Finding Scalable Capital Finance Solutions for Educational Institutions

Explore the journey of Facilities Finance in educational institutions like High Tech High and Rocketship Education, detailing their financing strategies and outstanding debts. Learn about shifting market expectations and the implementation of innovative financing solutions for long-term sustainability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

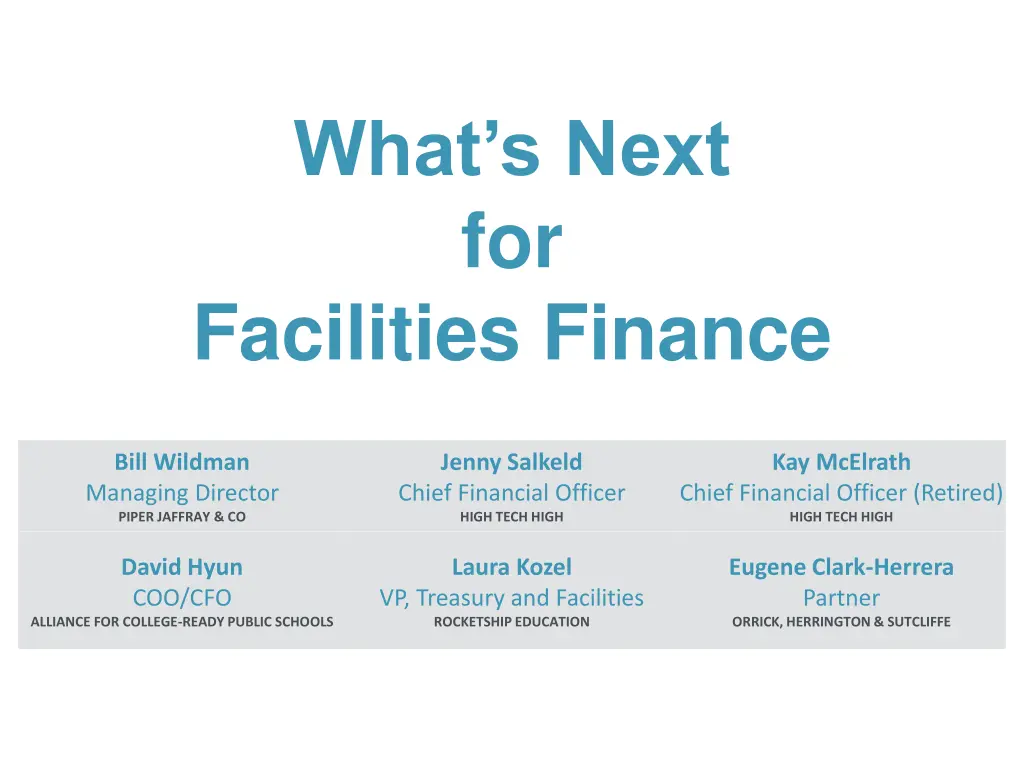

Whats Next for Facilities Finance Bill Wildman Managing Director PIPER JAFFRAY & CO Jenny Salkeld Chief Financial Officer HIGH TECH HIGH Kay McElrath Chief Financial Officer (Retired) HIGH TECH HIGH David Hyun COO/CFO Laura Kozel Eugene Clark-Herrera Partner ORRICK, HERRINGTON & SUTCLIFFE VP, Treasury and Facilities ROCKETSHIP EDUCATION ALLIANCE FOR COLLEGE-READY PUBLIC SCHOOLS

Alliance for College-Ready Public School and School Affiliates Financings Summary of Outstanding Public Debt Original Principal Outstanding Principal Issue Average Coupon Yield at Issuance Obligated Group Public Debt PCSD 2016 Series 2016C&D Series 2016A&B Series 2015A&B Subtotal Non-Obligated Group Public Debt Series 2013A&B Series 2012A Series 2011A Subtotal TOTAL Non-Public Financings, As of July 1, 2017 $1,450,000 58,330,000 19,100,000 55,260,000 $134,140,000 $1,450,000 58,330,000 19,375,000 54,750,000 $133,905,000 0.000% 5.099% 4.967% 4.840% 0.000% 5.094% 3.010% 4.008% $15,690,000 8,455,000 22,565,000 $46,710,000 $180,850,000 $14,855,000 8,260,000 21,300,000 $44,415,000 $178,320,000 6.290% 6.336% 6.961% 6.229% 6.297% 7.103% Original Principal $13,701,197 Outstanding Coupon Range 2.000% 3.800% 3.553% 5.153% 5.153% 5.184% Issue Facilities Grant Various Loans payable to LIIF sub-CDE, LISC Sub-CDE and Genesis Sub-CDE California Statewide Communities Development Promissory Notes (A-2, B-2, & C-2) Promissory Notes to NCB Capital Impact Promissory Notes to NCB Capital Impact Promissory Notes to NCB Capital Impact Various Loans payable to GLA Sub-CDE XI, LLC, New markets Investment 65 Subordinated Loan payable to Charter School Financing Partnership Subordinated Prommisory Note to Loan Initiatives Support Corporation Senior Loan with JP Morgan Chase Bank ExEd Facilities XII LLC Promissory Notes Promissory Notes to Housing Authority of the City of Los Angeles, California Various Loans payable to LIIF sub-CDE, LISC Sub-CDE and Genesis Sub-CDE Total 5,520,000 8,041,387 5,774,817 5,322,685 15,012,675 7.000% - 9.000% 0.000% 5.000% 5.000% 5.000% 5.250% 5.150% 3,000,000 3,200,000 3,242,268 3,000,000 15,012,675 $80,827,704

Finding Scalable Capital Finance Solutions The tax-exempt bond market was believed to be the right long-term solution for Rocketship; but required 3+ years to shift market expectations to achieve more favorable pricing and structure. 2008 2011 CDFI / NMTC / Bank Loans 2011 2013 Educate / Cultivate Partnerships 2012 2013 Build Track Record and prepare for Scale (Stand Alone Bond Offerings) 2014 2017 OG Implemented for Pre-Construction Bonds, Refinancing NMTC, and Developer Take-Outs currently 11 schools of 16 are in the OG. Shift Market Expectations with OG