Forex Trading Terminology and Currency Pairs

Explore the essential terms in forex trading, such as majors/minors, base and quote currencies, bid/ask prices, leverage, pips, and more. Learn about popular currency pair nicknames and FX market terminology for financial market movement.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

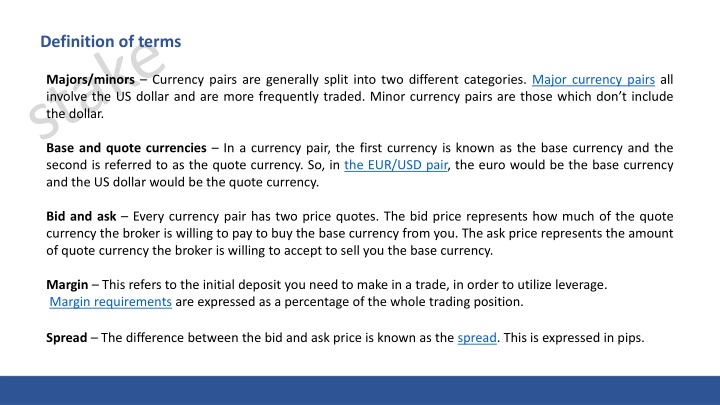

Definition of terms Majors/minors Currency pairs are generally split into two different categories. Major currency pairs all involve the US dollar and are more frequently traded. Minor currency pairs are those which don t include the dollar. Base and quote currencies In a currency pair, the first currency is known as the base currency and the second is referred to as the quote currency. So, in the EUR/USD pair, the euro would be the base currency and the US dollar would be the quote currency. Bid and ask Every currency pair has two price quotes. The bid price represents how much of the quote currency the broker is willing to pay to buy the base currency from you. The ask price represents the amount of quote currency the broker is willing to accept to sell you the base currency. Margin This refers to the initial deposit you need to make in a trade, in order to utilize leverage. Margin requirements are expressed as a percentage of the whole trading position. Spread The difference between the bid and ask price is known as the spread. This is expressed in pips.

Slippage Slippage refers to situations in which you receive a different trade execution price than intended. This can happen for a number of reasons, including slow software and large order sizes. Slippage is neither positive or negative, the same term is used whether the execution price has fallen or risen. Leverage When you make a trade with a forex broker, the broker offers you credit to hold a much larger trading position than you could afford with your own capital. Leverage rates are usually expressed as ratios, for example, 50:1. This means you can hold a position fifty times larger than your account balance. Pip The change in value between two currencies is expressed through a unit of measurement known as a pip. If the EUR/USD pair was to rise from $1.1001 to $1.1002, that increase of $0.0001 is equal to one pip. In major currency pairs, pips are the fourth decimal place in a quote. Lots Lots are the unit of measurement used to express trade size. There are three common lot sizes; a standard lot which is equal to $100,000 of a currency, a mini-lot which is equal to $10,000 of a currency, and a micro-lot which is equal to $1,000 of currency. Project Stake

Different Terms for Currency Pairs Different currencies and currency pairs have informal names, or nicknames, which are often used by traders and brokers. Below we ve highlighted some of the most important ones: GBP/USD = Cable USD/CAD = Loonie NZD/USD = Kiwi AUD/USD = Aussie EUR/USD = Fiber Project Stake

FX Terminology Regarding Financial Market Movement The following are special expressions or words both market participants and central bankers use when they refer to things that within the foreign exchange market, and financial markets in general. Long and Short When a trader buys a currency pair, it is said that he/she is taking a long position, as the expectations are that the pair will move to the upside. If this does indeed happen, the trader makes a profit. If a trader sells a currency pair, it is said that he/she is going short, as the expectations are that the pair will move to the downside. Long ( Buy ) Short ( Sell ) Project Stake

Bullish/Bearish and Hawkish/Dovish A trader who takes a long position, or is thinking of taking a long position, has a bullish view of that currency pair; or he/she is bullish about that currency. For example, one can be bullish about the Euro and, in particular, bullish on the EUR/USD pair. The opposite of bullish is bearish, either about a certain currency or on a currency pair. A central banker can be neither bullish nor bearish, as it is not possible for them to have a position on the market. Therefore, a central banker s position can be either hawkish or dovish (this being the equivalent of bullish or bearish respectively for the regular trader). Project Stake