Game Theory Applications in Computer Networks: Efficiency and Equilibrium Analysis

Explore the intriguing concepts of equilibrium and efficiency in computer networks through game theory, examining scenarios with affine cost functions, potential-based social cost bounds, and the impacts on loss of efficiency. Discover insights into Price of Anarchy, Price of Stability, and Loss of Efficiency metrics, shedding light on network dynamics and optimizations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

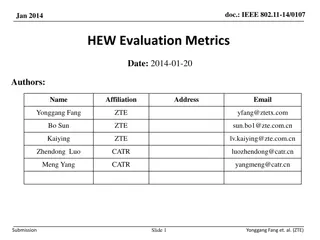

Game Theory: introduction and applications to computer networks Introduction Giovanni Neglia INRIA EPI Maestro 3 February 2014 Part of the slides are based on a previous course with D. Figueiredo (UFRJ) and H. Zhang (Suffolk University)

Always an equilibrium with small Loss of Efficiency? r Consider only affine cost functions, i.e. c (x)=a +b x r We will use the potential to derive a bound on the social cost of a NE m P(f) <= CS(f) <= 2 P(f) C (x) P (f ) C (f ) x f

Always an equilibrium with small Loss of Efficiency? r Consider only affine cost functions i.e. c (x)=a +b x r We will use the potential to derive a bound on the social cost of a NE m P(f) <= CS(f) <= 2 P(f) r P(f) = E P = E t=1, f c (t) <= <= E t=1, f c (f )= E f c (f )=CS(f) r P(f) = E P = E t=1, f (a +b t)= = E f a +b f (f +1)/2 >= Ef (a +b f )/2 =CS(f)/2

Always an equilibrium with small Loss of Efficiency? r Consider only affine cost functions i.e. c (x)=a +b x r P(f) <= CS(f) <= 2 P(f) r Let s imagine to start from routing fOpt with the optimal social cost CS(fOpt), r Applying the BR dynamics we arrive to a NE with routing fNE and social cost CS(fNE) r CS(fNE) <= 2 P(fNE) <= 2 P(fOpt) <= 2 CS(fOpt) r The LoE of this equilibrium is at most 2

Same technique, different result r Consider a network with a routing at the equilibrium r Add some links r Let the system converge to a new equilibrium r The social cost of the new equilibrium can be at most 4/3 of the previous equilibrium social cost (as in the Braess Paradox)

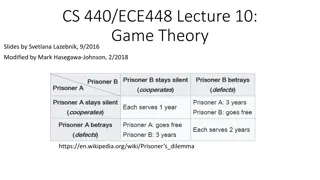

Loss of Efficiency, Price of Anarchy, Price of Stability r Loss of Efficiency (LoE) m given a NE with social cost CS(fNE) m LoE = CS(fNE) / CS(fOpt) r Price of Anarchy (PoA) [Koutsoupias99] m Different settings G (a family of graph, of cost functions,...) m Xg =set of NEs for the setting g in G m PoA = supg GsupNE Xg{CS(fNE) / CS(fOpt)} => worst loss of efficiency in G r Price of Stability (PoS) [Anshelevish04] m PoS = supg GinfNE Xg{CS(fNE) / CS(fOpt)} => guaranteed loss of efficiency in G

Stronger results for affine cost functions r We have proven that for unit-traffic routing games the PoS is at most 2 r For unit-traffic routing games and single- source pairs the PoS is 4/3 r For non-atomic routing games the PoA is 4/3 m non-atomic = infinite players each with infinitesimal traffic r For other cost functions they can be much larger (even unbounded)

Performance Evaluation Sponsored Search Markets Giovanni Neglia INRIA EPI Maestro 4 February 2013

Google r A class of games for which there is a function P(s1,s2, sN) such that m For each i Ui(s1,s2, xi, sN)>Ui(s1,s2, yi, sN) if and only if P(s1,s2, xi, sN)>P(s1,s2, yi, sN) r Properties of potential games: Existence of a pure-strategy NE and convergence to it of best-response dynamics r The routing games we considered are particular potential games

How it works r Companies bid for keywords r On the basis of the bids Google puts their link on a given position (first ads get more clicks) r Companies are charged a given cost for each click (the cost depends on all the bids)

Some numbers r 95% of Google revenues (46 billions$) from ads m investor.google.com/financial/tables.html m 87% of Google-Motorola revenues (50 billions$) r Costs m "calligraphy pens" $1.70 m "Loan consolidation" $50 m "mesothelioma" $50 per click r Click fraud problem

Outline r Preliminaries m Auctions m Matching markets r Possible approaches to ads pricing r Google mechanism r References m Easley, Kleinberg, "Networks, Crowds and Markets", ch.9,10,15

Types of auctions r 1stprice & descending bids r 2ndprice & ascending bids

Game Theoretic Model r N players (the bidders) r Strategies/actions: biis player i s bid r For player i the good has value vi r piis player i s payment if he gets the good r Utility: m vi-piif player i gets the good m 0 otherwise r Assumption here: values viare independent and private m i.e. very particular goods for which there is not a reference price

Game Theoretic Model r N players (the bidders) r Strategies: biis player i s bid r Utility: m vi-biif player i gets the good m 0 otherwise r Difficulties: m Utilities of other players are unknown! m Better to model the strategy space as continuous m Most of the approaches we studied do not work!

2ndprice auction r Player with the highest bid gets the good and pays a price equal to the 2ndhighest bid r There is a dominant strategies m I.e. a strategy that is more convenient independently from what the other players do m Be truthful, i.e. bid how much you evaluate the good (bi=vi) m Social optimality: the bidder who value the good the most gets it!

bi=viis the highest bid bids bids bi >bi bi bk bk Ui=vi-bk>vi-bi=0 Ui =vi-bk bh bh bn bn Bidding more than viis not convenient

bi=viis the highest bid bids bids bi bk bk bi <bi Ui=vi-bk>vi-bi=0 Ui =0 bh bh bn bn Bidding less than viis not convenient (may be unconvenient)

bi=viis not the highest bid bids bids bi >bi Ui =vi-bk<vi-bi=0 bk bk bi Ui=0 bh bh bn bn Bidding more than viis not convenient (may be unconvenient)

bi=viis not the highest bid bids bids bk bk bi bi <bi Ui =0 Ui=0 bh bh bn bn Bidding less than viis not convenient

Seller revenue r N bidders r Values are independent random values between 0 and 1 r Expected ithlargest utility is (N+1-i)/(N+1) r Expected seller revenue is (N-1)/(N+1)

1stprice auction r Player with the highest bid gets the good and pays a price equal to her/his bid r Being truthful is not a dominant strategy anymore! r How to study it?

1stprice auction r Assumption: for each player the other values are i.i.d. random variables between 0 and 1 m to overcome the fact that utilities are unknown r Player i s strategy is a function s() mapping value vito a bid bi m s() strictly increasing, differentiable function m 0 s(v) v s(0)=0 r We investigate if there is a strategy s() common to all the players that leads to a Nash equilibrium

1stprice auction r Assumption: for each player the other values are i.i.d. random variables between 0 and 1 r Player i s strategy is a function s() mapping value vito a bid bi r Expected payoff of player i if all the players plays s(): m Ui(s, s, s) = viN-1(vi-s(vi)) i s payoff if he/she wins prob. i wins

1stprice auction r Expected payoff of player i if all the players play s(): m Ui(s, s, s) = viN-1(vi-s(vi)) r What if i plays a different strategy t()? m If all players playing s() is a NE, then : m Ui(s, s, s) = viN-1(vi-s(vi)) viN-1(vi-t(vi)) = = Ui(s, t, s) r Difficult to check for all the possible functions t() different from s() r Help from the revelation principle

The Revelation Principle vi vi bi' bi t() s() vi' bi' s() r All the strategies are equivalent to bidder i supplying to s() a different value of vi

1stprice auction r Expected payoff of player i if all the players plays s(): m Ui(v1, vi, vN) = Ui(s, s, s) = viN-1(vi-s(vi)) r What if i plays a different strategy t()? r By the revelation principle: m Ui(s, t, s) = Ui(v1, v, vN) = vN-1(vi-s(v)) r If viN-1(vi-s(vi)) vN-1(vi-s(v)) for each v (and for each vi) m Then all players playing s() is a NE

1stprice auction r If viN-1(vi-s(vi)) vN-1(vi-s(v)) for each v (and for each vi) m Then all players playing s() is a NE r f(v)=viN-1(vi-s(vi)) - vN-1(vi-s(v)) is minimized for v=vi r f (v)=0 for v=vi, m i.e. (N-1) viN-2 (vi-s(v)) + viN-1 s (vi) = 0 for each vi m s (vi) = (N-1)(1 s(vi)/vi), s(0)=0 m Solution: s(vi)=(N-1)/N vi

1stprice auction r All players bidding according to s(v) = (N-1)/N v is a NE r Remarks m They are not truthful m The more they are, the higher they should bid r Expected seller revenue m ((N-1)/N) E[vmax] = ((N-1)/N) (N/(N+1)) = (N- 1)/(N+1) m Identical to 2ndprice auction! m A general revenue equivalence principle

Outline r Preliminaries m Auctions m Matching markets r Possible approaches to ads pricing r Google mechanism r References m Easley, Kleinberg, "Networks, Crowds and Markets", ch.9,10,15

Matching Markets goods buyers 1 v11, v21, v31 1 v12, v22, v32 2 2 v12, v22, v32 3 3 vij: value that buyer j gives to good i How to match a set of different goods to a set of buyers with different evaluations

Matching Markets p1=2 1 12, 4, 2 1 8, 7, 6 2 p2=1 2 7, 5, 2 p3=0 3 3 Which goods buyers like most? Preferred seller graph How to match a set of different goods to a set of buyers with different evaluations

Matching Markets p1=2 1 12, 4, 2 1 8, 7, 6 2 p2=1 2 7, 5, 2 p3=0 3 3 Which goods buyers like most? Preferred seller graph r Given the prices, look for a perfect matching on the preferred seller graph r There is no such matching for this graph

Matching Markets p1=3 1 12, 4, 2 1 8, 7, 6 2 p2=1 2 7, 5, 2 p3=0 3 3 Which goods buyers like most? Preferred seller graph r But with different prices, there is

Matching Markets p1=3 1 12, 4, 2 1 8, 7, 6 2 p2=1 2 7, 5, 2 p3=0 3 3 Which goods buyers like most? Preferred seller graph r But with different prices, there is r Such prices are market clearing prices

Market Clearing Prices r They always exist m And can be easily calculated if valuations are known r They are socially optimal in the sense that they maximize the sum of all the payoffs in the network (both sellers and buyers)

Outline r Preliminaries m Auctions m Matching markets r Possible approaches to ads pricing r Google mechanism r References m Easley, Kleinberg, "Networks, Crowds and Markets", ch.9,10,15

Ads pricing Ads positions companies r1 1 v1 1 v2 r2 2 2 v3 3 r3 3 vi: value that company i gives to a click ri: click rate for an ad in position i (assumed to be independent from the ad and known a priori) How to rank ads from different companies

Ads pricing as a matching market Ads positions companies r1 1 v1r1, v1r2, v1r3 1 v2r1, v2r2, v2r3 r2 2 2 v3r1, v3r2, v3r3 3 r3 3 vi: value that company i gives to a click ri: click rate for an ad in position i (assumed to be independent from the ad and known a priori) r Problem: Valuations are not known! r but we could look for something as 2nd price auctions

The VCG mechanism r The correct way to generalize 2ndprice auctions to multiple goods r Vickrey-Clarke-Groves r Every buyers should pay a price equal to the social value loss for the others buyers m Example: consider a 2ndprice auction with v1>v2> vN With 1 present the others buyers get 0 Without 1, 2 would have got the good with a value v2 then the social value loss for the others is v2

The VCG mechanism r The correct way to generalize 2ndprice auctions to multiple goods r Vickrey-Clarke-Groves r Every buyers should pay a price equal to the social value loss for the others buyers m If VBSis the maximum total valuation over all the possible perfect matchings of the set of sellers S and the set of buyers B, m If buyer j gets good i, he/she should be charged VB-jS- VB-jS-i

VCG example Ads positions companies r1=10 1 v1=3 1 v2=2 r2=5 2 2 v3=1 3 r3=2 3 vi: value that company i gives to a click ri: click rate for an ad in position i (assumed to be independent from the ad and known a priori)

VCG example Ads positions companies 1 30, 15, 6 1 20, 10, 4 2 2 10, 5, 2 3 3

VCG example Ads positions companies 1 30, 15, 6 1 20, 10, 4 2 2 10, 5, 2 3 3 r This is the maximum weight matching r 1 gets 30, 2 gets 10 and 3 gets 2

VCG example Ads positions companies 1 30, 15, 6 1 20, 10, 4 2 2 10, 5, 2 3 3 r If 1 weren t there, 2 and 3 would get 25 instead of 12, r Then 1 should pay 13

VCG example Ads positions companies 1 30, 15, 6 1 20, 10, 4 2 2 10, 5, 2 3 3 r If 2 weren t there, 1 and 3 would get 35 instead of 32, r Then 2 should pay 3

VCG example Ads positions companies 1 30, 15, 6 1 20, 10, 4 2 2 10, 5, 2 3 3 r If 3 weren t there, nothing would change for 1 and 2, r Then 3 should pay 0

The VCG mechanism r Every buyers should pay a price equal to the social value loss for the others buyers m If VBSis the maximum total valuation over all the possible perfect matchings of the set of sellers S and the set of buyers B, m If buyer j gets good i, he/she should be charged VB-jS- VB-jS-i r Under this price mechanism, truth-telling is a dominant strategy

Outline r Preliminaries m Auctions m Matching markets r Possible approaches to ads pricing r Google mechanism r References m Easley, Kleinberg, "Networks, Crowds and Markets", ch.9,10,15

Googles GSP auction r Generalized Second Price r Once all the bids are collected b1>b2> bN r Company i pays bi+1 r In the case of a single good (position), GSP is equivalent to a 2ndprice auction, and also to VCG r But why Google wanted to implement something different???