Foreign Exchange Dealings and Ready Exchange Rates

The foreign exchange dealings between a bank and its customer, known as Merchant business, involve ready transactions executed on the same day at the merchant rate. This includes discussions on ready exchange rates for trade and non-trade transactions, such as TT buying rates and bill buying rates. These rates play a crucial role in the purchase and sale of foreign currencies by banks. Understanding how these rates are calculated is essential for those involved in international trade and finance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

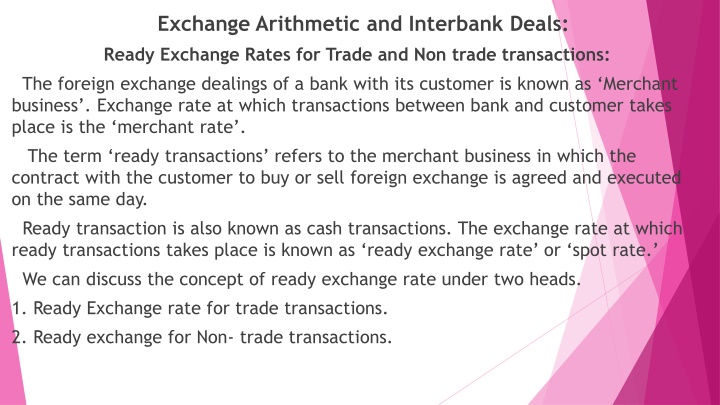

Exchange Arithmetic and Interbank Deals: Ready Exchange Rates for Trade and Non trade transactions: The foreign exchange dealings of a bank with its customer is known as Merchant business . Exchange rate at which transactions between bank and customer takes place is the merchant rate . The term ready transactions refers to the merchant business in which the contract with the customer to buy or sell foreign exchange is agreed and executed on the same day. Ready transaction is also known as cash transactions. The exchange rate at which ready transactions takes place is known as ready exchange rate or spot rate. We can discuss the concept of ready exchange rate under two heads. 1. Ready Exchange rate for trade transactions. 2. Ready exchange for Non- trade transactions.

Ready exchange rate for trade transactions. Like a trader, the bank purchases and sells the foreign currency and make profit. Types of Buying rates: For the buying and selling of foreign currencies, there are different rates. The price in terms of the home currency at which a banker is willing to buy a foreign currency is the buying rate. On the basis of the time of realization of foreign exchange by the bank, two types of buying rates are quoted. They are. 1. TT buying Rates. 2. Bill Buying Rate. 1. TT buying rates: A TT (Telegraphic transfer) Buying rate is the rate at which the bank is willing to buy the foreign currency from the customer for their TT transactions.

In other words TT buying rates is the rate applied when the transaction does not involve any delay in realisation of the foreign exchange by the bank. This rate is calculated by deducting from the inter bank buying rate the exchange margin as determined by the bank. TT rate is applicable to the following transactions. 1. Payment of DDs, MTs, TTs etc drawn on the bank where bank s Nostro account is already credited. 2. When foreign bills are collected. 3. When there is cancellation of foreign exchange sold earlier. The methods of calculating. TT buying rate is shown in format below. It is assumed that the foreign exchange to be purchased is US dollars.

Bill buying rate: Bill buying rate is the rate applicable to payment of import bills. This is the rate applied when foreign bill is purchased. When a bills purchased, the rupee equivalent of the bill value is paid to exporter immediately. The proceeds will be realized by the bank after the bill is presented to the drawee at the overseas centre In the case of a usance bill, the proceeds will be realized on the due date of the bill which includes the transit period and the usance period of the bill. For example: if the bill is purchased is 45 days usance bill. In this case bill is realized only after 70 days. [25 days (transit period)+45 days (Usance periods)] Two points to be considered while loading the bills buying rate. They are. 1. Forward margin is available for periods of calendar mong not for 25 days. 2. Forward margin may be at a premium or discount. Premium is to be added to the spot rate and discount should be deducted from it. The following format shows the method of calculating bill buying rate, assuming US dollar to be the foreign currency.

Selling Rate: Depending upon work involved, there are two types of selling rates. They are. 1. TT selling rates. 2. Bill selling rates. 1. TT selling rate: This rate is used for all transactions which do not involve handling of document by the bank. TT selling rate is quoted for the following transactions. a. Issue of DDs, MTS, TTS etc. b. Cancellation of foreign exchange purchased earlier. The TT selling rate is calculated on the basis of the inter-bank selling rate. The rate to the customer is calculated by adding exchange margin to the inter bank rate.

2. Bills selling rate: Bills selling rate is applied to all transactions which involve handling of documents by the bank like payment against import bills. This rate is calculated by adding exchange margin to the selling rate. That means, the exchange margin is included into the bills selling rate twice, once on the inter bank rate and again on the TT selling rate. the following format explains the calculation of TT and bills selling rate, with US dollar representing the foreign currency.

Cross rates: A cross rate is a rate of exchange derived from the quotations of any two currencies in terms of a third, or of more than two currencies in terms of another. Cross rate is the price of any currency other than home currency. Thus, the rate of exchange between the rupee and the Canadian dollar will be found through the common currency, the US dollar. The technique is similar for both spot and forward cross rates. Ready Rates for Non-Trading Transactions: 1. Purchase and sale of foreign currency traveller cheques. 2. Purchase and sale of foreign currency notes and coins. 3. Encashment of MTs and DDs where reimbursement has not been obtained and encashment of personal cheques

Forward exchange contracts: Forward exchange contract is a device which can afford adequate protection to an importer or an exporter against exchange risk. Under a forward exchange contract a banker and a customer or another banker enter into a contract to buy or sell a fixed amount of foreign currency on a specific future date at a predetermined rate of exchange. Forward exchange contract is a contract where a specified amount of one currency is exchanged for a specific amount of another currency at a future value date. No cash pass hands at the time of making the contract, seller agrees to deliver, and buyer agrees to take up against payment in a stated currency specified on the date or during the period indicated at the rate of exchange fixed in the contract. Need of forward Exchange contract: 1. Forward contract in foreign exchange are made to cover or eliminate exchange risk. 2. It also renders debtor and creditors free from the risk due to fluctuation in the exchange rate.

3. The speculate find the forward contract useful to cover exchange risk in converting the investment on maturity into home or any other currency. Features of forward contract: 1. Parties: A forward contract may be made between a banker and his customer or between bankers. A contract between a banker and his customer is usually entered into directly. While a contract between bankers may be made either directly between themselves or through an exchange broker. 2. Dates of delivery: According to rule 7 of FEDAI, a forward contract is deliverable at a future date, duration of the contract being computed from the spot value date of the transaction. Thus if a 3 month forward contract is booked on the 12th February, the period of two months should commence from 14th February and the forward contract will fall due on 14th April.

3. Fixed Forward contract: The forward contract under which the delivery of foreign exchange shouldtake place on a specified future date is known as fixed forward contract. 4. Option Forward contract: An arrangement whereby the customer can sell or buy from the bank foreign exchange on any day during a given period of time at a predetermined rate of exchange is known as option forward contract. According to rule of 7 FEDAI, the option period of delivery should not exceed one month. Uses of forward exchange contract: 1. These contract are used to hedge a future import payment or export receipt. 2. Companies can selectively use these constructs for speculation. 3. A bank may use a forward exchange contract as a service to a customer. 4. A money market trader may use these contracts to arbitrage between instruments denominated in one currency and similar instrument denominated in another currency.

Inter Bank Deals: Inter bank deals refer to the operations of the purchase and sale of foreign exchange between the banks. It consists of foreign exchange dealings of a bank in the interbank market. Foreign exchange trading of international banks has become a major source of income for them. The inter bank payment system is paper based, using bankers cheques. Electronic inter bank transfer system in New York is through the Clearing House Bank Payment System(CHIPS) and in London through the Clearing House Automated Payment System (CHAPS). The net amount payable or receivable is conveyed through a society for World Wide Inter Bank Financial Telecommunication (SWIFT). This method is being used in India as well. SWIFT is for communicating message as between the trading banks. A study of inter bank deals consists of the following 1. Cover deals. 2. Swap deals. 3. Arbitrage operations.

Cover Deals: Purchase and sale of foreign currency in the market undertaken to acquire or dispose of foreign required or acquired as a consequence of its dealing with its customer is known as the cover deal . The purpose of cover deal is to insure the bank against any fluctuations in the exchange rates. While quoting a rate to the customer, the bank considers the inter bank rate. To this inter bank rate , the bank adds or deduct its margin and arrives at the rate it quotes to the customer. For example, if it is buying dollar from the customer spot, it takes inter bank buying rate, deducts its exchange margin and quotes the rate. Here the bank assume that immediately on purchase from the customer the bank would sell the foreign exchange to inter bank market buying rate. Swap deals: A swap deal is a transaction in which the bank buys and sells the specified foreign currency simultaneously for different maturities. Thus swap deals may involve.

1. Simultaneous purchase spot and sale of forward or vice versa. 2. Simultaneous purchase and sale both forward but for different maturities. Need for swap deals: 1. To cover the exchange risk for the bank in foreign exchange market. 2. Swap can be carried out to adjust cash position in a currency. 3. Swap is needed when there early delivery or extension of forward contracts. Arbitrage Operations: Arbitrary is an act of simultaneously purchase and sale of different currencies in two or more exchange market with the intention of making profits from the differences between the exchange rate prevailing at the same time in different market. Arbitrage transaction form an integral part of trading in foreign currencies by dealers. These involve purchase of a currency in one market for immediate resale in another. These transaction are not themselves speculate. They are done in order to take advantage of discrepancies that may exist in the structure of exchange rates at a given time. Institutions engaging themselves in arbitrage operations make the price on a given type of exchange in one market more or less equivalent to that on the same type of exchange in another market.

There are two types of arbitrage operations in banks namely. 1. Direct arbitrage. It is also called as simple arbitrage. When the arbitrage operation onvolves only two currencies, it is known as direct arbitrage. 2. Compound arbitrage. When the arbitrage operation involves more than two currencies, it is known as compound arbitrage. ****************************