Financial Statements Literacy Overview

This collection of images provides an overview of financial statements literacy, including key points on the statement of net assets, the accounting equation, and example statements. Explore the primary financial statements and gain insights into understanding an organization's financial position and resources.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Financial Statements Literacy September 19, 2018

Holtzman Partners LLP Financial Audit and Review Services Employee Benefit Plan Audit Services Tax Services IT Risk & Compliance SOX Compliance and Internal Controls Advisory

Agenda Agenda Financial Statement Overview Financial Statement Analysis Financial Statement Ratios and Other Performance Measures Upcoming changes to Not-for-Profit Accounting Auditor Involvement

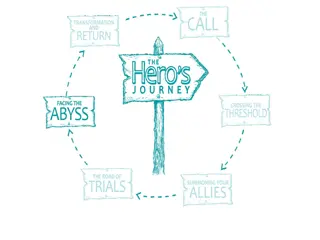

Key Roadmap to Organization Key Roadmap to Organization What are the sources of the organization s money? Where is the organization s money now? Where is the organization s money going in the future?

Primary Financial Statements Primary Financial Statements Basic financial statements: Statement of Net Assets Statement of Activities Statement of Cash Flows

The Statement of Net Assets Key Points Summary of the financial position of an organization at a particular date Not necessarily market value Only recognizes assets that can be expressed in monetary terms Focus on the quality of the assets Resources (Assets) Obligations (Liabilities)

Accounting Equation Accounting Equation Assets = Liabilities + Net Assets Resources Sources of Funding Resources used to generate revenues Creditors claims against resources Net Assets (Self-funded) + =

Example: Statement of Net Assets Classified: Current and long-term assets Current and long-term liabilities Not required for nonprofits Listed in decreasing order of liquidity Comparative: Identifies significant changes over time

The Income Statement Key Points Shows the results of an organization s operations over a period of time What goods were sold, services performed, or contributions received that provided revenue for the organization? What costs were incurred in normal operations to generate these revenues? What are the earnings or change in net assets? Revenues Cash Inflow Revenues and Support Expenses Change in Net Assets

Example: Income Statement Classified: Expenses are categorized by function Classified as Unrestricted, Temporarily, and Permanently Restricted Comparative: Identifies significant changes over time

The Statement of Cash Flows Key Points Reports the amount of cash collected and paid out by an organization for a period of time How did the organization receive cash and use it? Complementary to the statement of activities Indicates ability of an organization to generate income in the future Operating Investing Financing Change in Cash

Example: Statement of Cash Flows Operating activities Transactions that enter into the determination of change in net assets Investing activities Transactions that involve the purchase and sale of property, plant, equipment, and other assets not generally held for resale, and the making and collecting of loans Financing activities Transactions whereby resources are obtained from, or repaid to, creditors

Statement of Functional Expenses Key Points Distributes cost over functional and natural categories. Joint costs allocated among appropriate functional categories.

Notes to the Financial Statements Notes to the Financial Statements Disclosure of important information that is not shown on the face of the financial statements Additional information behind the summary totals Supplementary information required by the FASB Significant Accounting Policies Commitments Composition of Temporarily & Permanently Restricted Assets In-Kind Support Allocation of Joint Costs Related Parties

Financial Statement Preparation Financial Statement Preparation Organizations require periodic, timely reporting U.S. GAAP most common method of accounting Financial Accounting Standards Board (FASB) continually monitors and updates GAAP GAAP = Generally Accepted Accounting Principles

Be Aware! Be Aware! Different accounting methods often produce radically different results U.S. GAAP vs. IFRS Accrual Basis vs. Cash Basis Governmental Accounting Standards IFRS = International Financial Reporting Standards

Accrual vs. Cash Accounting Accrual Accounting Revenues and expenses are recorded as they are earned and incurred. Advantage: matches revenues and related costs Disadvantage: more complicated and judgmental Provides a more accurate picture of an organization s surplus (deficit) Financial statement users can make more informed judgments concerning the organization s health Cash Accounting Revenues and expenses are recorded when cash is received or paid. Disadvantage: does not accurately reflect economic condition of the organization Advantage: easy to use, like a personal checkbook Surplus (deficit) is difficult to measure

Financial Statement Ratios and Other Performance Measures

Building Blocks of Analysis Ability to meet short-term obligations and to efficiently generate revenues Ability to generate future revenues and meet long- term obligations Solvency Liquidity Ability to generate a profit that can be used to finance program services Ability to use resources efficiently to provide program services Profitability Efficiency

Current Ratio Current Ratio Working Capital Ratio Solvency Liquidity Current assets Current liabilities = Profitability Efficiency Measure of Liquidity

Months Cash on Hand Months Cash on Hand Cash and Cash Equivalents Monthly Expenses Liquidity Solvency = Profitability Efficiency Measure of Liquidity

Leverage Leverage Solvency Liquidity Total Liabilities Total Assets = Profitability Efficiency Measure of Solvency

Efficiency Ratio Efficiency Ratio Solvency Liquidity Program Expenses Total Expenses = Efficiency Profitability Measure of Efficiency

Fundraising Efficiency Ratio Fundraising Efficiency Ratio Fundraising Expenses Contributions + Special Events Revenue Solvency Liquidity = Efficiency Profitability Measure of Efficiency

Profitability Profitability Return on Investments Investment Income Average Investments Solvency Liquidity and Efficiency Gross Margin (Sales of Merchandise Cost of Goods Sold) Sales of Merchandise Profitability Margin on Rental Activities (Rental Revenue Rental Expenses) Rental Revenue Efficiency Measure of Profitability

Other Financial Performance Measures Trend Analysis At least 3 years financial data Annual growth rates Program expenses Support services Total revenues Cash Compensation costs Budget to Actual Operating plan Allocates resources to ensure program goals are met Identifies financial challenges that could arise Provides indicators for gauging staff performance and gives staff goals Not formally disclosed Board approves annually

Upcoming Changes to Not-for-Profit Accounting

Not Not- -for for- -Profit Accounting Changes Profit Accounting Changes ASU 2016-14, Presentation of Financial Statements of Not-for-Profit Entities Issued August 2016 First overhaul of NFP financial presentation since early 90s (SFAS 115/116) Applies to all NFPs including business-oriented health care entities Effective: Annual financial statements issued for fiscal years beginning after December 15, 2017 (early adoption permitted) Efficiency

Not-for-Profit Accounting Changes Net asset classes reduced from three to two New liquidity and availability disclosures required All NFPs must report expenses by nature and function in one place, and describe methods used to allocate among functional categories Use of direct method in SOCF eliminates reconciliation of change in net assets to cash flows from (used for) operating activities Efficiency

Two Net Asset Classes Two Net Asset Classes Temporarily Restricted Permanently Restricted Current Presentation Unrestricted New Without Donor * Restrictions With Donor * Restrictions** Presentation *Donors include other types of contributors, including makers of certain grants **Within Net Assets with Donor Restrictions, Funds of Perpetual Duration replaces the superseded Permanently Restricted

Operating Cash Flows Operating Cash Flows Direct vs. Indirect Method Direct vs. Indirect Method Cash flows from operating activities: Cash received from contributors Cash received from service recipients Interest and dividends received Miscellaneous receipts Cash paid to employees Cash paid to suppliers Interest paid Grants paid Net cash used by operating activities Direct Method 10,645 5,020 8,570 150 (13,400) (5,658) (5,175) Cash flows from operating activities: Change in net assets Adjustments to reconcile change in net assets to net cash Depreciation Net gains on investments Net gain on sale of equipment Net change in operating assets and liabilities Contributions receivable Accounts receivable Prepaid expenses and other assets Accounts payable and accrued expenses Grants payable Contributions restricted for long-term investments Net cash used by operating activities 15,450 3,200 (15,800) (382) (90) (230) (325) (460) 390 870 (425) (3,040) (230) Indirect Method

Levels of Assurance Levels of Assurance Provide an opinion on whether the financial statements are presented fairly, in all material respects, with the applicable framework Audit Obtain limited assurance as a basis for reporting whether the accountant is aware of any material modifications that should be made Review No verification of the accuracy or completeness of the information provided by management basic presentation of financial statements Compilation

Audit Communications Audit Communications Management Representation Letter Audited Financial Statements Required Communications Report on Internal Control Communication to Those Charged with Governance

Common Landmines Common Landmines Financial statements can provide a wealth of information about an organization, but understand the context of what you are reviewing: What is the basis of accounting? What levels of assurance can be placed on the information? What assurance does an audit not provide?

Contact information: jillian.bergman@holtzmanpartners.com (512) 610-7216