Financial Training Concepts

Explore financial training concepts including operating cycle steps, managerial approach, financial approach, sources of cash, return on investment, return rate, risk assessment, interest calculation, and compound interest. Gain insights into essential financial principles for effective decision-making and capital management.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

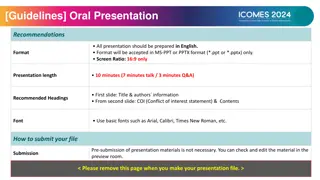

Presentation Transcript

M5 - TRAINING Operating Cycle Steps: Plan, Implement, Feedback, New Plan, Managerial Approach: how business works and relationships between business variables Financial Approach: time value of money (capitalism) Expect more back than invested Used for capital budgeting (asset acquisition/planning)

M5 - TRAINING Sources of Cash Debt should match acquisition Borrow Issue Stock Own Investment Bonds

M5 - TRAINING Return Invest $1000 and it becomes $1150 $1000 Return OF $150 Return ON 1. Return on Investment Common Year Measure $50 in one year or $60 in two 50< 60, but one year time frame 50>30 2. Return on Investment Common Size Measure Rate of Return requires known investment amount Is $1000 better or $10,000 better

M5 - TRAINING Return Rate of = Return $Amt of Return ON Investment $Amt of Investment 1000 = 10% 10000 10000 = 1% 1000000 Negative Rate of Return is possible 980-1000 = 20 = -2% 1000 1000

M5 - TRAINING Risk Risk Adjusted = Risk Free + Inflation + Business Risk + Liquidity Risk Rate of Return When Free of Risk External No Control Control Through Behavior Ability to Sell Assets or Raise Capital Quick Risk is determined, NOT divine Risk Takers Vs. Risk Averse matters to accounting based decision making

M5 - TRAINING Interest Principal * Rate * Time Simple Interest Loans Interest equal each year, unless $ added to principal Bottom pg. 1 of 7 example Compound Interest Loans = Time Value of Money Interest earned is added to principal in each period Top pg. 2 of 7 example (see next slide)

M5 - TRAINING Compound Interest Interest added at specified points in time: annual Interest earned becomes part of principal 2008 2009 2010 $10,000 * 10% * 1 ($10,000+$1000) * 10% * 1 ($11,000+$1100) * 10% * 1 Total Interest Return of Principal Total Value = $1000 = $1100 = $1210 $3310 $10,000 $13,310 Interest earned/incurred becomes part of the principal. Where did the extra $310 come from? Total Compoundings = 1 per year * 3 years = 3

M5 - TRAINING Compound Interest Amount of Total Interest Increases with # Compoundings (see additional examples pg. 2 of 7) Semi Annual 2 times per year 2 per year * 3 years = 6 compoundings $3400.95 Monthly 12 times per year 12 per year * 3 years = 36 compoundings >3400.95

M5 - TRAINING Compound Interest Future Value Factor = (1 + r/c)^n r = annual rate c = number compoundings per year n = total compoundings Example: Semi Annual, 10%, $10000 investment r = .10 c = 2 n = (3 * 2) = 6 Factor = (1+.1/2)^6 = 1.340095 (see pg. 326) Factor * Investment = Total Value 1.340095 * 10000 = 13,400.95

M5 - TRAINING Compound Interest Example: Monthly, 10%, 10,000 Investment, Future Value Factor = (1 + r/c)^n r = annual rate c = number compoundings per year n = total compoundings

M5 - TRAINING Compound Interest Example: Monthly, 10%, 10,000 Investment Future Value Factor = (1 + r/c)^n r = annual rate = .1 c = number compoundings per year n = total compoundings

M5 - TRAINING Compound Interest Example: Monthly, 10%, 10,000 Investment Future Value Factor = (1 + r/c)^n r = annual rate = .1 c = number compoundings per year = 12 n = total compoundings

M5 - TRAINING Compound Interest Example: Monthly, 10%, 10,000 Investment Future Value Factor = (1 + r/c)^n r = annual rate = .1 c = number compoundings per year = 12 n = total compoundings = 12 * 3 = 36

M5 - TRAINING Compound Interest Example: Monthly, 10%, 10,000 Investment Future Value Factor = (1 + r/c)^n r = annual rate = .1 c = number compoundings per year = 12 n = total compoundings FVF = (1 + .1/12)^36 = 1.34818 Factor * Investment = 1.34818 * 10000 = $13,481.82 Number of compoundings increased interest

M5 - TRAINING Time Value of Money Lump Sum Calculators Get your calculators ready, using 10bii Shift, DISP, # (number value for decimal) Shift, C ALL (clear values between problems) N xP/YR I/YR NOM% PV EFF% PMT P/YR FV AMORT

M5 - TRAINING Time Value of Money Lump Sum Calculators Future Value of $1: use monthly example PV = -10000 FV = unknown r = 10 on calculator I/Y c = 12 on calculator p/yr n = 36 FV = $13,481.82 Example: Try semi annual example, 10%, $10,000 Let me introduce you to the power of this tool.

M5 - TRAINING Time Value of Money Lump Sum Calculators Future Value of $1: semi annual, 10%, $10,000 PV = -10000 FV = unknown r = 10 on calculator I/Y c = 12 2 on calculator p/yr n = 36 6 FV = $13,481.82 $13,400.96

M5 - TRAINING Time Value of Money Lump Sum Calculators Present Value of $1: $10,000, 5 years from now, 8%, quarterly PV = FV = r = on calculator I/Y c = on calculator p/yr n = PV = Example: Try semi annual example, 10%, $10,000

M5 - TRAINING Time Value of Money Lump Sum Calculators Present Value of $1: $10,000, 5 years from now, 8%, quarterly PV = unknown FV = 10000 r = 8 on calculator I/Y c = 4 on calculator p/yr n = 4 * 5 = 20 FV = -$6,729.71 Example: Try semi annual example, 8%, $10,000, 5 yr

M5 - TRAINING Time Value of Money Annuity Equal payments, Equal time, same interest rate Example: 3 annual pmts, $5000 each, 10% FV? Would you accept $15,000 in 3 years? ___________________________________________ Pmt $5000 $5000 Pmt Pmt $5000 Instead of one lump sum in the PV and one lump sum in the FV, now we are going to add to the principal over the life of the investment.

M5 - TRAINING Time Value of Money Annuity Example: 3 annual pmts, $5000 each, 10% (interest compounded on payment date) FV? ___________________________________________ Pmt $5000 $5000 Pmt Pmt $5000 Date 1/1/08 1/1/09 1/1/10 Pmt $50000 $5000500 10,500 $5000 1050 16,550 Interest Future Value 5000 Money not used yet Charge for use of money

M5 - TRAINING Time Value of Money FV Annuity Calculator Example: 3 annual pmts, $5000 each, 10% FV? ___________________________________________ Pmt $5000 $5000 Pmt Pmt $5000 Pmt = annuity c = number of pmts per year (compoundings) r = annual rate n = total payment (compoundings) FVA = unknown (more than $15000?)

M5 - TRAINING Time Value of Money FV Annuity Calculator Example: 3 annual pmts, $5000 each, 10% FV? ___________________________________________ Pmt $5000 $5000 Pmt Pmt $5000 Pmt = -5000 c = 1 r = 10 n = 3 FVA = $16,550 on calculator P/YR on calculator I/YR

M5 - TRAINING Time Value of Money FV Annuity Calculator Example: need $31,772.48 after 15 annual payments at 10% FV = $31,772.48 ___________________________________________ Pmt $5000 $5000 Pmt Pmt $5000 Pmt = annuity c = number of pmts per year (compoundings) r = annual rate n = total payments (compoundings) FVA = known

M5 - TRAINING Time Value of Money FV Annuity Calculator Example: need $31,772.48 after 15 annual payments at 10% FV = $31,772.48 ___________________________________________ Pmt ? ? Pmt Pmt ? Pmt = ? c = 1 r = 10 n = 15 FVA = 31,772.48 on calculator P/YR on calculator I/YR

M5 - TRAINING Time Value of Money FV Annuity Calculator Example: need $31,772.48 after 15 annual payments at 10% Pmt = -$1000 c = 1 r = 10 n = 15 FVA = 31,772.48

M5 - TRAINING Time Value of Money PV Annuity Example: 3 annual pmts, $5000 each, 10% PV? __________________________________________________ P P $5000 $5000 $5000 P Pmt = c = r = n = PVA =

M5 - TRAINING Time Value of Money PV Annuity Example: 3 annual pmts, $5000 each, 10% PV? __________________________________________________ P P $5000 $5000 $5000 P Pmt = -5000 c = 1 r = 10 n = 3 PVA = 12,434.26

M5 - TRAINING Time Value of Money PV Annuity Example: 3 annual pmts, $5000 each, 10% PV? __________________________________________________ P P $5000 $5000 $5000 P PROOF: Total pmt PVA = Total Interest Date 1/1/08 1/1/09 1/1/09 1/1/10 Pmt $5000 $5000 $5000 Interest Principal 1243.43 3756.57 867.77 4132.23 454.56 4545.64 Present Value $12,434.26 8677.26 4545.64 0

M5 - TRAINING Time Value of Money Which One? Are there Payments? Yes PVA or FVA (pmt vs. lump sum) Payments toward a lump sum = FVA Payments from a lump sum = PVA No PV or FV (lump sum vs. lump sum) Unknown future lump sum = FV Unknown current lump sum = PV

M5 - TRAINING Time Value of Money Example Machine costs $100,000 Will produce equivalent to $30,000 per year Useful life of 5 years (no salvage) 10% return required Should we buy it?

M5 - TRAINING Time Value of Money Example Machine costs $100,000 Will produce equivalent to $30,000 per year Useful life of 5 years (no salvage) 10% return required Should we buy it? Pmts? Yes or No Unknown PV or FV?

M5 - TRAINING Time Value of Money Example Machine costs $100,000 Will produce equivalent to $30,000 per year Useful life of 5 years (no salvage) 10% return required Pmt = c = r = n = PVA =

M5 - TRAINING Time Value of Money Example Machine costs $100,000 Will produce equivalent to $30,000 per year Useful life of 5 years (no salvage) 10% return required Pmt = 30000 c = 1 r = 10 n = 5 PVA = -113,723.60 PVA Cost = Purchase Decision 113,723.60 100,000 = YES? This is only the first step

M5 - TRAINING Time Value of Money Example Need money to buy a tractor. Can make $8000 annual interest payments for 3 years, at which time you can afford to make a lump sum payment of $100,000. You will agree to 7% interest. How much will the bank loan you today?

M5 - TRAINING Time Value of Money Example Need money to buy a tractor. Can make $8000 annual interest payments for 3 years, at which time you can afford to make a lump sum payment of $100,000. You will agree to 7% interest. Pmt = c = r = n = PVA = FV =

M5 - TRAINING Time Value of Money Example Need money to buy a tractor. Can make $8000 annual interest payments for 3 years, at which time you can afford to make a lump sum payment of $100,000. You will agree to 7% interest. Pmt = -8000 c = 1 r = 7 n = 3 PVA = ? FV = -100000

M5 - TRAINING Time Value of Money Example Need money to buy a tractor. Can make $8000 annual interest payments for 3 years, at which time you can afford to make a lump sum payment of $100,000. You will agree to 7% interest. Pmt = -8000 c = 1 r = 7 n = 3 PVA = 102,624.32 FV = -100000

M5 - TRAINING Time Value of Money Example Need money to buy a tractor. Can make $8000 annual interest payments for 3 years, at which time you can afford to make a lump sum payment of $100,000. You will agree to 7% interest. What if we change the rate to 8% What if we change the rate to 9%

M5 - TRAINING Time Value of Money Example Need money to buy a tractor. Can make $8000 annual interest payments for 3 years, at which time you can afford to make a lump sum payment of $100,000. You will agree to 7% interest. What if we change the rate to 8% $100,000 What if we change the rate to 9% $97,468.71

M5 - TRAINING Time Value of Money Example AGE? ________________________________________________________ FVA Retirement PVA Pmt = c = r = n = FVA = Pmt = c = r = n = PVA =