Financial Strategies for Efficient Equity Buyback and Reserves Management

Learn about the intricate details of equity buyback strategies, reserve management, and journal entries in the books of a company. Explore how to convert partly paid-up equity shares, handle security premium, transfer equity share capital, and execute bonus transactions effectively. Understand the distinctions between free reserves and non-free reserves, along with their respective purposes and examples. Enhance your knowledge of creating controlled revenue reserves, bonus transfers, and proper financial journal entries for various company transactions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

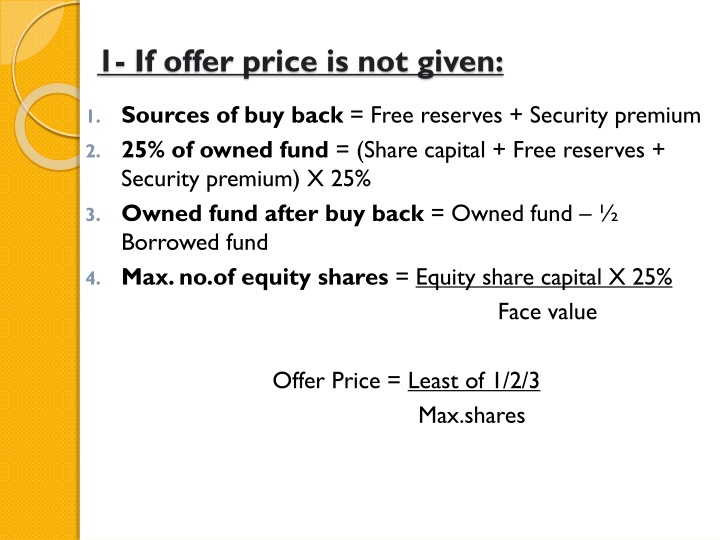

1- If offer price is not given: 1. Sources of buy back = Free reserves + Security premium 2. 25% of owned fund = (Share capital + Free reserves + Security premium) X 25% 3. Owned fund after buy back = Owned fund Borrowed fund 4. Max. no.of equity shares = Equity share capital X 25% Face value Offer Price = Least of 1/2/3 Max.shares

2- If offer price is given: 1. Sources of buy back = Free reserves + Security premium 2. 25% of owned fund = (Share capital + Free reserves + Security premium) X 25% 3. Owned fund after buy back = Owned fund Borrowed fund 4. Max. no.of equity shares = Equity share capital X 25% Face value = Max shares X Offer price Maximum Shares = Least of 1/2/3/4 Offer Price

Free Reserves Non Free Reserves Meaning Free reserves are those reserve which can be utilised for any purpose. It is also called as divisible profit. Non free reserves are created for specific purpose. It is also called as non- divisible profit. Purpose To declare dividend, bonus, remove losses. To write off specific losses Examples P&L,General Reserve, Revenue Reserve, Reserve Fund, Dividend Equalisation Reserve, **Investment Allowance Reserve(Unutilised). Capital Reserve, CRR, Security Premium, DRR, Statutory Reserve, Forfeited Shares A/c.

Journal Entries in the books of Co. (Buy Back) S-F-T-W-C-P-B-E To Convert Partly Paid-up Equity Shares into Fully Piad-up Equity Share Final Call A/c Dr No.of Shares X Unpaid Amt To Equity Share Capital A/c No.of Shares X Unpaid Amt Bank A/c Dr (Same Amt) To Equity Share Final Call A/c (Same Amt) Sale of Investment Bank A/c ...Dr XXX P&L A/c (Loss) .Dr X To P&L A/c (Profit) X To Investment A/c XXX Fresh Issue of Preference Shares Bank A/c .Dr. XXX To Security Premium A/c (Issued @ Premium) X To Pref. Share Capital A/c XXX

Transfer of ESC, Premium on B.B to ESH Equity Share Capital A/c ..Dr XXX Premium on B.B A/c .. ..Dr X To Equity Share Holder A/c XXX Writing Off Premium on B.B (S.P to P) Security Premium A/c .Dr XXX To Premium on B.B A/c XXX Creation of CRR (CRR= ESC PSC) Free Reserves A/c Dr XXX Security Premium A/c ...Dr X To CRR A/c XXX Payment to ESH ESH A/c .Dr XXX To Bank A/c XXX

Bonus to ESH CRR A/c Dr XXX Other Res. A/c ..Dr XX To Bonus to ESH A/c XXX Bonus Trnsfr to ESC Bonus to ESH A/c Dr XXX To ESC A/c XXX