Foreign Investment in India: Forms and Benefits

Foreign investment plays a crucial role in economic growth, with various forms such as Foreign Direct Investment, Portfolio Investment, Depository Receipts, and Debt Capital. By attracting foreign capital, developing countries like India can increase investment rates, while developed countries leverage it for sustainable development. Foreign Direct Investment involves a foreign entity investing in a business in another country, while Portfolio Investment sees funds entering through stock and bond markets. Depository Receipts and Debt Capital also contribute to capital accumulation. Overall, foreign investment facilitates economic progress and global business expansion.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

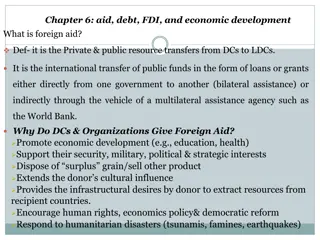

Foreign Investment in India Foreign capital is needed for a developing country to increase the rate of investment and for capital accumulation for further economic growth. For developed country it is needed to support sustainable development.

Forms of foreign capital 1. Foreign Direct Investment 2. Foreign Portfolio Investment 3. Depository Receipts 4. Debt Capital

Foreign Direct Investment It is the investment made by foreign individual or a firm in one country into business located in another country. Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets, including establishing ownership or controlling interest in a foreign company.

Foreign Portfolio Investment It is the entry of funds into a country where foreigners deposit money in a country s bank or make purchases in the country s stock and bond markets.

Depository Receipts These are a negotiable certificate issued by a bank representing share in a foreign company traded on a local stock exchange. These are in the form of American and Global ADR is a negotiable certificate issued by a US bank representing shares in a foreign stock is traded on US exchange. ADRs are denominated in US$ with the underlying security held by a US financial institution overseas.

Global Depository Receipt are negotiable instrument issued by Depository Bank against the domestic shares of the issuing company. GDRs are listed and traded on one or more international exchanges, except USA.

Debt Foreign capital These are loans from friendly governments, or multilateral institutions like IMF External commercial borrowing Remittances Foreign Currency deposits of non-resident citizens of the country.

Foreign Direct Investment FDI can be made in a variety of ways, including the opening of a subsidiary or associate company in a foreign country, acquiring a controlling interest in an existing foreign company or by means of a merger or joint venture with a foreign company. Thus FDI is calculated to include all kinds of capital contributions such as the purchase of stocks as well as the reinvestment of earnings by a wholly owned company incorporated abroad and the lending of firms to a foreign subsidiary or branch.

Types of FDI 1. Greenfield Investments and Mergers and Acquisitions 2. Horizontal and vertical investment 3. Inward or outward investment 4. According to WTO

Greenfield Investment A Greenfield investment refers to a type of FDI where a company establishes a wholly new operation in a foreign country. It can be a new production or an expansion of the existing production facilities of the host country. Due to this there are increased employment opportunities, relatively high wages, R & D and capacity enhancement.

Acquiring or Merging It is acquiring control of existing entities though cross-border mergers and acquisitions. It occurs when a transfer of existing assets from local firms takes place They represents about 77% of all flows in developed countries and about 33% of all flows in developing countries

Horizontal and Vertical Investment Horizontal investment refers to FDI in the same industry abroad as the foreign investor company. Vertical Direct Investment can be of two kinds (A)Backward investments into industry that provides inputs into a firm s domestic production eg. Mining (B) Forward investment in an industry that utilises the outputs from a firm s domestic production.

Inward or outward investment An inward investment involves an external or foreign entity either investing in or purchasing the goods of a local economy. An Outward direct investment is a business strategy in which a domestic firm expands its operations to a foreign country.

Categories according to WTO 1. Equity capital 2. Reinvested earnings 3. Other capital

Equity capital It is the value of MNC s investment in shares of an enterprise in a foreign country. It includes mergers and acquisitions and Greenfield investment.

Reinvested earnings These are the retained profit of the firm in which MNC has invested Other capital Short and long term lending and borrowing between the MNC and affiliate.

Benefits of FDI 1. Increased investment (i) Fdi provides additional capital. (ii) It does not increase the external debt. 2. Transfer of new technology 3. Contribution to balance of payments - By contributing towards debt servicing repayments - - by boosting export markets and produce foreign exchange revenues

4. Social development -by raising wages and income 5. Infrastructure Greenfield investment can stimulate new infrastructure development and technologies in host economies. 6. Stimulate domestic enterprises 7. Import substitution

8. Stimulate exports and generate inward flow of earnings which help in trade balance. 9. Competition ..in the domestic market 10. Human capital formation 11. Revenues 12. Sectoral development 13. Better allocation 14. Growth 15. Better management techniques and practicesS

Drawbacks of FDI to host countries 1. Competition ..drives out local competitors 2. Balance of Payments The earnings of MNCs and imports affect the capital account of the balance of payment of the host country. 3. Trade balance .negative trade balance if MNCs import a high percent of components.

4. Dependency 5. Diversion 6. Sovereignty and Autonomy 7. Social impact- FDI benefits only a small percentage of people who are educated and wealthy. Widens the gap. 8. Cultural Impact Investment may occur for non-traditional goods or on sophisticated goods

9. Local, Small and rural business 10. Inappropriate techniques