Four Components of Fintech Initiatives

Explore the key components of fintech, including P2P financing, robo-advising, blockchain technologies, and machine learning. Discover the implications of these innovations in the financial landscape and how they are reshaping the industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Four Components of Fintech Campbell R. Harvey Duke University and NBER September 2019 C

Fintech initiatives 1. P2P Financing 2. Robo-advising and Asset Management 3. Blockchain, Smart Contracting and DeFi 4. Machine learning Campbell R. Harvey 2019 2

1. P2P Finance Landscape: P2P Lending Crowdfunding Payments and New Banks Campbell R. Harvey 2019 3

1. P2P Finance Implications: Makes it possible to for entrepreneurs to obtain financing that was not possible in the past Allows anyone to make microinvestments in firms previously, investments in startups were reserved for select qualified investors Campbell R. Harvey 2019 4

1. P2P Finance Implications: WeChat Pay has 1+ billion users Alipay has 1+ billion users! Campbell R. Harvey 2019 5 https://www.electran.org/wp-content/uploads/MPC_StateofMobilePayments-Report-FINAL.pdf

1. P2P Finance Implications: WeChat Pay has 1+ billion users Alipay has 1+ billion users! Campbell R. Harvey 2019 6 https://www.electran.org/wp-content/uploads/MPC_StateofMobilePayments-Report-FINAL.pdf

1. P2P Finance Implications: Allows the unbanked to join the world of Internet commerce Large swath of skilled employees in traditional banking will be displaced. Traditional banks at great risk. Campbell R. Harvey 2019 7

2. Robo Asset Management Landscape: Algorithm gives low cost advice to a retail investor based on an algorithm that selects a diversified portfolio that matches the investor s risk preferences Not just for the retail investor many institutional investors turning to systematic trading algorithms for asset management Campbell R. Harvey 2019 8

2. Robo Asset Management Implications: Large shake out of asset management industry with thousands of smaller asset management companies closing because they are unable to compete with the large companies that have invested in big data and machine learning Campbell R. Harvey 2019 9

3. Blockchain, Smart Contracting and DeFi The opportunity: Imagine a world were transactions costs are near zero, the integrity of the transaction can be quickly verified, the transaction happens almost immediately, and the system is secure from outside attack. This is the blockchain opportunity. Campbell R. Harvey 2019 10

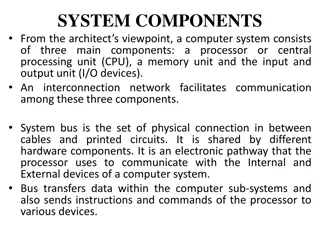

3. Blockchain Blockchain is a very special ledger Quickly and easily accessed and shared by many -- distributed Immutable (you can only add to it you cannot alter history) Removes single point of failure Campbell R. Harvey 2019 11

3. Blockchain Blockchain is a very special ledger Quickly and easily accessed and shared by many -- distributed Immutable (you can only add to it you cannot alter history) Cryptographically secured Campbell R. Harvey 2019 12

What can Blockchain Technology do? Solves many problems Verification of ownership Efficient exchange of ownership Almost anything can be tokenized Stocks, bonds, any asset, programmable assets, fiat, commodities, Campbell R. Harvey 2019 13

DeFi Decentralized finance Blockchaincombined with P2P allows for raising capital, investing capital in a decentralized way (greatly reducing the role of middle people) Campbell R. Harvey 2019 14

4. Machine Learning Four forces: Computing power and the rise of GPU Growth of big data AI and Machine Learning advances Open source software Campbell R. Harvey 2019 15