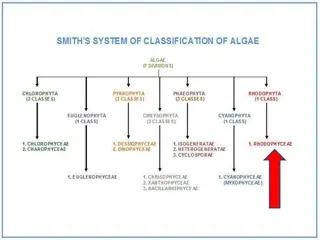

General Characteristics of Green Algae: Division Chlorophyta

Green algae from the Division Chlorophyta exhibit various characteristics such as containing chlorophyll A and B, accessory pigments, and varying chloroplast shapes. They store food as pyrenoids, display flagellated stages, and reproduce sexually. Examples include Chlamydomonas with cup-shaped chloroplasts and Volvox forming spherical colonies. Other genera like Scendusmus, Closterium, and Cosmarium also showcase unique features within the Chlorophyta division.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Dependents Pub 4012 Tab C Pub 4491 Lesson 6

Personal Exemption Deduction Suspended Personal exemption amount reduced to $0 for tax years 2018 2025 $4,150 exemption amount still in place for qualifying relative gross income test 2 NTTC Training - TY2018

Dependent Rules Unchanged Even though no exemption deduction 2018 2025, important for: Deductions Limited to expenses for taxpayer, spouse and dependents, e.g. medical Credits Limited to expenses for taxpayer, spouse and dependents, e.g. education credits 3 NTTC Training - TY2018

Claiming a Dependent Two types of Dependents Qualifying child Includes permanently and totally disabled adult Qualifying relative Includes qualifying non-relative 4 NTTC Training - TY2018

Claiming a Dependent Taxpayer cannot claim individual as a dependent If taxpayer/spouse can be claimed as a dependent by another taxpayer Exception: if other person does not have to file, then taxpayer can claim dependents Individual must be U.S. citizen or national, U.S. resident alien, or resident of Canada or Mexico Individual cannot file MFJ Exception: filing only to receive withholding or estimated payments 5 NTTC Training - TY2018

Qualifying Child NTTC Tri-fold Four tests for qualifying child Support: child cannot provide over half their own support Age: under 19 or under 24 and full-time student and younger than taxpayer or spouse Any age if permanently and totally disabled Relationship: child, grandchild, brother, sister descendents thereof and qualified foster child Residency: child lived in home over 6 months 6 NTTC Training - TY2018

Qualifying Relative NTTC Tri-fold Four tests for qualifying relative Residency or Relationship Residency: lived with taxpayer all year Relationship: same as qualifying child plus parent, grandparent, aunt or uncle Notthe qualifying child of another taxpayer Gross income below exemption amount: $4,150 for 2018 Taxpayer provided over half the support of individual 7 NTTC Training - TY2018

Qualifying Child of More than One Person NTTC Tri-fold Tiebreaker rules: more than one taxpayer claims a child Only one the parent, parent wins Both parents claim child, custodial parent wins Child in custody of both parents same amount of time, parent with higher AGI wins None is parent, taxpayer with highest AGI wins 8 NTTC Training - TY2018

Child of Separated Parents NTTC Tri-fold Form 8332 releases exemption to non-custodial parent Does not allow non-custodial parent to file HoH, claim EIC or claim child / dependent care credit (CDC) Does allow non-custodial parent to claim Child Tax Credit Must be signed by custodial parent Custodial parent may still file HoH, claim EIC or claim CDC Form 8332 or pre-2009 divorce decree pages can be scanned and attached to return* * Tax-Aide policy is not to mail Form 8453 taxpayer should retain in case IRS asks for documents or details 9 NTTC Training - TY2018

Support Items included in support* Food, lodging, clothing, education, medical and dental care, recreation, transportation, gifts, necessities Social Security benefits in child s name is income provided by child Welfare benefits considered income provided by parent * Costs are after reimbursements or tax-free scholarships 10 NTTC Training - TY2018

Multiple Support Form 2120 Multiple Support Declaration required if Several individuals together provide over 50% support Considered individuals must provide at least 10% support Declaration states who may claim dependent Individuals can vary year to year Individuals providing at least 10% support decide among themselves who claims the dependent 11 NTTC Training - TY2018

Dependents Questions? Comments? 12 NTTC Training - TY2018