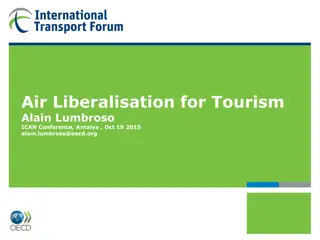

General Codes Provisions: Progressive Liberalisation & International Cooperation" (80 characters)

The General Codes Provisions cover aspects such as discrimination, reciprocity, public order, and governance. The Code serves as an instrument for progressive liberalisation of capital movements since 1961, promoting cooperation among countries. It outlines procedures for liberalisation, reservations, exceptions, and notifications. Implementing the Codes benefits countries by signaling market stability, receiving peer support, ensuring transparency, and influencing jurisprudence. The Codes facilitate dialogue and cooperation on capital flow measures, ultimately supporting international economic cooperation and stability. (424 characters)

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

General Codes Provisions Caroline Mehigan Economist, Investment Division, DAF, OECD

Outline Introduction to the Codes Coverage of the Codes Discrimination, equivalent treatment & reciprocity Public order, national security concerns Governance of the Codes

The Code as an instrument for progressive liberalisation Adopted in 1961 as a Council Decision to: Art 1. progressively abolish . . restrictions on movements of capital Code of Liberalisation of Capital Movements (CLCM) The Code is the only binding multilateral agreement (among 36 countries, including twelve G20 members) covering international capital movements, short-term and long-term, inflows and outflows.

Main Provisions of the Codes The right to proceed gradually towards liberalisation through a process of lodging and maintaining reservations Exceptions for reasons of public order and security Derogations in case of temporary economic difficulties The obligation not to discriminate among Codes Adherents Provisions allowing exceptions for additional liberalisation by special customs or monetary systems (European Union) A system of notification, examination and consultation which is run by the Investment Committee in a session enlarged to all Adherents (ICC).

The Codes as instruments for international cooperation Liberalisation in a multilateral setting At a pace that takes into account individual country circumstances Role for dialogue and cooperation on capital flow measures

Benefits for an individual country You send reassuring signals to the market at times of turbulence You get support and recognition of the peers for your actions The peers owe you transparency in their measures You enjoy others liberalisation measures regardless of your own degree of openness You shape the jurisprudence and evolving rules under the Code You can seek redress in case of unfair treatment

Context: OECD country usage of CFMs, CBMs, MPMs Combining various data sources IMF AREAER (CFM), De Cresenzio et al (CBM), Cerutti et al (MPM) Track the adjustment in these measures 2000-14 OECD member countries Upward trend MPMs post GFC, also CBM Core tenet of OECD membership, progressive liberalisation of capital accounts, downward trend CFMs

CFMs, MPMs & CBMs

The liberalisation lists of the CLCM I & II: Foreign Direct Investment - - - - X: Sureties, Guarantees and Financial Back-up Facilities III: Real Estate - - IV: Capital Markets (shares and bonds) XI: Operation of Deposit Accounts XII: Operations in Foreign Exchange - V: Operations on Money Markets - XIII: Life assurance (transfers - VI: Negotiable Instruments and only) Non Securitised Claims - - XIV: Personal Capital Movements - VII: Collective Investment Securities XV: Physical Movement of Capital Assets - - VIII: Commercial loans - XVI: Disposal of Non-Resident owned Blocked Funds IX: Financial loans

List A List B I & II Direct Investment & Liquidation IV - Operations in Securities on Capital Markets V Operations on Money Markets VII Collective Investment Securities VI Negotiable Instruments & Non- Securitized Claims VIII Credits directly linked with int. commercial trans or services IX Financial Credits and Loans X Sureties, guarantees and financial back up facilities XI - Operation of Deposit Accounts By Residents of Accounts with Non- Resident Institutions XI - Operation of Deposit Accounts By Non-Residents of Accounts with Resident XIV Personal capital movements XII Operations in foreign exchange XV Physical movement of capital assets XIII Life assurance XVI Disposal of non-resident owned blocked funds

Differences between Lists A and B Differences between Lists A and B List A Operations are subject to Standstill Typically long term operations Reservations can be lodged only at time of accession, adherence or when new understandings take place Need to invoke derogation clause to re-introduce restrictions on List A operations. List B Operations are not subject to standstill Typically short term operations Reservations can be lodged at any time The very existence of List B is unique in international agreements, neither GATS nor bilateral investment treaties normally include such flexibility.

CLCIO- Current Invisibles Code The CLCIO main focus is on the free cross border provision of services i.e. the supply of services to residents by non-resident service suppliers abroad and vice versa. The establishment of financial services (banking and non-bank financial institutions, insurance, pension) It also provides for the free transfer of funds in connection with current international transactions Liberalisation list in annex A specifies 11 areas: Business and industry, foreign trade, transport, insurance and private pension services, banking and financial services, income from capital, travel and tourism, films, expenditure, public income and expenditure, and general (including professional services) personal income and

Discrimination, Equivalent Treatment & Reciprocity

No Reciprocity, nor discrimination Art 8. Right to benefit from measures of liberalisation Art 9. Non-discrimination (MFN) Art. 10 Exception to Art 9. for special customs or monetary system

Equivalent Treatment Measures which differentiate between residents and non-residents are however, not always contrary to the obligations of the Code. In certain cases the committee has accepted that a different regime applies to residents than to non- residents On the condition that these are not more burdensome than necessary

Equivalent Treatment Particularly relevant for the est. of branches or agencies by non-residents enterprises. As a subsidiary, via incorporation, same conditions apply as to resident investors i.e. minimum capital reqs. If a branch is used, host country may feel need to impose special requirements for prudential reasons.

Public order, National Security Concerns

Public Order and Security Public Order and Security [Art. 3] The provisions of this Code shall not prevent a Member from taking action which it considers necessary for: i) the maintenance of public order or the protection of public health, morals and safety; ii)the protection of its essential security interests; iii)the fulfilment of its obligations relating to international peace and security. According to the User s Guide these safeguard provisions are deemed to address exceptional situations. Recently, members have been encouraged to lodge reservations when they introduce restrictions for national security concerns, to both enhance the transparency and also act as a first step towards eventual liberalisation.

Controls and formalities [Art. 5] a. The measures of liberalisation provided for in this Code shall not limit the powers of Members to verify the authenticity of transactions or transfers nor to take any measures required to prevent evasion of their laws or regulations. Authorised agent rules Members may require that transactions and transfers be effected through authorised agents

Scope of Obligations Freedom to complete listed operations Operation = transaction + associated transfers and payments Only operations between residents and non-residents In domestic markets, key is non-discrimination compared with residents operating in domestic market in like circumstances. In markets abroad, key criteria: freedom for residents when abroad to carry out operations covered by the Code under rules of foreign jurisdiction Freedom of choice of currency for denomination and settlement for operations between residents and non- residents criteria vis-a-vis non-residents

Exemptions through understandings Adherents have agreed to exclude certain types of measure from the scope of their Code obligations including: Government operations for its own account Privatisation Primary placement of government securities Rules regarding operations/transactions reserved to the State Rules on the net foreign Exchange exposure of banks are exempt

Equivalent measures Measures such as screening procedures or registration requirements are not considered restrictions, if they do not affect the effective carrying out of the operation. However international transactions may be affected by certain measures which have effects equivalent to a restriction although they do not prevent operations. This is the case where such a measure raises the effective cost of operations. Equivalent measures in the field of capital movements might take the form of compulsory deposit requirements, interest rate penalties or queueing arrangements for security issues. The Codes treat these equivalent measures like restrictions subject to progressive liberalisation.

Notification and examination of derogation and reservations

Flexibility through the reservation system Article 2: " A Member may lodge reservations relating to the obligations when: iii) obligations relating to any such item begin to apply to that Member; or iv) at any time, in respect of an item in List B

Flexibility through derogation Article 7: Derogation Clauses b. If any measures of liberalisation result in serious economic and financial disturbance in the Member State concerned, that Member may withdraw those measures. c. If the overall balance of payments of a Member develops adversely at a rate and in circumstances which it considers serious, that Member may temporarily suspend the application of measures of liberalisation taken or maintained Over the last five years, two countries have invoked these clauses.

Agreed protocol in case of re- introduction of capital flows restrictions (1) In the event of recourse to new restrictions on capital movements, countries have agreed under the Code to well-tested guiding principles such as transparency, non-discrimination, proportionality and accountability: Capital flow restrictions are measures that could best be considered when alternative policy responses are insufficient to effectively achieve the objective pursued. Their implementation needs to be transparent. Measures should be subject to accountability, including open for international discussion. Measures should not discriminate among investors from different countries, and avoid unnecessary damage, especially when they have a bearing on the interests of another country.

Agreed protocol in case of re-introduction of capital flows restrictions (2) The severity of restrictions should be proportional to the problem at hand, with measures disrupting business as little as possible and in particular minimising adverse impacts on operations such as FDI and commercial credits. Restrictions and corresponding reservations may be maintained for as long as needed, but should be removed once non- restrictive means become available to address legitimate policy concerns. Countries should be mindful of their rights and obligations under international agreements, including IMF s Articles of Agreement.

Governance of the Codes

Governance of the Codes The Codes are governed by the OECD Investment Committee which considers all matters concerning the operation of the Codes. The Committee acts as a forum for discussion and exchange of information, considers questions of interpretation of their legal provisions, reviews country measures and assesses their conformity with the Codes obligations. The OECD Council has decided to enlarge the Investment Committee to include participation of countries adherents to the Codes, but which are not OECD members, with equal rights and responsibilities. The enlarged Investment Committee has been given the authority to take all final decisions concerning the Codes of Liberalisation.

Due process Articles 11 17: Procedural rules Mutual transparency: notification of liberalisation steps and of new measures Mechanism for dialogue and peer review: examination of derogations and reservations thematic peer reviews common understandings on conforming practices

Inclusive governance of the Code (1) Article 20, as amended in 2012 In this Code: Member shall mean a country which adheres to this Code Non-OECD countries can adhere to the Codes with equal rights and responsibilities as OECD countries

Inclusive governance of the Code (2) Should the existing text of the Codes need to be amended, the amendment decision would need to be agreed both in the enlarged Investment Committee and in Council. This "double consensus rule" also applies to the decision to invite an additional country to adhere to the Codes. Accordingly, no decision regarding the Codes can be made without the consent of adherents that are not members of the Organisation.