Forest Industries in National Economy: Trends and Market Impacts

Forest industries, particularly the pulp and paper sector, play a significant role in Finland's economy. This report explores trends in production volumes, export volumes, and employment in the industry. It discusses the market drivers, impact on other sectors, and emerging product portfolios. The data reflects the changing landscape of the forest industries and their importance in the national economy.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Current situation and market drivers B. Berg-Andersson, M. Kulvik, J. Kunttu, J. Lintunen, T. Orfanidou EFI & ETLA Economic Research Koli Forum Round Table September 28, 2022

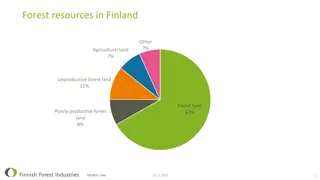

Forest industries in the national economy Pulp and paper industry is large in Finland, by value the most important exporting branch. The major part of products are exported Woodworking industry Products are mostly used in construction or exported Both industries use significant amounts of domestic intermediate inputs Changes in forest industries production effects other branches, i.e., forestry, transportation, chemical and machinery industries

Trends: Forest industries production volumes Millon tonnes/m3 16 2021 4 450 4 200 8 300 11 900 Production Paper Paperboard Chemical Pulp Sawn softwood* Change from prev. year Paper Paperboard Chemical Pulp Sawn Softwood * estimate 1000 t 1000 t 1000 m3 14 Paper 12 Board -1,6 % 14,6 % 8,3 % 9,4 % Chemical pulp 10 Sawn Softwood 8 6 4 2 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 4 SOURCE: Finnish Forest Industries Federation

Trends: Export volumes since 1960 Milj. tonnes/m3 16 Pulp Exports 2021 Paper & Board & Converted Products Paper, paperboard and converted products Chemical Pulp Sawn and planed goods 1000 m3 Wood-based panels Change from prev. year Paper, paperboard and converted products Chemical Pulp Sawn and planed goods Wood-based panels 14 Sawn and planed goods 1000 t 1000 t 8 650 4 050 8 850 1 050 Wood-based panels 12 1000 m3 10 7,0 % 4,1 % 6,7 % 16,1 % 8 6 4 2 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 5 SOURCE: Finnish Customs 15.8.2022

Employment in pulp and paper industry: Finland (blue line) and Europe (red bars) Thousand Trends Thousand Technological improvement, effective machines employment has steadily declined As a result, productivity has steadily increased (def. productivity= value added/employment) Note: also outsourcing from (maybe about) year 2000 onwards Sources: Statistics Finland, CEPI, and Etla Paper demand has decreased heavily, and demand of paperboard has increased a worldwide shift in production towards paperboard Enrichment of product portfolio: Engineered wood products, textile fibers, liquid biofuels, biomedicals, etc.

Exports of paper, pulp, paper and paperboard products to Russia, seasonally adjusted (CPA17) Milj. e 75 Market factors Short term 50 Forest industry strike in January-February 2020 UPM strike January-April 2022 affects industry production volumes a lot 25 Covid-19 2020 decrease in demand of especially graphical paper Reductions in production following low demand and strike 2021 rebound (except paper), Stora Enso Veitsiluoto paper mill closed down Forest recreation Sources: Finnish Customs, Statistics Finland, ETLA Research 0 2015/12016/12017/12018/12019/12020/12021/12022/1 Exports to Russia, seasonally Russian invasion of Ukraine Wood imports from Russia stopped Exports of paper industry products to Russia has fallen dramatically although no sanctions are imposed by EU Energy crisis Bioenergy up Inflation

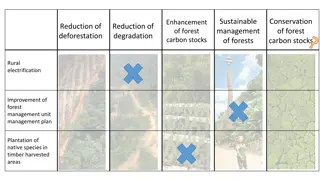

Increasing environmental regulation LULUCF climate policy No net emissions Reference level EU-wide target of LULUCF/AFOLU sink up to 2035 Biodiversity strategy Strict protection Nature restoration

Increasing environmental regulation Renewable energy directive III Forest bioenergy Primary woody biomass (biomass from forests) Secondary woody biomass (by-product biomass) Cascading woody biomass use: Wood products Extending their service life Re-use Recycling Bioenergy Disposal

Pulp and paper industries 2022 UPM strike in early 2022 reduced exports of pulp and paper in the first half of the year No EU sanctions are imposed on forest industry exports to Russia, but Finns have withdrawn voluntarily from Russia Russian forest industry exports to EU have been stopped by sanctions Paperboard exports have been increasing (volume +5 % in Jan-May), pulp -25 %, paper -53 % (Source: Finnish Forest Industries) Export prices are higher than ever before (+30 % Y/Y in Jan-July) In total, exports of the pulp and paper industry are declining about 13%, in volume terms, in 2022 as a result of the strike (-22 % in Jan-June) Output declines 7%

Pulp and paper industries 2023-2026 Export prices are expected to decline from the current high levels Export volumes will rebound in 2023 from the low level of 2022 After 2023, export volumes and output increase slowly, driven by paperboard and pulp Value added reduces in 2022 and 2023 but increase slowly from 2024 onwards In ETLA report no 112 The Finnish Forest Industries Up to Year 2025 it was calculated that employment will decrease on average by 3,1% per year during the period 2021-2025 (this part of the forecast not yet updated to 2026) Productivity was expected to grow by 3% per year in 2023-2025

Woodworking industries 2022 The value of exports increased remarkably in 2021 (+55%), as export prices rose by 36%. Also, the volume of exports grew strongly (+15%) Demand has been higher than market supply, which has put upward pressure on prices Export prices were all time high in June 2022, but turned downwards both in July and in August on average export prices are still expected to be 25 % higher in 2022 compared to last year The export volume is declining around 6 % this year from its high level in 2021, (-10% in Jan-June) Output does not follow exports one-to-one Construction keeps growing: 10% increase in wood product output

Woodworking industries 2023-2026 Export prices are expected to decline from the current high levels After 2022, export volumes increase slowly Output is expected to level out by 2025 Value added reduced very strongly in 2021, so it is expected to grow this year. On average in the years 2023-2026 value added will not grow. Employment and growth in productivity is expected to remain relatively stable (Source: Etla report no. 112, this part of the forecast not yet updated)

Conclusions Recent years have been full of surprises Export prices have been all time high Demand for domestic wood has been increased by the reduction in wood imports Demand shocks such as the war in Ukraine or Covid-19 affect short term forecasts, which therefore need to be revised Supply shocks such as strikes also induces a need to revise forecasts In long term forecasts, temporary shocks do not affect the trends very much Regulation can insert pressure on domestic wood supply in longer term