noncurrent asset

Current Assets: Cash Unrestricted Available to pay creditors Report as current asset Restricted May report as current but disclose restrictions Eliminate cash and related current liability when measuring short-term debt-paying ability

Current Assets: Marketable Securities Any equity or debt instrument that it readily saleable and can be converted into cash, or exchanged with ease. Stocks, bonds, short-term commercial paper and certificates of deposit are all considered marketable securities because there is a public demand for them and because they can be readily converted into cash. Debt and equity securities Readily marketable Managerial intent to convert to cash within the year or the operating cycle, whichever is longer Carried at fair value Analysis: Reclassify continuing investments as noncurrent

Current Assets: Receivables Sales made but not paid-for by the customers (trade debtors). Accounts receivables are shown as current (short- term) assets in a balance sheet and are, in fact, unsecured promises by customers to pay in the future. These sums are a key factor in determining a firm's liquidity and may be discounted used in raising a short-term bank loan, or sold to a factor. A provision is usually made in the accounts of a firm to offset uncollectible accounts receivable (bad debts) as losses. Claims to future cash inflows Arise from sales to customers Trade (account) receivables Notes receivable Other current receivables

Current Assets: Receivables (cont d) Valuation Ignore cost of fund use for delayed collection Assume rate of interest is reasonable Notes that are noninterest-bearing carry an unreasonable rate, or are for an amount different from value of transaction are recorded at present value Impairment Uncollectibility Allowed discounts Allowances given Returns

Current Assets: Receivables (cont d) Impairment: Accrue (allowance method) Based on estimate of receivables realizable value Set up allowance Expense recognized on income statement Asset reduced by contra account Allowance Expense on income statement before deducted on tax return Charge-off of a specific receivable Reduces accounts receivable and allowance for doubtful accounts No impact on financial income or net assets Deductible event for income taxes

Current Assets: Receivables (cont d) Impairment: Direct write-off Alternative to accrual method when Receivables are not material or Amount for accrual cannot be reasonably estimated Charge-off of a specific receivable Recognize expense Reduce asset Bad debt expense likely to be recognized in a year subsequent to the sale Does not match expense with revenue

Current Assets: Receivables (cont d) Trade receivables Typically collected within 30 days Installment receivables May be carried as a current asset yet collection may be significantly longer than trade receivables Usually considered to be lower quality than trade receivables

Current Assets: Receivables (cont d) Customer concentration May impair the quality of receivables if a large portion of receivables is from a few customers Liquidity Number of days sales in receivables Accounts receivable turnover

Days Sales in Receivables Gross Receivables Net Sales 365 Should mirror the company s credit terms Reading reflects end-of-year status of receivables Use of the natural business year (lower sales at year-end) can understate result Compare Firm data for several years Other industry firms and industry averages

Days Sales in Receivables (cont d) Causes for overstatement Sales volume expands materially late in the year Receivables are uncollectible and should have been written off The company seasonally dates invoices A large portion of receivables are on the installment basis Causes for understatement Sales volume decreases materially late in the year A material amount of sales are on a cash basis The company has a factoring arrangement in which a material amount of the receivables is sold to an outside party

Accounts Receivable Turnover Net Sales Average Gross Receivables Indicates the liquidity of receivables Determining average gross receivables End of year and beginning of year base points for average mask seasonal fluctuations Internal analysis: use monthly or weekly amounts External analysis: use quarterly data

Accounts Receivable Turnover in Days Average Gross Receivables Net Sales 365 Similar to Number of Days Sales in Receivables except average receivables are used Should reflect firm s credit and collection policies

Practical Exercise The Hawk Company wants to determine the liquidity of its receivables. It has supplied you with the following data regarding accounts for December 31, 2003 and 2002. Net sales Receivables, less allowance for losses and discounts: Beginning or year (allowance for losses and discounts 2003 -$12,300; 2002 - $ 7180) End Of year (allowance for losses and discounts 2003-$11180, 2002-$12300) Required: Compute the number of days sales in receivables at December 31st 2003 and 2002 Compute the accounts receivable turnover for 2003 and 2002 (Use year- end gross receivables.) Comment on the liquidity of Hawk Company receivables 2003 $1,180,178 2002 $2,200,000 240,360 230,180 220,385 240,360

The Hawk Company receivables have been much less liquid in 2003 in comparison with 2002. The days' sales in receivables at the end of the year have increased from 41.92 days in 2002 to 71.62 days in 2003. The accounts receivable turnover declined in 2003 to 4.87 from a turnover of 8.98 in 2002. These figures represent a major deterioration in the liquidation of receivables. The reasons for this deterioration should be determined. Some possible reasons are a major customer not paying its bills, a general deterioration of all receivable accounts, or a change in the Hawk Company credit terms.

Practical Exercise Mr. Williams, the owner of Williams produce, wants to maintain control over accounts receivable. He understands that day s sales in receivables and accounts receivable turnover will give a good indication of how well receivables are being managed. Williams produce does 60% of its business during June July and August. Mr. Williams provided the pertinent data. Compute the day s sales in receivables for July 31, 2003 and December 31, 2003, based on the accompanying data. Compute the accounts receivable turnover for the period ended July 31, 2003, and December 31, 2003. (Use year- end gross receivables) Comment on the results from (a) and(b) Net sales Receivables, less allowance for doubtful accounts: Beginning of period (allowance January 1, $,3,000, August, 1, $4,000) End of period (allowance December 31, $3,500; July 31, $4,100) For Year Ended December 31, 2003 $800,000 For Year Ended July 31, 2003 $790,000 50,000 $89,000 55,400 90,150

This company appears to have a seasonal business because of the materially different days' sales in receivables and accounts receivable turnover when computed at the two different dates. The ratios computed will not be meaningful in an absolute sense, but they would be meaningful in a comparative sense when comparing the same dates from year to year. They would not be meaningful when comparing different dates.

Practical Exercise The following inventory and sales data for this year for G.Rabbit Company are: End of Year Net sales $ 3,150,000 Gross receivables 180,000 Inventory 480,000 Cost of goods sold 2,250,000 Required Using the above data from the G Rabbit Company, compute: a. The account receivable turnover in days b. The inventory turnover in days c. The operating cycle Beginning of Year $ 160,000 390,000

Practical Exercise The Anna Banana Company would like to estimate how long it will take to realize cash from its ending inventory. For this purpose, the following data are submitted: Account receivable, less allowance For doubtful accounts of $30,000 Ending inventory Net sales Cost of Goods Sold Required: Estimate how long it will take to realize cash from ending inventory $560,000 680,000 4,350,000 3,600,000

Lecture Summary Liquidity of Short-Term Assets; Related Debt Paying Ability Current Assets , Current Liabilities and the Operating Cycle Cash, Marketable Securities, Receivable, Inventories, Prepayments, Other Current Assets,